Latest Posts

rssA Trading Psychology- 5 Points

How do you know if your trading psychology problem is really just about trading or is a sign of larger problems? Here is a quick checklist:

A) Does your problem occur outside of trading? For instance, do you have temper and self-control problems at home or in other areas of life, such as gambling or excessive spending?

B) Has your problem predated your trading? Did you have similar emotional symptoms when you were young or before you began your trading career?

C) Does your problem spill over to other areas of your life? Does it affect your feelings about yourself, your overall motivation and happiness in life, and your effectiveness in your work and social lives?

D) Does your problem affect other people? Do you feel as though others with whom you work or live are impacted adversely by your problem? Have others asked you to get help?

E) Do you have a family history of emotional problems and/or substance use problems? Have others, particularly in your immediate family, had treated or untreated emotional problems?

If you answered “yes” to two or more of the above items, consider that you may not be alone. More than 10% of the population qualifies with a diagnosable problem of anxiety, depression, or substance abuse. Tweaking your trading will be of little help if the problem has a medical or psychological root. A professional consultation if you answered “yes” to two or more checklist items might be your best money management strategy.

What do you need to have to be a successful trader

What do you buy?

Still the best Disclaimer

Catalyst that could lead to a crash

“Chinese banks face state loans turmoil; about Rmb1,550B in questionable loans. “

This simple sentence reminds me of the Japanese Banks prior to the big Nikkei crash, that has not yet recovered (over 20 years).

What did we learn from the subprime mess ? The banks lied to us …..

What did we learn about the Nikkei crash ? The banks lied ….

1) Watch the Shanghai Index ! It has risen from its July’s low to almost 2600 ; a key resistance level.

2) Watch light crude oil prices (key indicator for the Chinese demand)

3) Did you just make some money on this rally ? SELL !!!!

I am bearish ? No, its just NOT the time to “buy and hold”

Market Mapping

8 One Liner Lessons For Traders

– markets change and if a trader doesn’t adapt, he’ll be driving a cab

– becoming a successful trader is not easy, even if you’re experienced

– core competency in one endeavor, does not guarantee competency in another

– working for a living sucks

– always be prepared to trade

– markets aren’t the only thing that reverts to the mean

– never turn down an edge, no matter where you are, or what you have in your hand

– success is fleeting, losing is forever

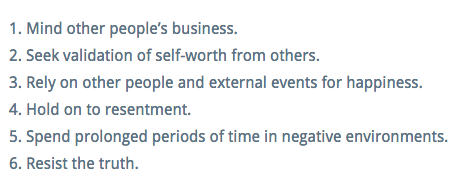

6 things happy people (and traders) never do

Size kills both