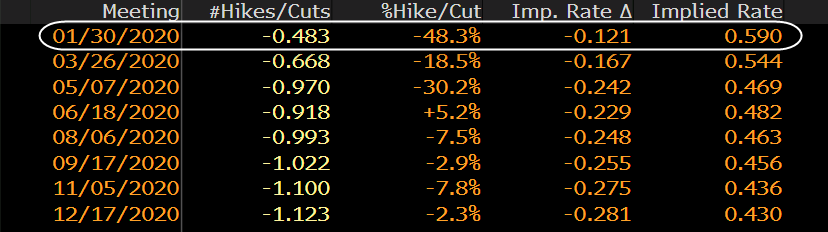

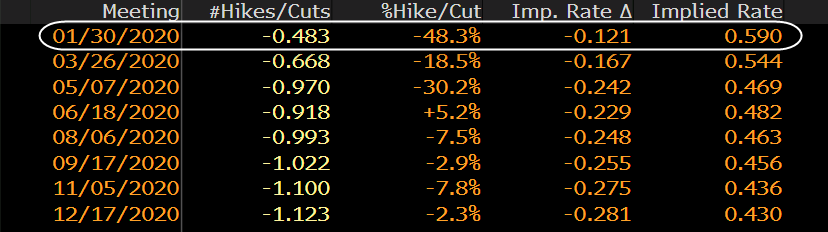

Odds of a 25 bps rate cut on 30 January falls below 50% from ~70% on Friday

1) What goes up must come down and vice versa.

1) What goes up must come down and vice versa.

That’s Newton’s law, not the law of trading. And even if the market does eventully self-correct, you have no idea when it will happen. In short, there’s no point blowing up your account fighthing the tape.

2) You have to be smart to make money.

No, what you have to be is disciplined. If you want to be smart, write a book or teach at a university. If you want to make money, listen to what the market is telling you and trade to make money — not to be “right.”

3) Making money is hard.

Nope. Sorry. Making money is actually easy. Statistically, you’re going to do it about half the time. Keeping it, now that’s the hard part.

4) I have to have a high winning percentage to be profitable.

Not true. How often you are right on a trade is only half of the equation. The other half is how much do you make when you’re right and how much you lose when you’re wrong. You can remember that with this formula:

Probability (odds of it going up or down) x Magnitude (how much it goes up or down) = Profitability

5) To be successful, I have to trade without emotions.

That is both wrong and impossible. You are human so you have emotions. Emotions can be a powerful motivator to your trading.

When you feel angry or scared in trading, take that emotion and translate it into something more productive. For example, if you’re feeling angry because you just got run over by the market, view that anger as a reason to be more focused and disciplined in your entry and exit levels on the next trade.

When it comes to market timing, you’ve got to UNLEARN responses that you’ve spent your whole life learning. Market timing isn’t about you. It is just a strategy that works over time. In other fields, probability plays little if any role. You put in effort, make sure you meet the expectations of the people who pay you, and you’re a success. In the traditional workplace, it makes sense to put a little ego and pride into your work. Your effort and talent often have a direct payoff. But with market timing, the odds can go against you, no matter how much work you put in. The perfect trade can go wrong. That’s hard to accept for most people because it means that being a successful (profitable) market timer or trader, to some extent, is just a matter of the odds randomly working in your favor. But there is good logic behind this randomness. And a successful timing or trading strategy uses this logic to profit. A successful timing strategy will exit losses quickly. It will not stay with a bullish or bearish position to sooth the ego of the strategy’s designer. It will also stay with a successful trade and not exit quickly to lock in a profit. That may feel good for a day, but if the profitable trend lasts two, three, five times longer, you have lost out on a huge profit. Recognizing that odds are part of trading takes some of the glory out of it. But on the other hand, understanding odds helps you cope with inevitable drawdowns.

