By DJ Matt King from Citigroup

Jingle bells (fiscal cliff remix)

Dancing on the edge

Of the looming fiscal cliff

Impossible to hedge

The politicians’ tiff.

It’s spending cuts we need

To cut the deficit

But taxes too must rise

That much is definite!

Fiscal cliff, fiscal cliff

Drama all the way!

Surely sense will soon prevail

And help them meet halfway? Hey!

Fiscal cliff, fiscal cliff

Washington at play

With Congress so polarized

Who knows which way they’ll sway? (more…)

Archives of “January 2, 2019” day

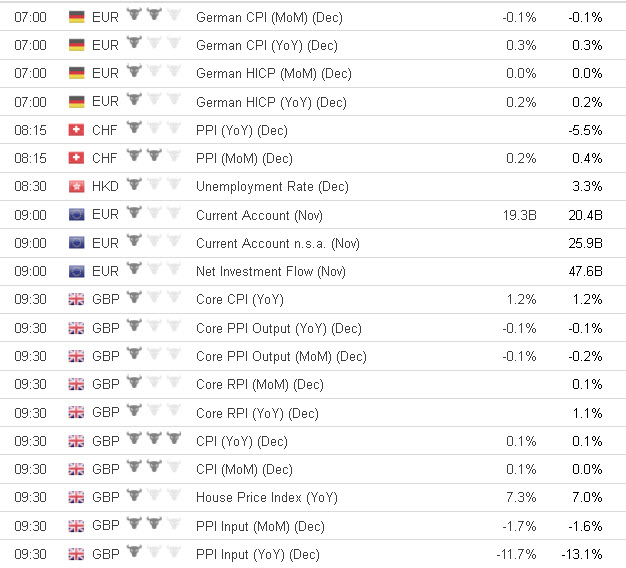

rssUpcoming Data From Europe and UK

Emirates Palace unveils gold dispensing ATM

Emirates Palace has raised the luxury stakes in the Gulf even higher by unveiling an ATM that dispenses gold.

Emirates Palace has raised the luxury stakes in the Gulf even higher by unveiling an ATM that dispenses gold.

The machine, which monitors the price of gold minute-by minute, offers small bars that weight up to 10 grammes engraved with the Emirates Palace logo, as well as a variety of coins.

Thomas Giessler, the inventor of the Gold to Go machine, chose Abu Dhabi because of its luxury atmosphere, and hopes it will tie in nicely with the region’s traditional ties in gold commerce.

“A gold machine should be made of gold,” said Thomas Geissler, the chief executive of Ex Oriente Lux AG. “This is now at a hotel made out of gold. It is the perfect place.”

Six coins of differing weights come engraved with a maple leaf, kangaroo and Krugerrand, symbols of the gold-producing nations South Africa, Canada and Australia.

Emirates Palace Hotel general manager Hans Olbertz said: “We seized upon this idea and, as one of the most exclusive hotels in the world, we wanted the Emirates Palace to play a pioneering role and be the first hotel in the world to offer its guests this golden service.”

The idea is aimed at both a souvenir and an investment. Gold is still one of the most sustainable forms of investment and is currently as a record high price due to volatility in the current global economic market. (more…)

These 16 Rules Will Make You A Better Trader

1. Never, Ever, Ever, Under Any Circumstance, Add to a Losing Position… not ever, not never! Adding to losing positions is trading’s carcinogen; it is trading’s driving while intoxicated. It will lead to ruin. Count on it!

2. Trade Like a Wizened Mercenary Soldier: We must fight on the winning side, not on the side we may believe to be correct economically.

3. Mental Capital Trumps Real Capital: Capital comes in two types, mental and real, and the former is far more valuable than the latter. Holding losing positions costs measurable real capital, but it costs immeasurable mental capital.

4. This is Not a Business of Buying Low and Selling High: It is, however, a business of buying high and selling higher. Strength tends to beget strength, and weakness, weakness.

5. In Bull Markets One Can Only Be Long or Neutral, and in bear markets, one can only be short or neutral. This may seem self-evident; few understand it, however, and fewer still embrace it.

6. “Markets Can Remain lllogical Far Longer Than You or I Can Remain Solvent.” These are Keynes’ words, and illogic does often reign, despite what the academics would have us believe. (more…)

A Winning Mindset is Required To Succeed

- A losing trader can do little to transform himself into a winning trader. A losing trader is not going to want to

transform himself. That’s the kind of thing winning traders do. - The winning traders have usually been winning at whatever field they are in for years.

- It is a happy circumstance that when nature gives us true burning desires, she also gives us the means to

satisfy them. Those who want to win and lack skill can get someone with skill to help them. - The “doing” part of trading is simple. You just pick up the phone and place orders. The “being” part is a bit more subtle. It’s like being an athlete. It’s commitment arid mission. To the committed, a world of support appears. All manner of unforeseen assistance materializes to support and propel the committed to meet grand destiny.

- In your recipe for success, don’t forget commitment – and a deep belief in the inevitability of your success.

This is a very important angle

Nuggets of Wisdom from REMINISCENCES OF A STOCK OPERATOR.

Just Today evening again completed reading this book and this was I think 10th time I had read this book.Iam telling you this is a Bible for Day Traders.

Here are some of the Quotes/Nuggets from this Book.Just spare some time and read them ……

Of course there is always a reason for fluctuations, but the tape does not concern itself with the why and wherefore.

My plan of trading was sound enough and won oftener than it lost. If I had stuck to it I’d have been right perhaps as often as seven out of ten times.

What beat me was not having brains enough to stick to my own game.

But there is the Wall Street fool, who thinks he must trade all the time. No man can always have adequate reasons for buying or selling stocks daily or sufficient knowledge to make his. play an intelligent play.

The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall

Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.

It takes a man a long time to learn all the lessons of all his mistakes. (more…)

Risk/Reward Ratio analysis is crucial in all decision making.

Never Ever Follow The Villager Into Equities

It’s a moot point: Is the Buffalo leading the Villager or is the Villager Following The Buffalo? The Chinese are contemplating the same.

Just months ago, his courtyard home at the edge of the orchard was a makeshift trading floor where local farmers gathered to share tips and track the Shanghai Composite. Now, the gates are closed, a security camera stands watch, and nobody wants to talk about the stock-trading local party secretary.

“Out for the whole day,” ventured a neighbor.

“Who?” said another.

“Maybe he flew away in a plane,” joked a third. The country was gripped by stock fever, a frenzy of borrowing and buying that saw Chinese markets soar to historic heights, drawing in tens of millions of first-time investors, including dozens of people in this northern Chinese village.

The rally was bolstered by rah-rah editorials in the state-controlled press. Invoking President Xi Jinping’s vision for a powerful and prosperous China, the People’s Daily called rising stock prices “carriers of the China dream.” When the benchmark index hit 4000 points, an editorial in the same party flagship promised it was “just the beginning” of the bull run.

Smart people use simple language.