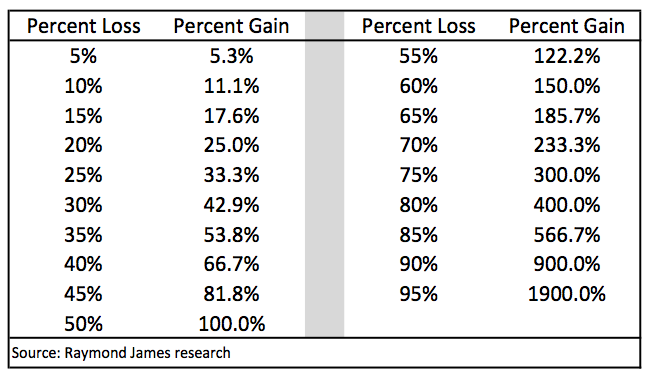

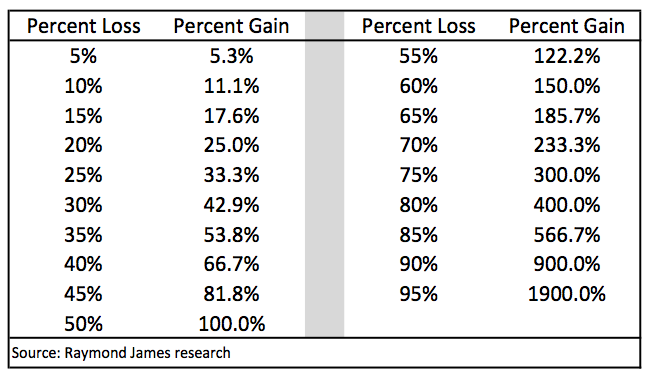

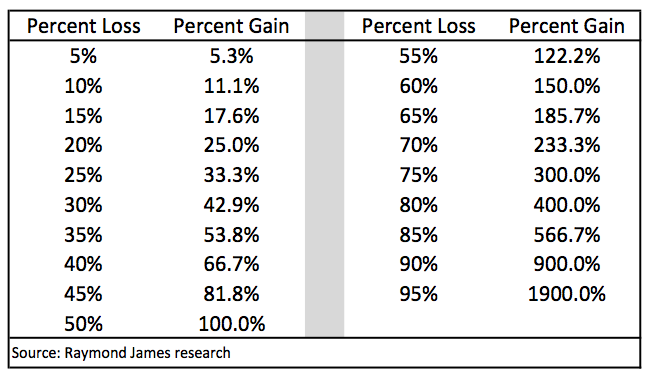

The table below depicts the percentage gain necessary to get back even, after a certain percentage loss.

One must always remember Slansky’s admonition which is that you have to take account of whether you’re a winner or loser, and what your average rate of win is relative to the distribution of losses. If you’re a good player, never accept a bet with a small edge if it might subject you too close to gambler’s ruin, or getting stopped out of you position even if you have an edge. Many a good player doesn’t call bets in one’s favor if it has too high a variability relative to his bank roll. Many a t-grade should not be taken when the variables like an announcement put the normal tit and tat into jeopardy. I hate to force a weaker player, (assuming I might ever have that luxury again) into making a good shot. Board players are the same way. They can sometimes create a crisis, a tension where if the weaker player makes the rite move, he might pull out a draw or victory. Much better to grind the poor sinner or market into oblivion.

One must always remember Slansky’s admonition which is that you have to take account of whether you’re a winner or loser, and what your average rate of win is relative to the distribution of losses. If you’re a good player, never accept a bet with a small edge if it might subject you too close to gambler’s ruin, or getting stopped out of you position even if you have an edge. Many a good player doesn’t call bets in one’s favor if it has too high a variability relative to his bank roll. Many a t-grade should not be taken when the variables like an announcement put the normal tit and tat into jeopardy. I hate to force a weaker player, (assuming I might ever have that luxury again) into making a good shot. Board players are the same way. They can sometimes create a crisis, a tension where if the weaker player makes the rite move, he might pull out a draw or victory. Much better to grind the poor sinner or market into oblivion.

Mark Douglas, in his classic book on trading behavior entitled THE DISCIPLINED TRADER: DEVELOPING WINNING ATTITUDES, describes what he believes are the three steps to a trader’s ultimate, long term success. The following steps have very little to do with technical anaysis and everything to do with the trader’s mental resources. Douglas explains that the “more sophisticated you become as a trader, the more you will realize that trading is completely mental. It isn’t you against the markets, it’s just you” (204). So, if it is just you what are the steps?

Mark Douglas, in his classic book on trading behavior entitled THE DISCIPLINED TRADER: DEVELOPING WINNING ATTITUDES, describes what he believes are the three steps to a trader’s ultimate, long term success. The following steps have very little to do with technical anaysis and everything to do with the trader’s mental resources. Douglas explains that the “more sophisticated you become as a trader, the more you will realize that trading is completely mental. It isn’t you against the markets, it’s just you” (204). So, if it is just you what are the steps?

