Falls below Thursday low at 1.11851. Close risk.

U.S. stocks closed higher Tuesday, but off the session’s best levels, after Federal Reserve Chairman Jerome Powell suggested more fiscal stimulus may be needed as the American economy may only make a slow recovery from the COVID-19 pandemic.

Rising coronavirus cases in several U.S. states are also are concern for investors, even though retail sales and industrial production data show the economy is slowly recovering, and progress on the development of potential therapeutic drugs has been reported.

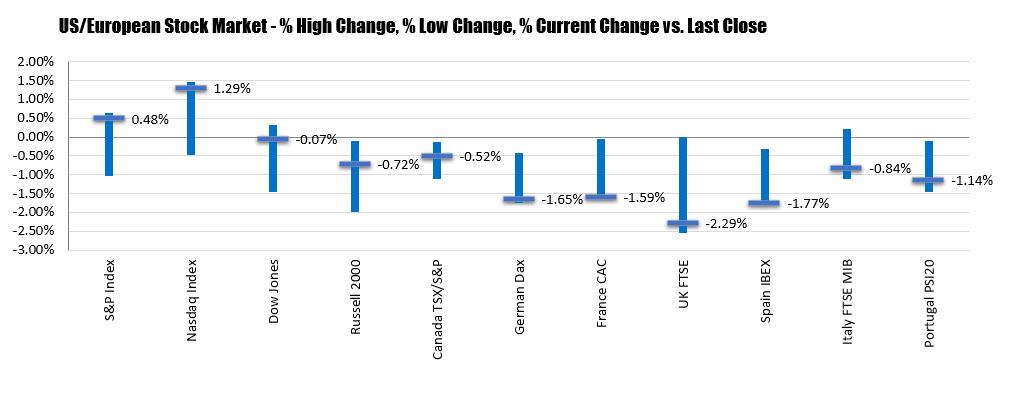

The Dow Jones Industrial Average DJIA, +2.04% rose 526.82 points, or 2%, to end at 26,289.98. The S&P 500 index SPX, +1.89% added 58.15 points to close at 3,124.74, a gain of 1.9%. The Nasdaq Composite Index COMP, +1.74% advanced 169.84 points, or 1.8%, to end at 9,895.84.

All three benchmarks extended their win streak to three straight sessions, but finished below their best levels of the day.

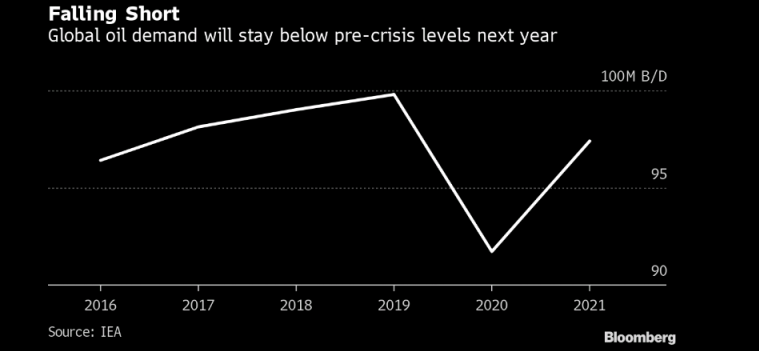

“The market may present producers with an opportunity to ramp up more quickly than dictated by current OPEC+ policy, or US and other non-OPEC production could recover more strongly than forecast.”

Fed proposal to expand its main street lending program to provide access to credit for nonprofit organizations

There are further T&Cs but I won’t go into them here.

So, what can you do about the fear that keeps you from following your trading plan and maintaining your commitments? How to overcome fear that keeps you from following your trading plan. Well, let’s begin with what causes fear. Fear stems from a perceived threat that may or may not be real. Threat begins as a perception and a thought. In other words, when we have interpreted that an event is threatening our physical, mental, emotional, social or spiritual well-being we have given that event a meaning. Now, meaning is a crucial process that controls not only what you perceive but how you perceive it. For example, that price action is moving toward my stop and that means that I’m going to lose in this trade (the movement of the price action may or may not take you out and at this point it is only an opinion but it is often treated as a fact). In other words, the meaning here would be activated by a limiting or irrational belief about the inevitability of losing, and this in turn would prompt another limiting belief about what that says about you; i.e., “I’m a very poor trader and a loser because my stop loss was hit.” It often continues to spiral downward from there. So, what you are thinking is the genesis of the emotion that you experience…the fear.

Secondly, fear determines what you choose to do. This is where you become immobilized or act in erratic illogical ways that increase your risk and destroy your desired results. At this point it is important that you identify the thinking/beliefs that are fuelling the fear. Here is an important question to ask; “What must I be telling myself or believing to feel this fear.” This introspective inquiry will help you ferret out the underlying fear based programming that created that belief and in-turn developed the fear response in the first place. (more…)

For the trading week, the Dow industrial average led the way with a 3.71% gain in the US. The NASDAQ index lagged as earlier in the week the flow funds were into the more beaten down industrial stocks. Nevertheless the NASDAQ gained by 2.21%. The S&P index rose by 3.25%.

For the trading week, the Dow industrial average led the way with a 3.71% gain in the US. The NASDAQ index lagged as earlier in the week the flow funds were into the more beaten down industrial stocks. Nevertheless the NASDAQ gained by 2.21%. The S&P index rose by 3.25%.For many traders emotional trading is a problem and it stops them from being consistent in the market. We see what causes emotional trading in this article and I share six steps to greatly help reduce it, or stop it entirely.

Emotions in trading have always been one of the main causes of losses, and at the same time − the main driving force for all types of money. Remember the classic idea: buyers push the price up because of greed, and sellers sell because of fear of losses?

It still works perfectly in any market.

Popular training materials on market trading almost do not pay attention to managing emotions. This is understandable: any broker is the first participant in the trading process, which is vitally interested in having you leave your deposit to the market.

That is why most newcomers, especially those who passed the super-fast and super effective training in various brokerage kitchens, remain psychologically unprepared for trading. And even good technical training will not help such players save their money.

Assessing and reacting to market risk is one of the most important things you’ll have to do as a trader. Sadly, human being as a whole are so mediocre at this task, investors and traders reliably make decisions that economists consider “irrational.”

So obviously these are commonly more referred to as emotional trading.

Six Steps to Help You Stop Emotional Trading

Financial markets are a by-product of modern era and, in the grand scheme of things, our brains have evolved over millions of years for survival out in the open. They haven’t had the time to get good at making sound and perfectly rational financial decisions.

We have brain processes; an emotional one and a logical one that are constantly competing against one another for our future expression in the market. And normally, for the trader that has little to no market experience, who trades money they can’t afford to lose, or who has a short fuse overall, the stage is set for an incident.

But also more seasoned traders tend to make emotional trading decisions that they consider stupid in hindsight. Perhaps less often than inexperienced traders do, and with minor consequences, but those errors do happen.

Many a times, although we know with the logical part of our brain that we will get better results if we follow our trading rules, so many of us do exactly the opposite, despite clear knowledge of what we should do.

We remove stops, we cut winners short, we go in with too big of a size… I mean, we’re clearly

not purely rational beings ― and we can’t be because that would make us robots, not humans.