Since we are human merchants and we like what we do, executing the above-portrayed model would require a ton of tolerance and it would likewise be extremely exhausting. we better utilize a computerized forex-system to execute this coin-choice exchanging model. all we would need to do is truly utilize a guarded hazard the board of most extreme 1% per exchange, on the grounds that a half winning-likelihood would not imply that we would not need to confront 10 or 15 failure exchanges a column! recollect that these probabilities become valid in the long run!

since we like to inhale and encounter the business sectors, and we obviously need to exchange physically utilizing specialized examination or key news, we should now have a more critical investigation of the universe of cash the board, stop misfortune, take benefit, and obviously additionally the satisfactory exchange volume. since section 1 of this article arrangement, we realize how a dealer can ensure his record by straightforward RISK MANAGEMENT counts. this is totally vital and its significance can’t be rehashed regularly enough!

Presently, in the comic, sadly, flipism didn’t turn out to be well for Donald. A coin flip for every choice brought about a progression of incidents for poor Donald. Amusingly, however, so as to bargain out some proper recompense, Donald managed to pursue down the con artist Professor Batty by finding the misrepresentation behind the correct entryway dependent on a coin flip, so maybe the way of thinking holds some legitimacy. In spite of the fact that I don’t really advocate carrying on with a real existence dependent on coin flips, incidentally, coin flips and the hidden factual rules that administer coin flips are especially powerful when applied to certain issues normally looked in the information.

without utilizing any investigation technique each time you open exchange, you have a half possibility that the exchange goes toward you! the reality of the situation may prove that in 10 exchanges it goes 8 or multiple times toward you, or against you… be that as it may, in 1.000 exchanges you will have indirect 500 victors and 500 washouts. you can contrast that with tossing a coin. the more regularly you toss a coin the more you can be certain, that the scientific probability will appear and affirm the half possibility for each side of the coin or every bearing of an exchange. knowing this, all you need to do ist to pick an SL/TP-RATIO of 1:2. for instance 20 pips SL and 40 pips TP. in the event that you currently win each second exchange (half), you will naturally make benefits!

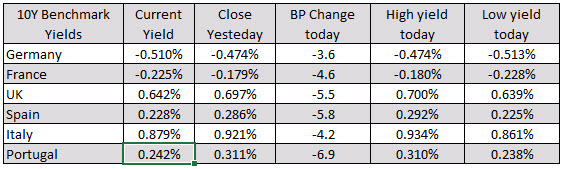

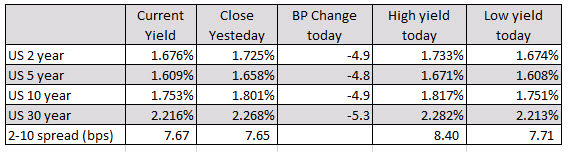

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

No, not the fear you’re thinking of, the other kind of fear, the fear of missing out.

No, not the fear you’re thinking of, the other kind of fear, the fear of missing out. You have to have the ability to change and see how the markets are changing and adapt to it. That’s a constant process. That’s why I think you see some people do well for four or five years and then just disappear.

You have to have the ability to change and see how the markets are changing and adapt to it. That’s a constant process. That’s why I think you see some people do well for four or five years and then just disappear.