It has long been observed, casually, that the trends of hemlines and stock prices appear to be in lock step. Skirt heights rose to mini-skirt brevity in the 1920’s and in the 1960’s, peaking with stock prices both times. Floor length fashions appeared in the 1930’s and 1970’s (the Maxi), bottoming with stock prices. It is not unreasonable to hypothesize that a rise in both hemlines and stock prices reflects a general increase in friskiness and daring among the population, and a decline in both, a decrease. Because skirt lengths have limits (the floor and the upper thigh, respectively), the reaching of a limit would imply that a maximum of positive or negative mood had been achieved

It has long been observed, casually, that the trends of hemlines and stock prices appear to be in lock step. Skirt heights rose to mini-skirt brevity in the 1920’s and in the 1960’s, peaking with stock prices both times. Floor length fashions appeared in the 1930’s and 1970’s (the Maxi), bottoming with stock prices. It is not unreasonable to hypothesize that a rise in both hemlines and stock prices reflects a general increase in friskiness and daring among the population, and a decline in both, a decrease. Because skirt lengths have limits (the floor and the upper thigh, respectively), the reaching of a limit would imply that a maximum of positive or negative mood had been achieved

Archives of “population” tag

rssUS Media Hits Record High, As CNBC Viewership Drops To Multi-Year Low

In today’s “less than surprising data point” category, the clear winner is Gallup’s analysis of people’s ever increasing distrust in the mass media. From 46% in 1998, the percentage of people who indicate they have “not very much/none at all” trust in mass media has grown to a stunning 57% currently. This is an all time record, as the general public perception toward the MSM has flipped over the past decade. Is it becoming increasingly more difficult to lie to the average American? In this time of unprecedented economic upheaval, where the political regime depends on just how far any given administration’s lies can penetrate amongst the broader population, this may well become the most critical factor in determining policy for the future. And with ever increasing alternatives of non-traditional media, could the legacy ad-supported media model, which by definition is one which espouses the status quo, be doomed precisely by the slow but steady education of the average American, who intuitively realizes that nearly every “fact” appearing in the media, especially that supported by any given political party, is a lie?

In today’s “less than surprising data point” category, the clear winner is Gallup’s analysis of people’s ever increasing distrust in the mass media. From 46% in 1998, the percentage of people who indicate they have “not very much/none at all” trust in mass media has grown to a stunning 57% currently. This is an all time record, as the general public perception toward the MSM has flipped over the past decade. Is it becoming increasingly more difficult to lie to the average American? In this time of unprecedented economic upheaval, where the political regime depends on just how far any given administration’s lies can penetrate amongst the broader population, this may well become the most critical factor in determining policy for the future. And with ever increasing alternatives of non-traditional media, could the legacy ad-supported media model, which by definition is one which espouses the status quo, be doomed precisely by the slow but steady education of the average American, who intuitively realizes that nearly every “fact” appearing in the media, especially that supported by any given political party, is a lie?

From Gallup’s study on media distrust:

For the fourth straight year, the majority of Americans say they have little or no trust in the mass media to report the news fully, accurately, and fairly. The 57% who now say this is a record high by one percentage point.

The 43% of Americans who, in Gallup’s annual Governance poll, conducted Sept. 13-16, 2010, express a great deal or fair amount of trust ties the record low, and is far worse than three prior Gallup readings on this measure from the 1970s. (more…)

Skill versus Hard work

Is trading success dependent on innate skills? Or is hard work suffi-cient? There is no question in my mind that many of the supertraders have a special talent for trading. Marathon running provides an appro-priate analogy. Virtually anyone can run a marathon, given sufficient commitment and hard work. Yet, regardless of the effort and desire, only a small fraction of the population will ever be able to run a 2:12 marathon. Similarly, anyone can learn to play a musical instrument. But again, regardless of work and dedication, only a handful of individuals possess the natural talent to become concert soloists. The general rule is that exceptional performance requires both natural talent and hard work to realize its potential. If the innate skill is lacking, hard work may pro-vide proficiency, but not excellence.

