Major indices rise modestly on the day in up and down session

The S&P is closing higher. Since yesterday was a record high, that means today is a record as well (that analysis is pretty simple).

The Nasdaq remains below it’s record close at 8163.99. The high today reached 8109.36 – near the closing level for the day.

The final numbers are showing:

- The S&P index rose 8.68 points or 0.29% at $1413.56

- The Nasdaq index rose 17.931 points or 0.22% at 8109.09

- The Dow rose by 69.25 points or 0.26% at 26786.68

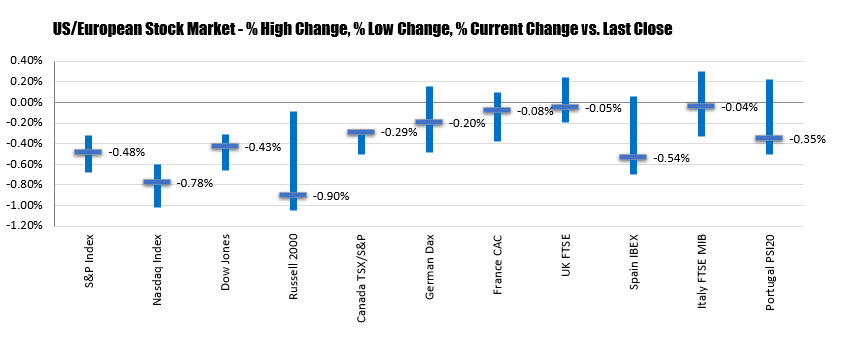

Looking at the % changes and % high/low levels, the major US stock are all closing at/near the highs for the day. European shares (apart from the Portugal PSI20) closed higher as well.

Some winners today:

- Verizon, +2.61%

- Cisco, +1.95%

- McDonald’s, +1.53%

- Gilead, +1.49%

- MasterCard, +1.41%

- Delta Airlines, +1.33%

- alphabetic, +1.15%

- Facebook, +1.04%

- Pfizer, +1.03%

- Intuit,, 0.81%

- visa, +0.78%

- Microsoft, +0.66%

- Walt Disney, +0.64%

- Amazon, +0.63%

- Apple, +0.59%

Some losers on the day include:

- Nvidia, -2.37%

- Beyond Meat, -1.88%

- Chewy, -1.87%

- Broadcom, -1.67%

- Chevron, -1.52%

- Charles Schwab, -1.42%

- Dow DuPont, -1.31%

- micron, -1.27%

- Tesla, -1.15%

- Exxon Mobil, -1.06%

- Wells Fargo, -0.96%

- Bank of America, -0.95%

- Box, -0.91%

- QUALCOMM, -0.66%

- Boeing, -0.62%

“The secret recipe for success in stock market is simple. 30% in market analysis skills, 30% in risks management, 30% in emotion control, and 10% in luck.”

“The secret recipe for success in stock market is simple. 30% in market analysis skills, 30% in risks management, 30% in emotion control, and 10% in luck.”  The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.

The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages. Patience is a virtue, and no place does this truism hold more water than the stock market. When a trader allows doubt, a facet of fear, to inform his trading decision, he sets himself up for failure. The market does not care about the wants of an individual trader, whereas when making a turn across oncoming traffic, a mistake may result only in an oncoming driver slamming on his or her brakes in order to avoid an accident. The market will not extend such a courtesy. It will run over anyone and anything between it and where it is going without as much as an afterthought. It is the responsibility, not of the market to go where the trader wants it to go, but for the trader to determine the most likely course of the market and plan accordingly. Patience, achieved by a trader monitoring his internal dialogue, makes it possible.

Patience is a virtue, and no place does this truism hold more water than the stock market. When a trader allows doubt, a facet of fear, to inform his trading decision, he sets himself up for failure. The market does not care about the wants of an individual trader, whereas when making a turn across oncoming traffic, a mistake may result only in an oncoming driver slamming on his or her brakes in order to avoid an accident. The market will not extend such a courtesy. It will run over anyone and anything between it and where it is going without as much as an afterthought. It is the responsibility, not of the market to go where the trader wants it to go, but for the trader to determine the most likely course of the market and plan accordingly. Patience, achieved by a trader monitoring his internal dialogue, makes it possible. You can give anyone the best tools in the world and if they don’t use them with good money management, they will not make money in the markets….

You can give anyone the best tools in the world and if they don’t use them with good money management, they will not make money in the markets….