Inside the Coronavirus (Scientific American)

• Why tech didn’t save us from covid-19 (MIT)

• The New Weapon in the Covid-19 War (Bloomberg)

• Study suggests 80% of Covid-19 cases in the US went undetected in March (CNN)

• Chinese Covid-19 Vaccines Cleared for Final Testing in UAE (Bloomberg)

• Can Covid Damage the Brain? (New York Times)

• What We Know—and Really Don’t Know—About the Future of COVID-19 Vaccines (Slate)

• Gilead is about to start trials of an inhaled version of Remdesivir (Gilead)

• How A Scientific Paper About A Promising COVID-19 Treatment Was Debunked (FiveThirtyEight)

Archives of “LINKS” category

rssTesting, Vaccine & Treatment Medical News:

Antibody Tests Point To Lower Death Rate For The Coronavirus Than First Thought (NPR)

• Coronavirus May Be a Blood Vessel Disease, Which Explains Everything (Medium)

• Wuhan’s Mass Testing May Have Eradicated the Coronavirus (Bloomberg)

• At-Home Covid-19 Testing Arrives, With Accuracy and Access Questions (Wall Street Journal)

• Surgisphere: governments and WHO changed Covid-19 policy based on suspect data from tiny US company (The Guardian)

• The Top Canadian Doctor Who Aced the Coronavirus Test (NYT)

• Georgia student, son of 2 first responders, creates lifesaving COVID-19 equipment (NBC News)

• A mysterious company’s coronavirus papers in top medical journals may be unraveling (Science mag)

• ‘Superspreaders’ Could Actually Make Covid-19 Easier to Control (Bloomberg)

• Biotech Startup Aims to Make Use of Humanity’s Genetic Outliers (Businessweek)

• Self Assured Destruction: Covid-19 is now endemic in the United States. (Epsilon Theory)

• The C.D.C. Waited ‘Its Entire Existence for This Moment.’ What Went Wrong? (New York Times)

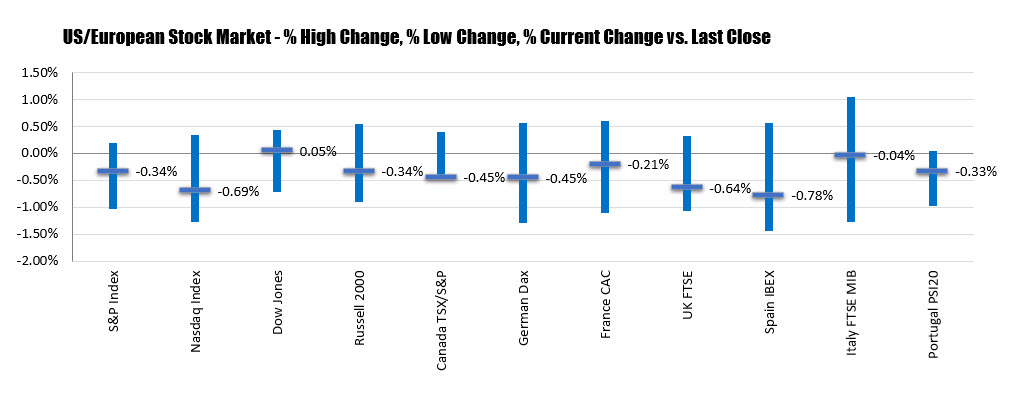

S&P and NASDAQ snap 4-day winning streak ahead of US jobs report today

Dow industrial average ekes out a small gain

the S&P and NASDAQ index snapped a 4 day winning streak ahead of the US jobs report released tomorrow at 8:30 AM ET. The Dow industrial average up the trend by closing higher on the day but just barely.

- S&P index, -10.52 points or -0.34% at 3112.35

- NASDAQ index -67.098 points or 0.69% at 9615.81

- Dow industrial average up 11.93 points or 0.05% at 26281.82.