Is trading success dependent on innate skills? Or is hard work suffi-cient? There is no question in my mind that many of the supertraders have a special talent for trading. Marathon running provides an appro-priate analogy. Virtually anyone can run a marathon, given sufficient commitment and hard work. Yet, regardless of the effort and desire, only a small fraction of the population will ever be able to run a 2:12 marathon. Similarly, anyone can learn to play a musical instrument. But again, regardless of work and dedication, only a handful of individuals possess the natural talent to become concert soloists. The general rule is that exceptional performance requires both natural talent and hard work to realize its potential. If the innate skill is lacking, hard work may pro-vide proficiency, but not excellence.

In my opinion, the same principles apply to trading. Virtually any-one can become a net profitable trader, but only a few have the inborn talent to become supertraders. For this reason, it may be possible to teach trading success, but only up to a point. Be realistic in your goals.

U.S. Treasury to China – Revalue Remnimbi or We Will

There’s a lot of talk around the markets and in Washington about China’s currency policy. What many want to know is whether the US Treasury will name China as a currency manipulator. Perhaps a more important question is, should China be named as a currency manipulator? And if it were named as such, what actions could the US take? In recent days the Chinese and the US administration have taken shots in the press at each other. The US is hinting that China is manipulating its currency to boost its economy. The Chinese is firing back saying that the US “should not politicize the remnimbi exchange rate issue.”

There’s a lot of talk around the markets and in Washington about China’s currency policy. What many want to know is whether the US Treasury will name China as a currency manipulator. Perhaps a more important question is, should China be named as a currency manipulator? And if it were named as such, what actions could the US take? In recent days the Chinese and the US administration have taken shots in the press at each other. The US is hinting that China is manipulating its currency to boost its economy. The Chinese is firing back saying that the US “should not politicize the remnimbi exchange rate issue.”

First, some background on the problem. Basic economics says that if you keep the currency of your country at a weak (but not so weak as to cause a collapse in it) level you help boost exports. The currency becomes weaker making your goods cheaper for foreign consumption. In a freely floating exchange system, the market determines the equilibrium value. Speculators look at economic statistics like GDP growth, interest rates, inflation etc. to figure out what a currency should be worth and then place bets accordingly. If speculators think that an economy can grow strongly while keeping inflation at a benign rate, they will bid up the currency of that economy. As that happens, the country whose currency is getting stronger could see a decrease in exports. This is caused by the larger amount of currency the importer uses to make the same purchase as previously made. (more…)

Marc Faber`s Picks For 2010

Dr. Marc Faber shared with the Economic Times his investment themes for 2010. Japanese stocks and shorting US Treasuries are his top picks for 2010:

Dr. Marc Faber shared with the Economic Times his investment themes for 2010. Japanese stocks and shorting US Treasuries are his top picks for 2010:

“I would avoid US government bonds and I think as a contrarian you really want the contrarian play. You should buy Japanese stocks and Japanese banks. This is the absolute contrarian play. Nobody is interested in Japan all the funds have withdrawn money from Japan they have given up on Japan I guarantee you the economy would not do well, forget about the economy the population is shrinking but you can have an economy that does not do well but the companies do well that is a big difference and I think the Japanese banks are very depressed. All the banks in Asia have actually recovered very strongly but not the Japanese banks so as a contrarian play I would look at that.” in Economic Times.

A Trading Psychology Checklist

How do you know if your trading psychology problem is really just about trading or is a sign of larger problems? Here is a quick checklist:

A) Does your problem occur outside of trading? For instance, do you have temper and self-control problems at home or in other areas of life, such as gambling or excessive spending?

B) Has your problem predated your trading? Did you have similar emotional symptoms when you were young or before you began your trading career?

C) Does your problem spill over to other areas of your life? Does it affect your feelings about yourself, your overall motivation and happiness in life, and your effectiveness in your work and social lives?

D) Does your problem affect other people? Do you feel as though others with whom you work or live are impacted adversely by your problem? Have others asked you to get help?

E) Do you have a family history of emotional problems and/or substance use problems? Have others, particularly in your immediate family, had treated or untreated emotional problems?

