“There are just four kinds of bets. There are good bets, bad bets, bets that you win, and bets that you lose. Winning a bad bet can be the most dangerous outcome of all, because a success of that kind can encourage you to take more bad bets in the future, when the odds will be running against you. You can also lose a good bet, no matter how sound the underlying proposition, but if you keep placing good bets, over time, the law of averages will be working for you.”

Latest Posts

rssToday's date is the day the market started crashing in 1929.

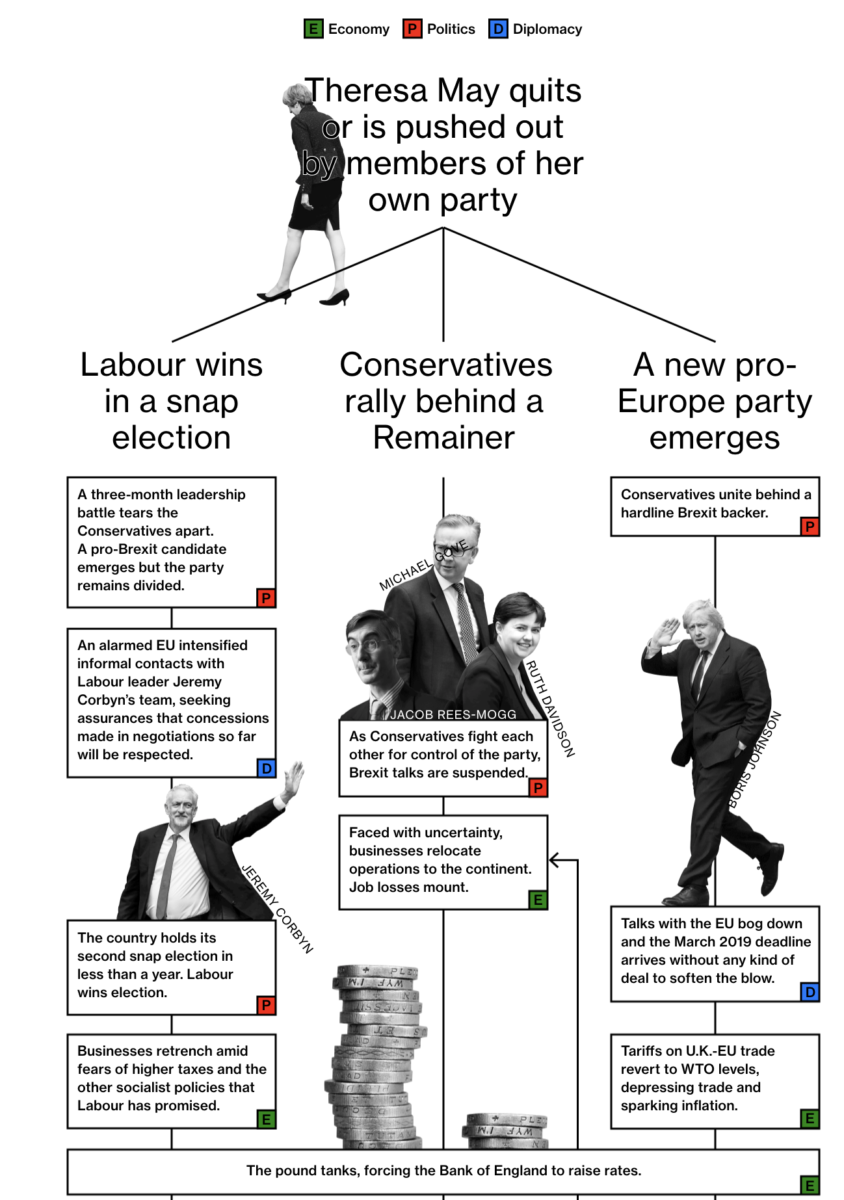

3 Ways U.K. Could Reverse Brexit

The greater the story, the greater the bubble

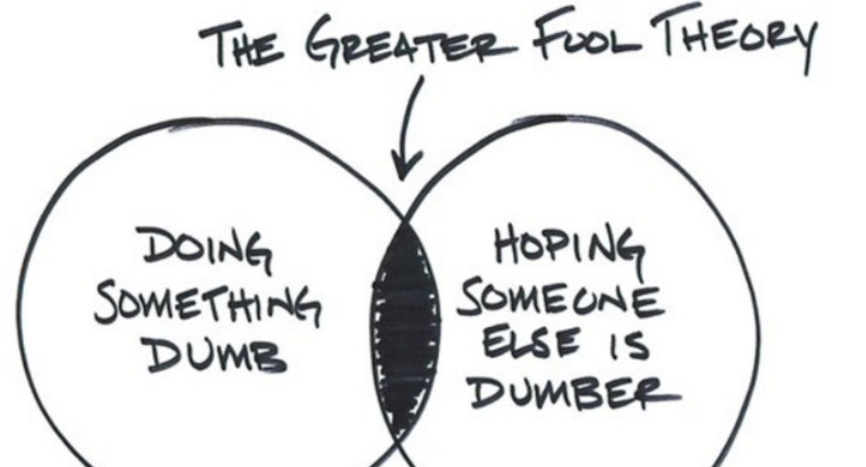

The greater fool theory explains almost every bubble

Some things have an intrinsic value. The most-obvious example is a stock with a dividend. The absolute floor for an equity is its dividend and so long as their is a profitable business behind it, the value is a multiple of that dividend.

