Archives of “January 3, 2019” day

rssMother Angela?

What U Knows About EU ?

Heads or Tails

“There is a random distribution between wins and losses for any given set of variables that defines an edge. In other words, based on the past performance of your edge, you may know that out of the next 20 trades, 12 will be winners and 8 will be losers. What you don’t know is the sequence of wins and losses or how much money the market is going to make available on the winning trades. This truth makes trading a probability or numbers game. When you really believe that trading is simply a probability game, concepts like “right” and “wrong” or “win” and “lose” no longer have the same significance. As a result, your expectations will be in harmony with the possibilities.”

“There is a random distribution between wins and losses for any given set of variables that defines an edge. In other words, based on the past performance of your edge, you may know that out of the next 20 trades, 12 will be winners and 8 will be losers. What you don’t know is the sequence of wins and losses or how much money the market is going to make available on the winning trades. This truth makes trading a probability or numbers game. When you really believe that trading is simply a probability game, concepts like “right” and “wrong” or “win” and “lose” no longer have the same significance. As a result, your expectations will be in harmony with the possibilities.”

What chart study/studies do you use most often?

Like trading styles, the way a trader analyzes a chart can vary from trader to trader and so today we want to know what chart studies you rely on.*

Risk, fear and worry

Risk is all around us. When we encounter potential points of failure, we’re face to face with risk. And nothing courts risk more than art, the desire to do something for the first time–to make a difference.

Fear is a natural reaction to risk. While risk is real and external, fear exists only in our imagination. Fear is the workout we give ourselves imagining what will happen if things don’t work out.

And worry? Worry is the hard work of actively (and mentally) working against the fear. Worry is our effort to imagine every possible way to avoid the outcome that is causing us fear, and failing that, to survive the thing that we fear if it comes to fruition.

If you’ve persuaded yourself that risk is sufficient cause for fear, and that fear is sufficient cause for worry, you’re in for some long nights and soon you’ll abandon your art out of exhaustion. On the other hand, you can choose to see the three as completely separate phenomena, and realize that it’s possible to have risk (a good thing) without debilitating fear or its best friend, obsessive worry.

Separate first, eliminate false causation, then go ahead and do your best work.

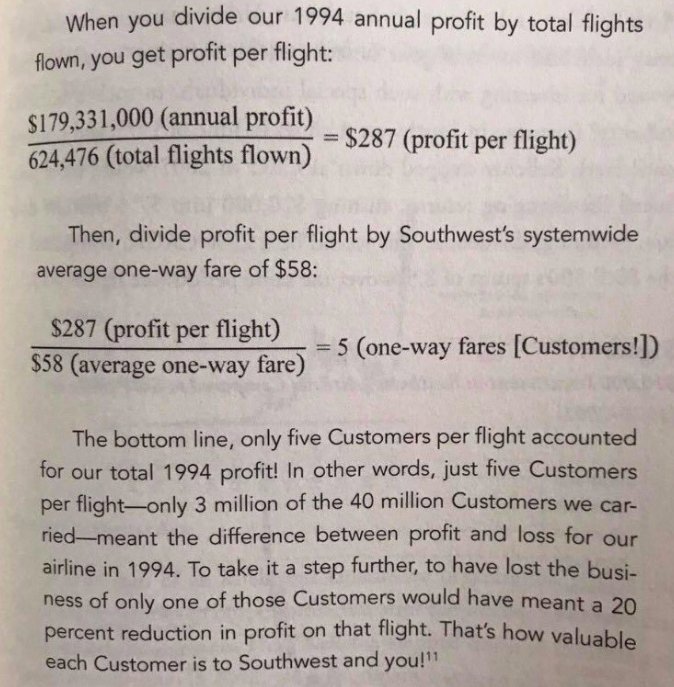

Herb Kelleher of Southwest Airlines on the importance of every customer.

Pull the trigger.

How do you make money investing in falling stocks?

There's no inflation