If you answered “yes” to two or more of the above items, consider that you may not be alone. More than 10% of the population qualifies with a diagnosable problem of anxiety, depression, or substance abuse. Tweaking your trading will be of little help if the problem has a medical or psychological root. A professional consultation if you answered “yes” to two or more checklist items might be your best money management strategy.

Per capita income in India is Rs 46,492

Per capita income of Indians grew by 14.5 per cent to Rs 46,492 in 2009-10 from Rs 40,605 in the year-ago period, as per the revised data released by the government today.

Per capita income of Indians grew by 14.5 per cent to Rs 46,492 in 2009-10 from Rs 40,605 in the year-ago period, as per the revised data released by the government today. The new per capita income figure estimates on current market prices is over Rs 2,000 more than the previous estimate of Rs 44,345 calculated by the Central Statistical Organisation (CSO).

Per capita income means earnings of each Indian if the national income is evenly divided among the country’s population at 117 crore.

However, the increase in per capita income was only about 6 per cent in 2009-10 if it is calculated on the prices of 2004-05 prices, which is a better way of comparison and broadly factors inflation.

Per capita income (at 2004-05 prices) stood at Rs 33,731 in FY10 against Rs 31,801 in the previous year, the latest data on national income said.

The size of the economy at current prices rose to Rs 61,33,230 crore in the last fiscal, up 16.1 per cent over Rs 52,82,086 crore in FY’09.

Based on 2004-05 prices, the Indian economy expanded by 8 per cent during the fiscal ended March 2010. This is higher than 6.8 per cent growth in fiscal 2008-09.

The country’s population increased to 117 crore at the end of March 2010, from 115.4 crore in fiscal 2008-09.

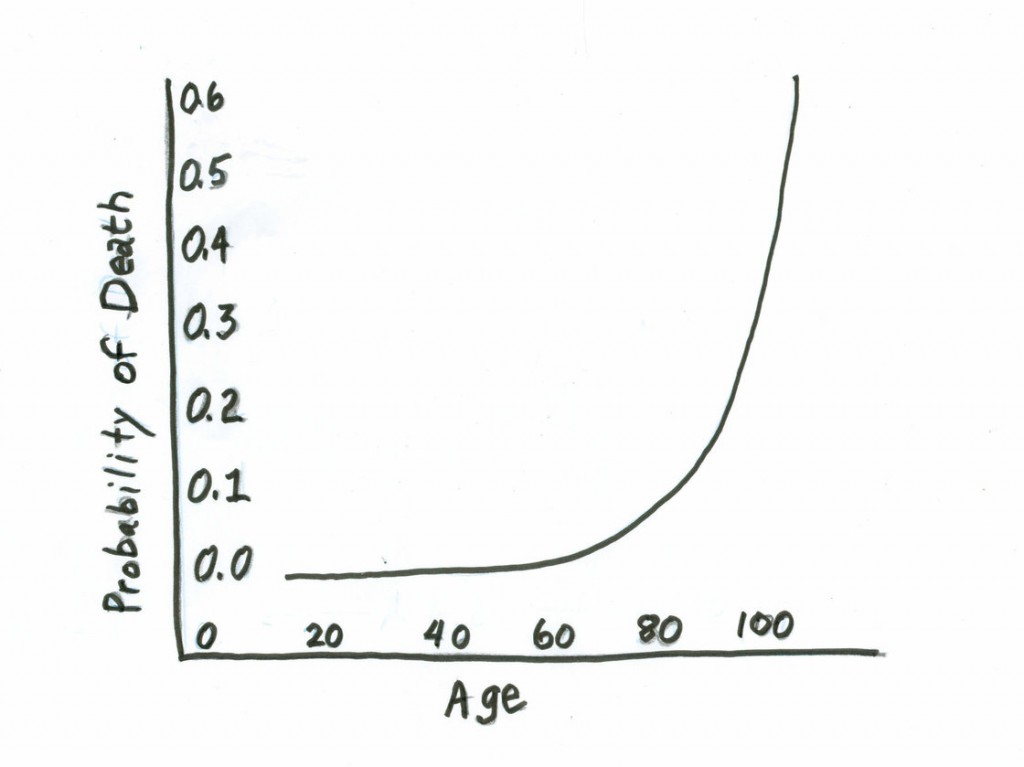

Every 8 Years, Your Chances of Dying Double

Robert Krulwich revisits the mysterious but true Gompertz Law of Human Mortality, named for the British actuary who had originally discovered this mathematical fact back in 1825.

