Everyone knows what they /SHOULD/ do… and everyone has trouble doing it. Why? Lots of reasons –

Everyone knows what they /SHOULD/ do… and everyone has trouble doing it. Why? Lots of reasons –

Market ambiguity compels you to make impulsive judgments … . Not enough sleep… . I can go on and on and on… and talk to you about your emotional architectures and using emotion analytics to better manage your risk as well as better deduce opportunity.

But here is a little “emotion analytics” trick –

Ask yourself – as you are contemplating entering or exiting a position “How will I feel if…. ?” … and then play out the scenarios, #1) the trade continues in my direction, #2) it pulls back and takes away some of my money, #3) it ….

By putting yourself into your potential future emotional contexts, you can make better “risk” judgments in the here and now.

(And oh yes, I know to some of you this sounds absurd…that is OK. Everyone that I have taught to do it, makes more money than when they just tried to use so-called discipline to intellectually overpower their desires to get in or out or… in and out … or ….)

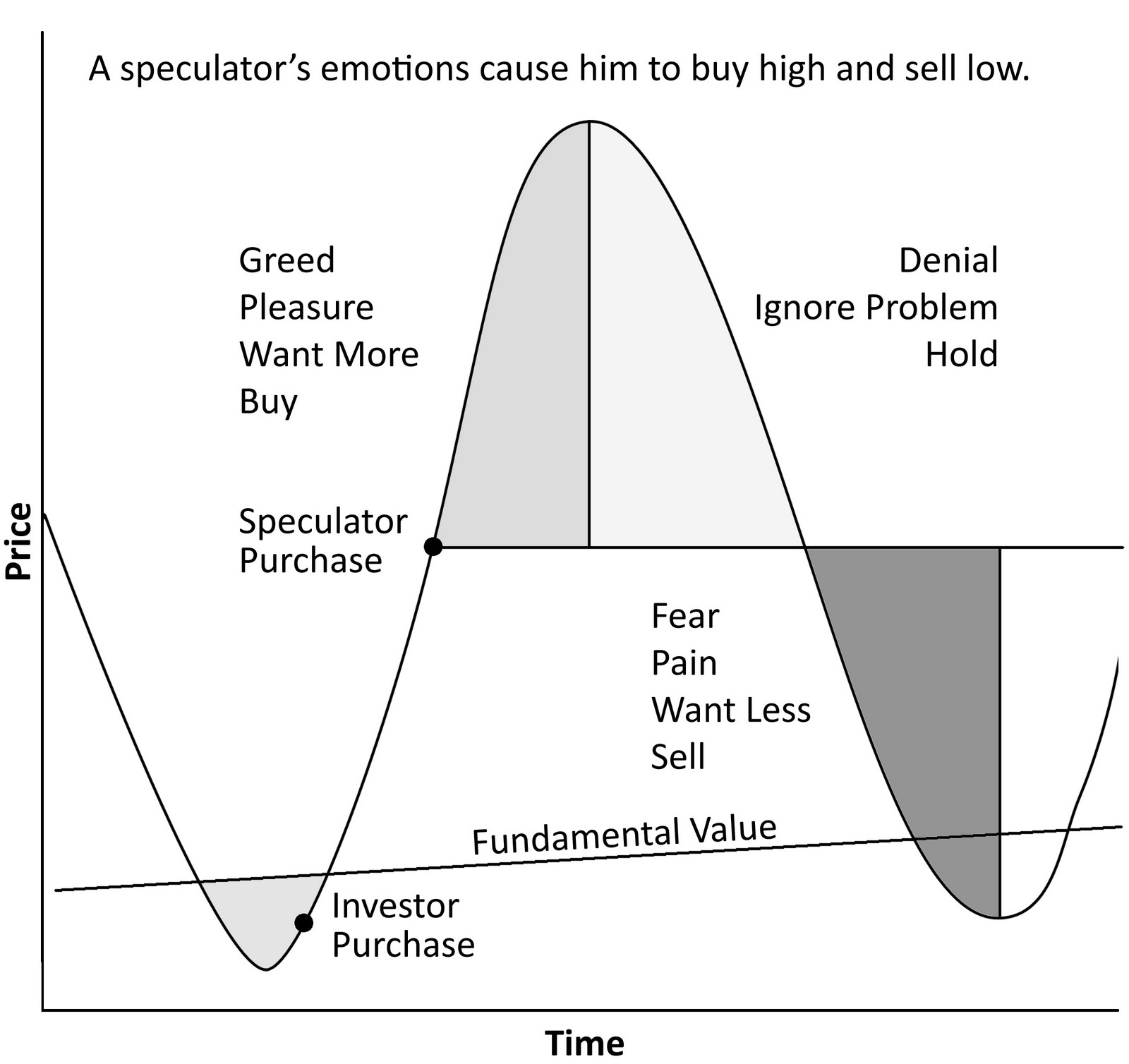

“The most risk is always going to be in the areas that had the biggest moves up already, and everybody’s talking about ‘em, and then you get sucked in at the most inopportune time — and then you don’t know what hit you.

“The most risk is always going to be in the areas that had the biggest moves up already, and everybody’s talking about ‘em, and then you get sucked in at the most inopportune time — and then you don’t know what hit you.  Everyone knows what they /SHOULD/ do… and everyone has trouble doing it. Why? Lots of reasons –

Everyone knows what they /SHOULD/ do… and everyone has trouble doing it. Why? Lots of reasons –