Links……..For U

Staying Safe:

• 24 Hours at the Epicenter of the Coronavirus Pandemic: Doctors, nurses, a congressman, workers in deserted museums and theatres, men on early release from Rikers, and the newly unemployed strained to keep New York City, and themselves, going. (New Yorker)

• What if immunity to covid-19 doesn’t last? (MIT Technology Review)

• ‘Frostbite’ toes and other peculiar rashes may be signs of hidden coronavirus infection, especially in the young (Washington Post)

• We have to wake up: factory farms are breeding grounds for pandemics (The Guardian)

Aid and assistance:

• COVID Tests Are Free, Except When They’re Not (Kaiser Health News)

• Useful table of extended state tax filing deadlines (Tax Foundation)

• Figuring Out Your Personal Finances Together (Wall Street Journal)

Staying Sane WFH:

• Signs You May Be Burning Out—and What to Do About It (Businessweek)

• “It Is Harrowing. It Is Daunting. It Is Overwhelming”: The Mental Toll of Coronavirus Is Crushing Medical Workers (Vanity Fair)

• Which epidemiologist do you believe? (UnHerd)

• Yuval Noah Harari: ‘Will coronavirus change our attitudes to death? Quite the opposite’ (The Guardian)

Vaccine & Treatment Updates:

• In Race for a Coronavirus Vaccine, an Oxford Group Leaps Ahead (New York Times)

• Some Countries Are Squashing the Coronavirus Curve. Vietnam Is One. (Wall Street Journal)

• Three potential coronavirus vaccines moving ahead in tests (Los Angeles Times)

• When will we get the Covid-19 vaccine? (UnHerd) see also How Long Will a Vaccine Really Take? (New York Times)

• UCSF team has discovered drugs that block coronavirus, paving way for ‘a better drug sooner’ (San Francisco Chronicle)

• The Secret Group of Scientists and Billionaires Pushing a Manhattan Project for Covid-19 (Wall Street Journal)

Resolving the Crisis:

• Dogs are being trained to sniff out coronavirus cases (Washington Post)

• Could contact tracing bring the US out of lockdown? (Vox)

• LA Becomes The First Major City In The US To Offer Free Testing To Every Resident, Even Those With No Symptoms (LAist)

• Why America’s coronavirus testing problem is still so difficult to solve (Vox)

• No Testing, No Treatment, No Herd Immunity, No Easy Way Out (The Atlantic)

• Poop may tell us when the coronavirus lockdown will end (LA Times)

• We Cannot “Reopen” America: The source of the economic shock is not government orders. It’s the pandemic. (The Bulwark)

• Reopening Plans Across U.S. Are Creating Confusing Patchwork (New York Times)

Post-Crisis

• What will cities look like once the lockdown lifts? (King’s College London)

• Five Ways the U.S. Military Will Change After the Pandemic (War on the Rocks)

• Will Travel Change After Coronavirus? Here’s What Experts Have to Say (Travel & Leisure)

• The Office You Left Is Not Going to Be the Office You Return To (Bloomberg)

• One Rich N.Y. Hospital Got Warren Buffett’s Help. This One Got Duct Tape. (New York Times)

• Covid-19’s future: small outbreaks, monster wave, or ongoing crisis (Stat)

• What the Coronavirus Crisis Reveals About American Medicine (New Yorker)

• The Immunity of the Tech Giants: When the pandemic is over, we most certainly should fear the industry more than ever (New York Times)

Read Links and Update yourself

- China turns tables on AAA debt time bomb nations (Bloomberg)

- Gold at new record high after Saudi reserves double (FT)

- Germany and France examine two-tier euro (Telegraph)

- So that’s why investors can’t think for themselves (WSJ)

- Failed AAA-deal rated Rembrandt spurs outcry (Bloomberg)

- Medvedev sees chance for new world order (FT)

- Amid the crisis, Wall Street touted BP stock (Reuters)

- Gold reclaims its currency status as the global economy unravels (Telegraph)

Worth Watching and Reading

Links -Read and Update yourself

- That’s enough ‘kicking ass’, Mr President: Barack Obama’s attacks on BP may play well at home, but they are damaging millions of British people (London Times)

- Banks with state debt ignore not-if-but-when default (Bloomberg)

- As reported, Caja Madrid, Bancaja start moves to form Spain top savings bank, as BBVA says Spain may need €50 billion of capital to infuse into insolvent banks (Bloomberg)

- BP weighs cutting dividend (WSJ)

- Kerviel co-worker says SocGen should have known about trades (Bloomberg)