via NPR:

Obviously, when you’re young (and past the extra-risky years of early childhood), the chances of dying in the coming year are minuscule — roughly 1 in 3,000 for 25-year-olds. (This is a group average, of course.)

But eight years later, the tables said, the odds will roughly double. ”When I’m 33 [the chances of my dying that year] will be about 1 in 1,500.”

And eight years after that…the odds double again: “It will be about 1 in 750.”

And eight years later, there’s another doubling. Looking down the chart, you’ll see that keeps happening and happening and happening. “Your probability of dying during a given year doubles every eight years.”

A helpful, if horrifying, chart:

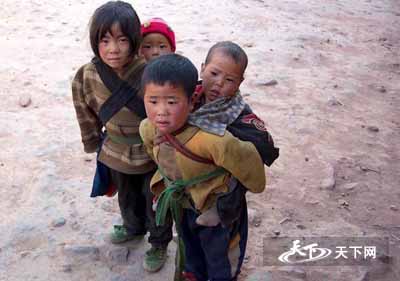

Chinese Bank Pledges to Allot Some $460Bln to Fight Poverty in Next 5 Years (India's Forex Reserve $361 bln )

Within the framework of China’s five-year plan, which outlines the country’s economic development goals for the 2016-2020 period, Beijing plans to improve the prosperity of some 70 million Chinese nationals, whose wealth is below the poverty line, according to the government data.

Within the framework of China’s five-year plan, which outlines the country’s economic development goals for the 2016-2020 period, Beijing plans to improve the prosperity of some 70 million Chinese nationals, whose wealth is below the poverty line, according to the government data.

According to the People’s Daily, money allocated by the ADBC are expected to fund education, infrastructure construction in the rural areas, resettlement programs, support corn farming and tourism.

The newspaper added that the proposed measures could improve the wealth status of the poorest citizens of China.

The ADBC is China’s bank which aims at the development of the country’s rural areas and agriculture by means of raising and allocation of special funds to support the sector, as well as agriculture-related business operations in line with Chinese legislation, according to the bank’s website.

Skill versus Hardwork

Is trading success dependent on innate skills? Or is hard work suffi-cient? There is no question in my mmd that many of the supertraders have a special talent for trading. Marathon running provides an appro-priate analogy. Virtually anyone can run a marathon, given sufficient commitment and hard work. Yet, regardless of the effort and desire, only a small fraction of the population will ever be able to run a 2:12 marathon. Similarly, anyone can learn to play a musical instrument. But again, regardless of work and dedication, only a handful of individuals possess the natural talent to become concert soloists. The general rule is that exceptional performance requires both natural talent and hard work to realize its potential. If the innate skill is lacking, hard work may pro-vide proficiency, but not excellence.

Is trading success dependent on innate skills? Or is hard work suffi-cient? There is no question in my mmd that many of the supertraders have a special talent for trading. Marathon running provides an appro-priate analogy. Virtually anyone can run a marathon, given sufficient commitment and hard work. Yet, regardless of the effort and desire, only a small fraction of the population will ever be able to run a 2:12 marathon. Similarly, anyone can learn to play a musical instrument. But again, regardless of work and dedication, only a handful of individuals possess the natural talent to become concert soloists. The general rule is that exceptional performance requires both natural talent and hard work to realize its potential. If the innate skill is lacking, hard work may pro-vide proficiency, but not excellence.

In my opinion, the same principles apply to trading. Virtually any-one can become a net profitable trader, but only a few have the inborn talent to become supertraders. For this reason, it may be possible to teach trading success, but only up to a point. Be realistic in your goals.