When it comes to market timing, you’ve got to UNLEARN responses that you’ve spent your whole life learning. Market timing isn’t about you. It is just a strategy that works over time. In other fields, probability plays little if any role. You put in effort, make sure you meet the expectations of the people who pay you, and you’re a success. In the traditional workplace, it makes sense to put a little ego and pride into your work. Your effort and talent often have a direct payoff. But with market timing, the odds can go against you, no matter how much work you put in. The perfect trade can go wrong. That’s hard to accept for most people because it means that being a successful (profitable) market timer or trader, to some extent, is just a matter of the odds randomly working in your favor. But there is good logic behind this randomness. And a successful timing or trading strategy uses this logic to profit. A successful timing strategy will exit losses quickly. It will not stay with a bullish or bearish position to sooth the ego of the strategy’s designer. It will also stay with a successful trade and not exit quickly to lock in a profit. That may feel good for a day, but if the profitable trend lasts two, three, five times longer, you have lost out on a huge profit. Recognizing that odds are part of trading takes some of the glory out of it. But on the other hand, understanding odds helps you cope with inevitable drawdowns.

Common sense can be brutally honest sometimes. As traders we get so focused on the little inconsequential detaisl sometimes that we miss the world around us. I have had this discussion with too many people over the last two months that told me they were bearish on the market and were taking a beating on the “high probability” that the market would reverse. Who sets those odds by the way? Are trends more likely to reverse than persist? If so, why the hell are we studying technical analysis?

Common sense can be brutally honest sometimes. As traders we get so focused on the little inconsequential detaisl sometimes that we miss the world around us. I have had this discussion with too many people over the last two months that told me they were bearish on the market and were taking a beating on the “high probability” that the market would reverse. Who sets those odds by the way? Are trends more likely to reverse than persist? If so, why the hell are we studying technical analysis?

Take a look over these trading rules I stumbled across last year and see if there are any realities that surface from them. Each time I look these over it reminds me of the realities of what we do here.

1. No matter what you read about trading, until you use an approach and test it with your money on the line you will never learn how to trade. Paper Trading is NOT Trading!

2. If it were really possible to “Buy Low Sell High” or “Cut your Losses and Let your Winners Run”, then almost everyone would be making money rather than losing it.

3. Remember that there is ALWAYS someone on the other side of your trade who is using a trading technique exactly the opposite of yours who hopes to make money with his system.

4. If 90% of all traders lose money, they must be following generally accepted trading rules. The 10% who win do not!

5. You trade your beliefs and your beliefs about your system. If you have a problem with yourself, fix yourself first.

6. Impatience, Fear and Greed will make you poor. Any need to trade is rooted in greed and impatience.

7. If you really understand the markets then YOU KNOW that there is the same opportunity on every time frame, in every market, every single day.

8. Waiting for the perfect trade is “chickening out”, and caused by your lack of faith in yourself or your system.

9. Any hardwired, automated trading system sold that truly works 70 or 80 or 90 percent of the time in every market would be worth hundreds of millions of dollars and would not be for sale at any price. (more…)

A random person is pulled off the street and given $10,000 to trade. They have no prior experience which, on the bright side, means they have no bad habits, emotional baggage, or preconceived notions. Before trading they go through a five day crash course on market basics (order entry process, chart reading, pattern recognition, etc…). Suppose you are tasked with the responsibility of drafting a set of risk management rules which they are required to abide by. The objective is to make them survive as long as possible in the trading arena so they can learn as much as possible through first-hand experience.

What types of rules would you set?

The ideal approach of course is to structure a set of rules which makes it as difficult as possible to blow up the account while still leaving them open to accumulating profits. The goal isn’t so much helping them capture large gains as much as it is helping them survive. After learning how to survive, then they can modify their approach to being more aggressive and seeking larger gains.

Here are two of my top rules: (more…)

Lesson Number One: Cut your losses quickly.

As soon as a trade is contemplated, a trader must know at what point in time he’ll be proven wrong and exit a position. If a trader doesn’t know his exit before he takes the entry, he might as well go to the racetrack or casino where at least the odds can be quantified.

Lesson Number Two: Confirm your judgment before going all in.