- Waiting for inflation? It’s already here (Minyanville)

- Enough with the economic recovery. It’s time to pay up (WaPo)

- Irked CDO investors now targetting Merrill (WSJ)

- Lehman emails that say “stupid” didn’t stay “just between us” (Bloomberg)

- US firms holding record piles of cash underscoring worries about sustainability of financial recovery (WSJ)

- Hungary PM says to issue second economic action plan in H2 (Reuters)

- The bearish forecasters who rose to fame in the market crash of 2008 have, for the most part, not surrendered their pessimism. Their moment could be coming back around (BusinessWeek)

- Risk/reward from current levels (Green Faucet)

- The beginning of the end for Wall Street (RCM)

- Daily humor from disgraced car czar Steve Rattner at the only venue desperate enough for clicks to still have him: How Wall Street stokes populist fury (MSN)

Ben Bernanke bails out Time Magazine

WASHINGTON – After naming Ben Bernanke Person of the Year for saving us from the crisis that he helped create, Time magazine sales have “dropped off a cliff,” according to one Time magazine employee, speaking on condition of anonymity.

As a result of the drop-off in demand, Time magazine is now going through a liquidity crisis. Because of this situation, Ben Bernanke has decided to provide Time magazine with the necessary liquidity to stave off bankruptcy. The Fed has added millions of editions of Time to its balance sheet.

“From what we can tell, these Time magazines – especially the edition with Greenspan on the cover – have more intrinsic value than do Treasuries. There is actually stuff to read in them. So our balance sheet isn’t impaired in any way by paying cover-price for these issues,” said Fed Chairman Bernanke. “We also felt it would be best for the economy to take these editions out of circulation, and we are asking the American people to sell their Greenspan editions to the FOMC.”

The preliminary numbers are showing that the Fed, through Open Market Operations, has monetized at least 500,000 copies of the edition with Greenspan on the cover – the last time a Fed Chairman appeared on the cover of the prestigious magazine.

“If necessary, the Fed has the tools it needs to remove any excess liquidity from the markets,” said Bernanke. “We could start by selling off the Jim Bunning baseball cards that we have on our balance sheet.”

A Few Notes on The Little Book of Behavioral Investing

The Little Book of Behavioral Investing: How Not to Be Your Own Worst Enemy, author James Montier states: “I…highlight some of the most destructive behavioral biases and common mental mistakes that I’ve seen professional investors make. I’ll teach you how to recognize these mental pitfalls while exploring the underlying psychology behind the mistake. Then I show you what you can do to try to protect your portfolio from their damaging influence on your returns.” Biases he surveys include: action bias, bias for stories, confirmation bias, conformity bias (herding or groupthink), conservatism (including sunk cost fallacy), disposition effect, empathy gap, endowment effect, hindsight bias, illusion of control, inattentional blindness, information overload, loss aversion, myopia, overconfidence, overoptimism, placebo effect, self-attribution bias and self-serving bias). Value investing provides the context for discussion. Citing a number of studies, he concludes that:

The Little Book of Behavioral Investing: How Not to Be Your Own Worst Enemy, author James Montier states: “I…highlight some of the most destructive behavioral biases and common mental mistakes that I’ve seen professional investors make. I’ll teach you how to recognize these mental pitfalls while exploring the underlying psychology behind the mistake. Then I show you what you can do to try to protect your portfolio from their damaging influence on your returns.” Biases he surveys include: action bias, bias for stories, confirmation bias, conformity bias (herding or groupthink), conservatism (including sunk cost fallacy), disposition effect, empathy gap, endowment effect, hindsight bias, illusion of control, inattentional blindness, information overload, loss aversion, myopia, overconfidence, overoptimism, placebo effect, self-attribution bias and self-serving bias). Value investing provides the context for discussion. Citing a number of studies, he concludes that:

“…we should do our investment research when we are in a cold, rational state–and when nothing much is happening in markets–and then pre-commit to following our own analysis and prepared action steps.”

“…fear causes people to ignore bargains when they are available in the market… The ‘battle plan for reinvestment’ is a schedule of pre-commitments…”

“We should get used to asking ‘Must I believe this?’ rather than… ‘Can I believe this?’” (more…)