The pressure is on

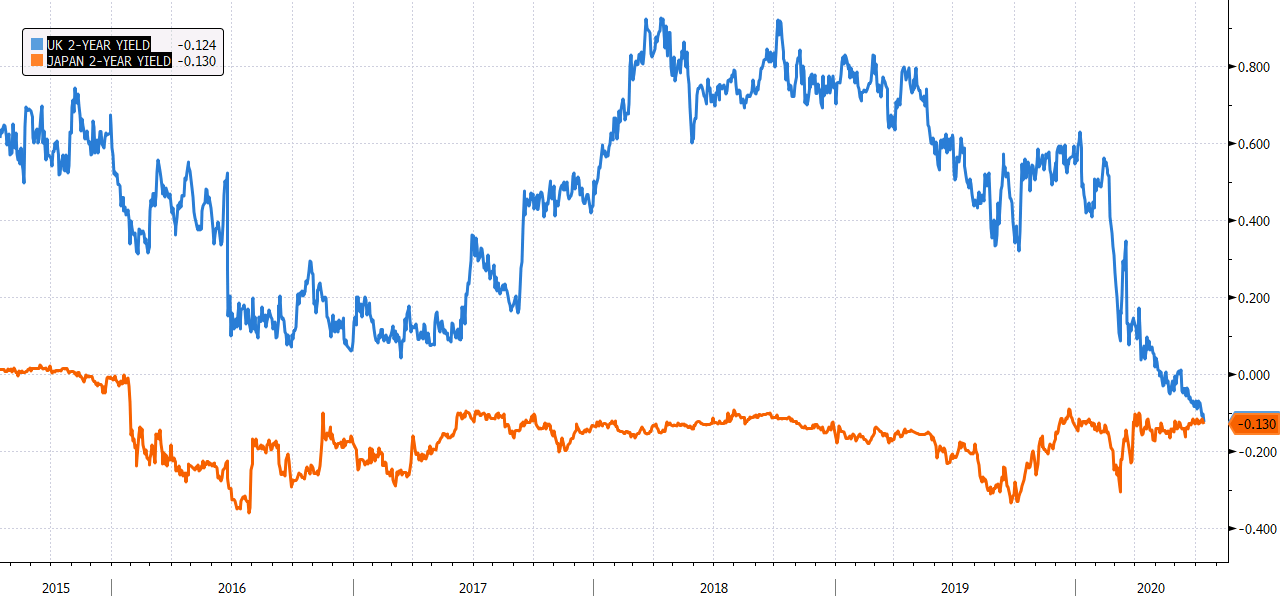

The US dollar has extended its gains as market participants get caught wrong-footed in a rebound after multi-month lows.

The dollar looked to be breaking down yesterday and today but stabled itself and is making a move to the upside. There are two near term factors to watch:

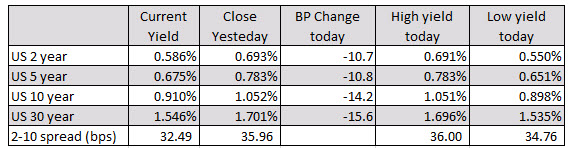

1) The 20-year auction

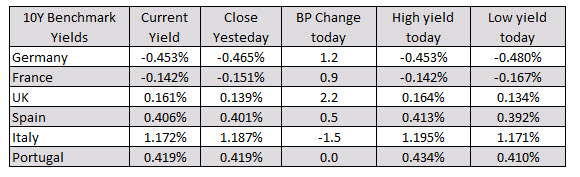

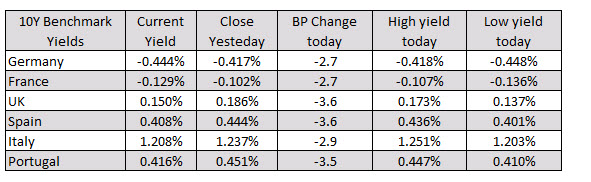

The US is selling $25B in 20-year bonds at the top of the hour. Last week there was a strong 10-year sale and a very weak 30-year sale so the bond market is off balance. A higher-than-anticipted yield could boost the dollar further.