Livermore was famous for throwing out a small position and waiting for his thesis to be confirmed. Once the stock was traveling in the direction he desired, Livermore would pile on rapidly to maximize the returns.

There are several ways to buy more in a winning position — pyramiding up, buying in thirds at predetermined prices, being 100% in no more than 5% above the initial entry — but the take home is to buy in the direction of your winning trade – never when it goes against you.

Lesson Number Three: Watch leading stocks for the best action.

Livermore knew that trending issues were where the big money would be made, and to fight this reality was a loser’s game.

Lesson Number Four: Let profits ride until price action dictates otherwise.

“It never was my thinking that made the big money for me. It always was my sitting.”

One method that satisfies the desire for profit and subdues the fear of a losing trade is to take one half of your profit off at a predetermined level, put a stop at breakeven on the rest, and let it play out without micromanaging the position. (more…)

The key to investment success is emotional discipline. Making money has nothing to do with intelligence. To be a successful investor, you have to be able to admit mistakes. I trained a guy to trade who had a 188 IQ. He was on “Jeopardy” once and answered every question correctly. That same person never made a dime in trading during 5 years!

-Victor Sperandeo

Most people lose money because of lack of emotional discipline

-the ability to keep their emotions removed from investment decisions. Dieting provides an apt analogy. Most people have the necessary knowledge to lose weight—that is they know that in order to lose weight you have to exercise and cut your intake of fats. However, despite this widespread knowledge, the vast majority of people who attempt to lose weight are unsuccessful. Why? Because they lack the emotional discipline.

-Victor Sperandeo

In my opinion, the greatest misconception about the market is the idea that if you buy and hold stocks for long periods of time, you’ll always make money. Let me give you some specific examples. Anyone who bought the stock market at any time between the 1896 low and the 1932 low would have lost money. In other words, there’s a 36 year period in which a buy-and-hold strategy would have lost money. As a more modern example, anyone who bought the market at any time between the 1962 low and the 1974 low would have lost money.

-Victor Sperandeo

-Victor Sperandeo

Once a price move exceeds its median historical age, any method you use to analyze the market, whether it be fundamental or technical, is likely to be far more accurate. For example, if a chartist interprets a particular pattern as a top formation, but the market is only up 10% from the last low, the odds are high that the projection will be incorrect. However, if the market is up 25% to 30%, then the same type of formation should be given a great deal more weight.

-Victor Sperandeo

To use a life insurance analogy, most people who become involved in the stock market don’t know the difference between a 20 year old and an 80 year old. Investing in the market without knowing what stage it is in is like selling life insurance to 20 year olds and 80 year olds at the same premium.

You have to do the mental work to let go of the need to know what is going to happen next or the need to be right on each trade. In fact the degree to which you think you know, assume you know, or in any way need to know what is going to happen next, is equal to the degree to which you will fail as a trader. Mark Douglas The most successful traders have found a way to inoculate themselves from the stress of trading, and from the outcome of their most recent trades. Here’s how they do it: They have an unshakable belief in the fact that 1) While the outcome of any given trade is uncertain they believe in their edge over a series of trades. In other words they know the expectancy of their method and have confidence that over a series of random outcomes, the odds are in their favor. 2) Anything can happen! In other words they have learned to think of every trade like tossing a coin – they don’t need to know what will happen. They don’t expect to either win or lose. This firm belief in the uncertainty of any given trade, while knowing that over a series of trades you will be profitable, is very liberating. When you learn the mental discipline of letting go of the result of any individual trade you keep your mind in a state where it can easily perceive the opportunities that the market is offering. It is not distracted by focusing on your expectations of what you think should happen – it can perceive what is most likely to happen. The Body/Mind Connection