Other things don’t have an intrinsic value. This includes virtually everything that doesn’t produce a yield. Oftentimes, prices of those things rise and fall based on future expectations of what profits or yield might be. In other cases, there is an estimation of utility. Oil, for instance, can be refined into gasoline which can be used to move things or for dozens of other uses.

Oftentimes there is a dispute about utility or a dispute about future profitability, which can lead to a dispute about prices. One way to resolve this is a model but oftentimes that’s so fraught with assumptions that it’s useless.

So how do you establish prices? Obviously, via the market.

This is when storytelling, which is another way of saying a sales job, takes over.

Cryptocurrencies are an obvious example. A Bitcoin has no yield but it has some utility. To some, that utility is replacing the US dollar as a global transparent currency. To others, it’s a way to facilitate transactions. And for others still, it’s a handy tool for criminal transactions. How you price it then, depends on how you view the future utility.

Or does it? (more…)

Nassim Taleb Explains The One Thing An Investor Should Never Fail To Do

Uncertainty should not bother you. We may not be able to forecast when a bridge will break, but we can identify which ones are faulty and poorly built. We can assess vulnerability. And today the financial bridges across the world are very vulnerable. Politicians prescribe ever larger doses of pain killer in the form of financial bailouts, which consists in curing debt with debt, like curing an addiction with an addiction, that is to say it is not a cure. This cycle will end, like it always does, spectacularly.

When it comes to investing in this environment, my colleague Mark Spitznagel articulated it well: investors are left with a simple choice between chasing stocks that have an increasing chance of a crash or missing out on continued policy effects in the short term. Incorporating a tail hedge minimizes the risk in the tail, allowing investors to remain invested over time without risking ruin. Spitznagel put together a video explaining the point.

The Hard Problem of Consciousness -VDO

What is consciousness?

“I THINK, therefore I am.” René Descartes’ aphorism has become a cliché. But it cuts to the core of perhaps the greatest question posed to science: what is consciousness? The other phenomena described in this series of briefs—time and space, matter and energy, even life itself—look tractable. They can be measured and objectified, and thus theorised about. Consciousness, by contrast, is subjective. As Descartes’ observation suggests, a conscious being knows he is conscious. But he cannot know that any other being is. Other apparently conscious individuals might be zombies programmed to behave as if they were conscious, without actually being so.

Video after the jump

The business end of the bible

A Jewish businessman was in a great deal of trouble.

A Jewish businessman was in a great deal of trouble.How Your Finger Length can Affect Risk Taking

In a study by Concordia University which analyzed the difference in length between the second finger (index finger) and fourth finger (ring finger), the difference in length can determine risk taking and financial success; however, it applies to men only. It also signifies high levels of prenatal testosterone.risk-taker the man is.

In a study by Concordia University which analyzed the difference in length between the second finger (index finger) and fourth finger (ring finger), the difference in length can determine risk taking and financial success; however, it applies to men only. It also signifies high levels of prenatal testosterone.risk-taker the man is.

The risk taking includes recreational, social and financial areas. It appears that the lower the ratio between the index and ring finger, the more of a

Truth and Trading

Recently I’ve been listening to The Teaching Company CD’s while I work out. I was particularly intrigued by a discussion of Meditations by Marcus Aurelius, a Roman Emperor who had always wanted instead to be a philosopher. His philosophy could be summarized in this way: Get out of bed, do your duty, and appreciate things along the way. Not bad.

Recently I’ve been listening to The Teaching Company CD’s while I work out. I was particularly intrigued by a discussion of Meditations by Marcus Aurelius, a Roman Emperor who had always wanted instead to be a philosopher. His philosophy could be summarized in this way: Get out of bed, do your duty, and appreciate things along the way. Not bad.

He believed in certain absolute values for living, and chose the values of Socrates which are truth, justice, courage, moderation, and wisdom.

Asking myself how these values impact trading I came up with some new insights. But first let’s look at how Marcus Aurelius defined these values. Professor J Rufus Fears, who teaches the course on “Books That Have Made History: Books That Can Change Your Life” explained it the following way:

1. Truth: Truth is an absolute value. Some things are true in all places and times. Resisting evil, for example, is always right.

2. Justice: Justice consists of treating others as one would wish to be treated. “Do unto others as you would have them do unto you” summarizes this concept of justice.

3. Courage: Courage means standing up for justice.

4. Moderation: Nothing should be carried to excess.

5. Wisdom: Wisdom enables a person to know what justice is, to recognize when courage is required, and to do what is right.

So how do these values play out in our trading? In this column, let’s explore truth as it applies to your trading. (more…)

Ten Trading Affirmations

| I accept the present as reality and take action accordingly. I take what the markets give me and am grateful for these gifts. I am willing to make mistakes, learn from them, forgive myself and move on. I am flexible and adaptable. I can easily and truthfully say “I don’t know” I trust myself to do what is in my best interest. The Market is my best teacher. I learn something new everyday. I am becoming a better trader. |