2) The FOMC minutes

The Fed is a below-the-radar risk at the moment. The strong belief in markets is that they’re creeping towards doing more for the economy but an improvement in US virus cases, decent economic data, higher inflation and the stock market at record highs might make them slow their roll. If so, the dollar could climb further

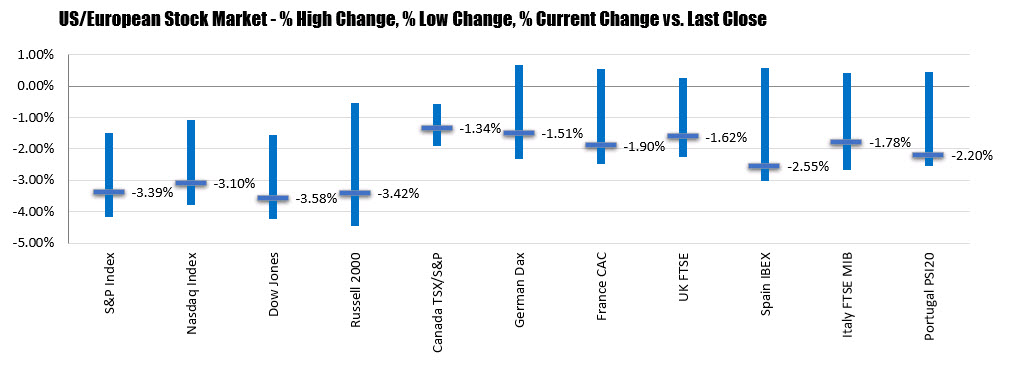

Overall, this looks like a position-squaring squeeze in a quiet mid-August market to me but you can’t take anything for granted. If it spills over into a broad risk-off move, then the dollar could have a lot of room to run.

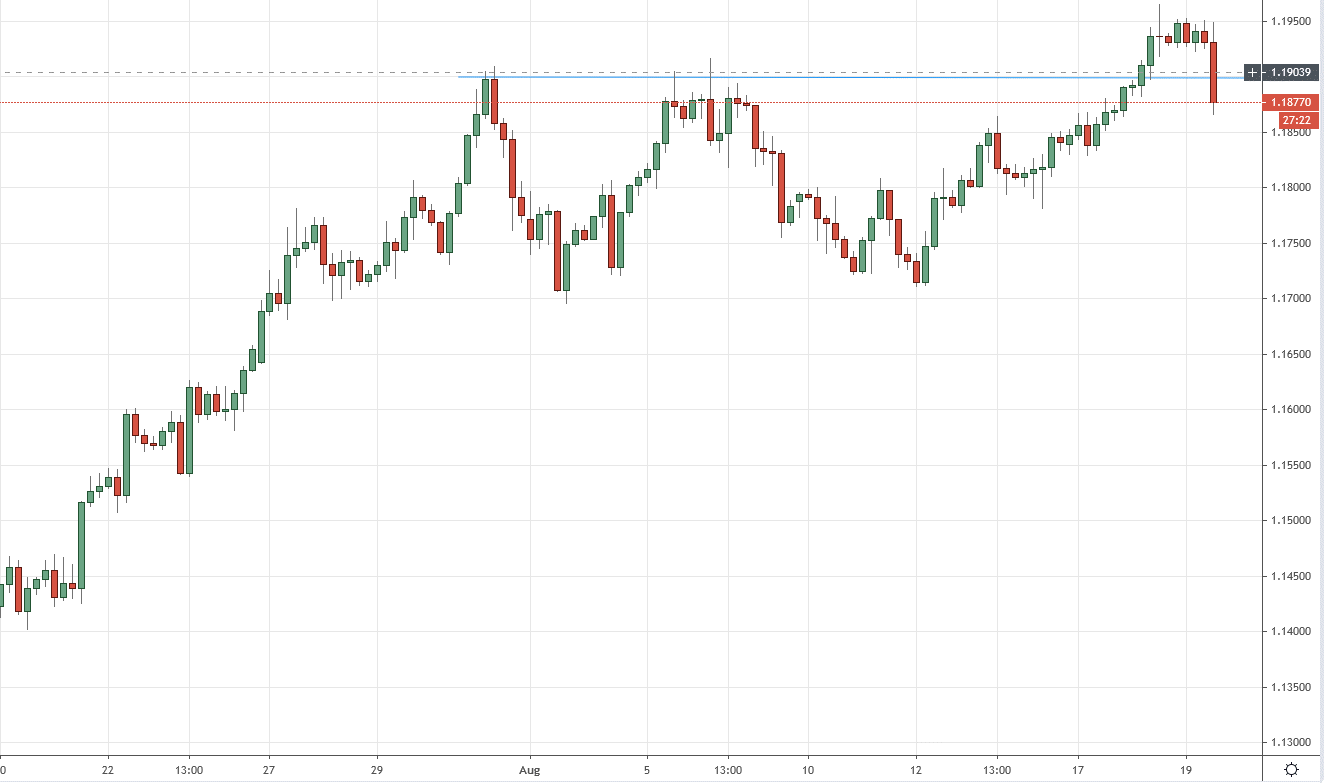

The EUR/USD chart to me looks like a retest of the range break before a further breakout but a close over 1.19 today would add confidence.