I recently came across a December 1996 San Jose Mercury News article on tech pioneers’ attempts to carry the pre-browser Internet’s bulletin board community vibe over to the new-fangled World Wide Web.

In effect, the article is talking about social media a decade before MySpace and Facebook and 15 years before the maturation of social media.

(Apple was $25 per share in December 1996. Adjusted for splits, that’s about the cost of a cup of coffee.)

So what’s the point of digging up this ancient tech history?

1. Technology changes in ways that are difficult to predict, even to visionaries who understand present-day technologies.2. The sources of great future fortunes are only visible in a rearview mirror.

Many of the tech and biotech companies listed in the financial pages of December 1996 no longer exist. Their industries changed, and they vanished or were bought up, often for pennies on the dollar of their heyday valuations.

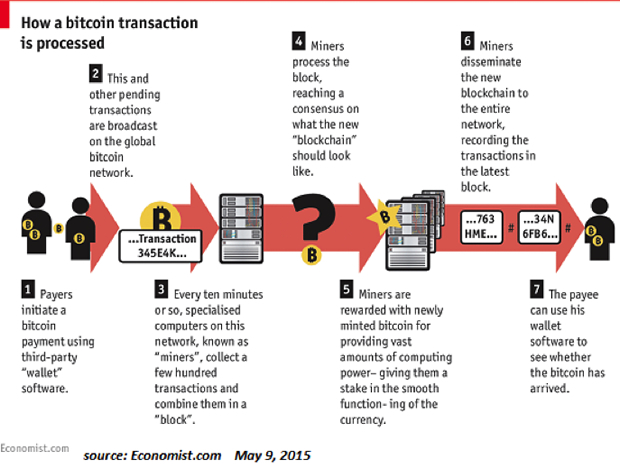

Which brings us to cryptocurrencies, which entered the world with bitcoin in early 2009.

Now there are hundreds of cryptocurrencies, and a speculative boom has pushed bitcoin from around $600 a year ago to $2600 and Ethereum, another leading cryptocurrency, from around $10 last year to $370.

Where are cryptocurrencies in the evolution from new technology to speculative boom to maturation? Judging by valuation leaps from $10 to $370, the technology is clearly in the speculative boom phase.

If recent tech history is any guide, speculative boom phases are often poor guides to future valuations and the maturation trajectory of a new sector.

Anyone remember “push” technologies circa 1997? This was the hottest thing going, and valuations of early companies went ballistic. Then the fad passed and some new innovation became The Next Big Thing.

All of which is to say: nobody can predict the future course of cryptocurrencies, other than to say that speculative booms eventually end and technologies mature into forms that solve real business problems in uniquely cheap and robust ways no other technology can match.

So while we can’t predict the future forms of cryptocurrencies that will dominate the mature marketplace, we can predict that markets will sort the wheat from the chaff by a winnowing the entries down to those that solve real business problems (i.e. address scarcities) in ways that are cheap and robust and that cannot be solved by other technologies.

Most traders have read Alexander Elder’s Trading for a Living, originally published in 1993. Elder has, of course, written other popular books such as Come into My Trading Room (2002) and Entries and Exits (2006). His latest work, The New Sell & Sell Short: How to Take Profits, Cut Losses, and Benefit from Price Declines (Wiley, 2011) is an expanded second edition of his 2008 book. It comes with a built-in study guide: three sets of questions and answers. Although it is a paperback, the charts and graphs are printed in color and the stock is of high quality.

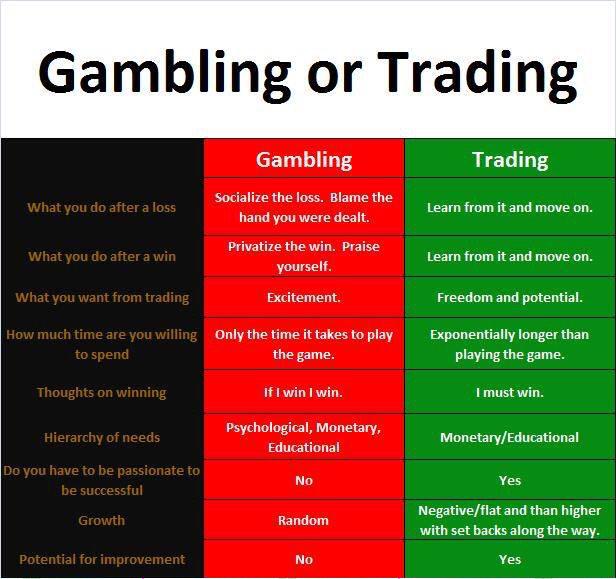

Most traders have read Alexander Elder’s Trading for a Living, originally published in 1993. Elder has, of course, written other popular books such as Come into My Trading Room (2002) and Entries and Exits (2006). His latest work, The New Sell & Sell Short: How to Take Profits, Cut Losses, and Benefit from Price Declines (Wiley, 2011) is an expanded second edition of his 2008 book. It comes with a built-in study guide: three sets of questions and answers. Although it is a paperback, the charts and graphs are printed in color and the stock is of high quality. All through time, people have basically acted and reacted the same way in the market as a result of: greed, fear, ignorance, and hope. That is why the numerical (technical) formations and patterns recur on a constant basis.

All through time, people have basically acted and reacted the same way in the market as a result of: greed, fear, ignorance, and hope. That is why the numerical (technical) formations and patterns recur on a constant basis.