1. STAY FOCUSED ON WHAT YOU NEED TO LEARN. The trader needs to stay focused on mastering the steps to achieving his goals and not the end result, knowing that the end result, money, will be a by-product of what he knows and how well he can act on what he knows. A big part of what the trader needs to learn is how to accept missed opportunities. “Except for the inability to accept a loss, there isn’t anything that has the potential to cause more psychological damage than a belief in missed opportunities. When you release the energy out of the belief that it is possible to miss anything, you will no longer feel compelled to do something, like getting into trades too early or too late.” (205).

2. LEARN HOW TO DEAL WITH LOSSES: Douglas outlines two trading rules for dealing with losses both of which are designed to help the trader deal with any threat of pain and confront, head on, the inevitability of a loss. The first is to predefine what a loss is in every potential trade. By predefine Douglas means “determine what the market has to look like or do, to tell you that the trade no longer represents an opportunity” (206). Secondly, “execute your losing trades immediately upon perception that they exist. When losses are predefined and executed without hesitation, there is nothing to consider, weigh, or judge and consequently nothing to tempt yourself with” (207).

3. BECOME AN EXPERT AT ONE MARKET BEHAVIOR: Simplicity and focus is the mother of success. “You need to start as small as possible and then gradually allow yourself to grow into greater and greater amounts of market information. What you want to do is become an expert at just one particular type of behavior pattern that repeats itself with some degree of frequency. To become an expert, choose one simple traing system that identifies a pattern. Your objective is to understand completely every aspect of the system. In the meantime, it is important to avoid all other possibilities and information” (209).

Three simple steps yet ironically it is in the simplicity that traders find the most difficulty. Trading is not difficult, we make it so. Remember this the next time you enter a trade.

Dear Readers & Traders………..Don’t miss to read this Book !!101% it should be in your Library.-Technically Yours ,Anirudh Sethi

1) Oil is priced in dollars.

1) Oil is priced in dollars.

2) Oil trades in Dollars and Euros right now in spite of the pricing unit being dollars. OPEC has recently admitted this fact.

3) Clearly oil does not have to be priced in Euros to trade in Euros, or for that matter priced in Yen to trade in Yen. The same applies to any major currency.

4) Neither Venezuela or Iran hold any dollar reserves. To the extent that either is taking trades in dollars, there is clearly nothing forcing them to hold dollars. By extension there is nothing forcing any OPEC country to hold dollars if it doesn’t want to.

5) It takes less than a second for Forex trades to take place. 24 hours a day, 7 days a week, one can sell any currency they want and buy any other currency.

6) The above logic applies to any currency and any commodity.

7) Nothing is stopping anyone at any time anywhere from selling dollars for whatever currency they want to hold. Nor is anything stopping anyone anywhere at any time from selling any major currency for U.S. Dollars.

8) Because currency conversion is instantaneous no one has to hold U.S. dollars to buy oil, copper, gold, iron, lead, wheat, soybeans, or anything else.

9) Dollars are held (or not held) for reasons totally unrelated to pricing unit. Some of those reasons are political, some are based on sentiment, some on trade patterns and trade relationships, and some to suppress the value of local currencies to improve exports.

10) Currencies float and so do the price of oil and commodities. Pricing oil (or any other commodity) in Euros will not cause a price change in dollars. Look at gold which is simultaneously priced in everything as proof.

“I Want To Find Out Who I Really Am”

When you trade your monitor will do a funny thing. It will become a mirror. A special type of mirror. A mirror that reflects your self-confidence, your self-esteem, your self-worth. The numbers and lines you see on your screen are just that, numbers and lines. Market information. At your choosing, when you decide to become part of those numbers and lines (putting on/off the trade) a sort of test begins. A test about you.

If you see the test as threatening, you will feel threatened. If you see the test as war, you will be engaging in war. If you see the test as one more failure, you will fail. If you see the test as the need to prove yourself right, you will administered the pain of being wrong. If you see the test as certainty, you will be rudely introduced to uncertainty. If you see the test as a battle of wills, you will sacrifice your soul. If you see the test as fear or loss of money, you will be giving away your scared money.

If you see and believe the test to be an exchange of information, you now become the one to confirm or deny information. If you believe the test to be one of giving up what you want in order to get it, you will get it. Get it?

There is an irony in trading of both price and time. It is exactly what you have to give of yourself in order to trade it with understanding.

P.S. There are only two types of traders, “Long Lived” and “Short Lived.” Both know the markets well. The “Longed Lived” just choose know “Themselves” better.Anyone who contemplates trading should ask themselves one simple question…..”Why Do I Want To Trade?” There are many wrong answers to this question, and only one right one…..