You have to do the mental work to let go of the need to know what is going to happen next or the need to be right on each trade. In fact the degree to which you think you know, assume you know, or in any way need to know what is going to happen next, is equal to the degree to which you will fail as a trader. Mark Douglas The most successful traders have found a way to inoculate themselves from the stress of trading, and from the outcome of their most recent trades. Here’s how they do it: They have an unshakable belief in the fact that 1) While the outcome of any given trade is uncertain they believe in their edge over a series of trades. In other words they know the expectancy of their method and have confidence that over a series of random outcomes, the odds are in their favor. 2) Anything can happen! In other words they have learned to think of every trade like tossing a coin – they don’t need to know what will happen. They don’t expect to either win or lose. This firm belief in the uncertainty of any given trade, while knowing that over a series of trades you will be profitable, is very liberating. When you learn the mental discipline of letting go of the result of any individual trade you keep your mind in a state where it can easily perceive the opportunities that the market is offering. It is not distracted by focusing on your expectations of what you think should happen – it can perceive what is most likely to happen. The Body/Mind Connection

It is often said that markets hate uncertainty and it is true. We do live and trade in uncertain times. But, as traders and investors, we must all learn to love and appreciate uncertainty. With uncertainty, also brings opportunity. Understanding this concept is so very important and learning how to profit from uncertainty consistently is going to make a critical difference between your success and failure.

It is often said that markets hate uncertainty and it is true. We do live and trade in uncertain times. But, as traders and investors, we must all learn to love and appreciate uncertainty. With uncertainty, also brings opportunity. Understanding this concept is so very important and learning how to profit from uncertainty consistently is going to make a critical difference between your success and failure.

Traders learn through experience the importance of examining and evaluating the markets through placing percentages on various future market scenarios. For example, at the hedge fund I worked at last week, every morning traders assemble for a 30 minute premarket meeting where everyone at the firm works closely together to outline the various potential scenarios for the market that day and then place specific odds on what they think is most likely to occur and why. One trader every day is in charge of diagramming out the different market scenarios on a whiteboard which resembles a flow chart so that the firm has a structured and easy to follow game plan. That game plan is also copied and stored so that the firm can later review it to learn and prepare in future days. In fact, at the end of every trading day they have another meeting to review the game plan and what went right and wrong and why.

By having the plan in place with various market scenarios outlined and positions to profit from those scenarios, uncertainty is no longer a factor. In fact, traders learn to love uncertainty because uncertain market conditions tend to favor those who are the most prepared to handle anything and everything Mr. Market could throw their way.

When the market does something outside of that original plan (it doesn’t happen as often as you might think), there is always a Plan B, Plan C, and so on with a number of preconfigured trading ideas to profit if the market moved in a specific manner different than the most likely scenario. By having this planned structure in place, everyone can then focus on price action and trading setups as they occur instead of flying by the seat of their pants or, even worse, finding themselves held hostage or paralyzed by the ticker.

I had the distinct privilege of looking through the archive of firm’s game plans for the past year and was amazed by how well the firm positioned itself according to the plan AND more importantly how it handled itself when the market did something unusual. In fact, just reviewing past game plans would be incredibly useful as a teaching mechanism for new traders who have little understanding of how the pros plan their work and work their plan. If you’re like me, you’ll begin to respect the other side of the trade much more than you probably do already.

As you might imagine, the process of formulating a game plan based on setting percentage odds for various scenarios was very interesting and useful for me to watch and participate in. It also stressed how important it is to have a plan, but at the same time be flexible enough to adjust as market conditions change. I usually spend at least an hour of prep time before every trading day, but after last week’s experience I will be doing more prep than before. That’s how important I think this kind of exercise can be!

So, the question becomes, are you adequately prepared every trading day? In working with many traders over the years, most are not as prepared as I saw with my very own eyes last week. In fact, given the firm’s results compared with other traders I know, I have good reason to think that kind of high-level preparation frequently can separate the winners from the losers.

Yes, it is true that we call can get lucky (every trade in theory has a 50% chance of working out, correct?), but over time the market will remove that luck factor and your success will be determined primarily on consistency and how you plan and deal with uncertainty in the markets. If you spend time every morning engaged in developing your own plan, I think you’re bound to see steady and significant improvement. As Sun Tzu once said, “every battle is won before it is ever fought” and that’s true for those who engage in doing battle with the market in such uncertain times.