Archives of “Education” category

rssLessons from the 1918 flu for today: second wave dangers

Multiple waves

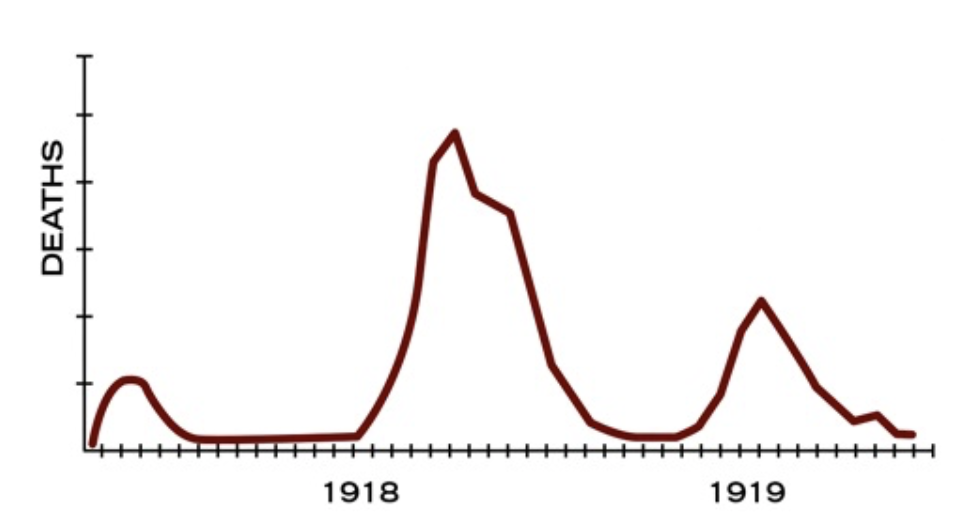

In case you are wondering what all the fuss is about second waves of the flu virus here is a chart that shows the second wave of infections from 1918.

In the flu of 1918/1919 the second wave was around 5 times greater than the initial spike of cases. There were 3 different waves of illness during the pandemic. the first was in March 1918 and fell back by the summer of 1919. However, the pandemic peaked in the U.S. during the second wave, in the fall of 1918. it was this highly fatal second wave was responsible for most of the U.S. deaths attributed to the pandemic. According to the CDC around 50 million deaths occurred worldwide because of the outbreaks and around 1/3 of the entire population was infected. Read the CDC piece here for more info.

In the flu of 1918/1919 the second wave was around 5 times greater than the initial spike of cases. There were 3 different waves of illness during the pandemic. the first was in March 1918 and fell back by the summer of 1919. However, the pandemic peaked in the U.S. during the second wave, in the fall of 1918. it was this highly fatal second wave was responsible for most of the U.S. deaths attributed to the pandemic. According to the CDC around 50 million deaths occurred worldwide because of the outbreaks and around 1/3 of the entire population was infected. Read the CDC piece here for more info.SOME WELL-KNOWN ALGORITHMIC STRATEGIES

On a broad sense most commonly used algorithmic strategies are Momentum strategies, as the names indicate the algorithm start execution based on a given spike or given moment. The algorithm basically detects the moment (e.g spike) and executed by and sell order as to how it has been programmed.

One another popular strategy is Mean-Reversion algorithmic strategy. This algorithm assumes that prices usually deviate back to its average.

A more sophisticated type of algo trading is a market-making strategy, these algorithms are known as liquidity providers. Market Making strategies aim to supply buy and sell orders in order to fill the order book and make a certain instrument in a market more liquid. Market Making strategies are designed to capture the spread between buying and selling price and ultimately decrease the spread.

Another advanced and complex algorithmic strategy is Arbitrage algorithms. These algorithms are designed to detect mispricing and spread inefficiencies among different markets. Basically, Arbitrage algorithms find the different prices among two different markets and buy or sell orders to take advantage of the price difference.

Among big investment banks and hedge funds trading with high frequency is also a popular practice. A great deal of all trades executed globally is done with high-frequency trading. The main aim of high-frequency trading is to perform trades based on market behaviors as fast and as scalable as possible. Though, high-frequency trading requires solid and somewhat expensive infrastructure. Firms that would like to perform trading with high frequency need to collocate their servers that run the algorithm near the market they are executing to minimize the latency as much as possible.

Adaptive Shortfall

Adaptive Implementation Shortfall algorithm designed for reduction of market impact during executing large orders. It allows keeping trading plans with automatic reactions to price liquidity.

Basket Trading

Basket Orders is a strategy designed to automated parallel trading of many assets, balancing their share in the portfolio’s value.

Bollinger Band

Bollinger bands strategy is a trading algorithm that computes three bands – lower, middle and upper. When the middle band crosses one of the other from the proper side then some order is made.

CCI (more…)

Conquering Your Fear

So, what can you do about the fear that keeps you from following your trading plan and maintaining your commitments? How to overcome fear that keeps you from following your trading plan. Well, let’s begin with what causes fear. Fear stems from a perceived threat that may or may not be real. Threat begins as a perception and a thought. In other words, when we have interpreted that an event is threatening our physical, mental, emotional, social or spiritual well-being we have given that event a meaning. Now, meaning is a crucial process that controls not only what you perceive but how you perceive it. For example, that price action is moving toward my stop and that means that I’m going to lose in this trade (the movement of the price action may or may not take you out and at this point it is only an opinion but it is often treated as a fact). In other words, the meaning here would be activated by a limiting or irrational belief about the inevitability of losing, and this in turn would prompt another limiting belief about what that says about you; i.e., “I’m a very poor trader and a loser because my stop loss was hit.” It often continues to spiral downward from there. So, what you are thinking is the genesis of the emotion that you experience…the fear.

Secondly, fear determines what you choose to do. This is where you become immobilized or act in erratic illogical ways that increase your risk and destroy your desired results. At this point it is important that you identify the thinking/beliefs that are fuelling the fear. Here is an important question to ask; “What must I be telling myself or believing to feel this fear.” This introspective inquiry will help you ferret out the underlying fear based programming that created that belief and in-turn developed the fear response in the first place. (more…)

Emotional Makeup is More Important Than Intelligence

- I haven’t seen much correlation between good trading and intelligence. Some outstanding traders are quite intelligent, but a few aren’t. Many outstanding intelligent people are horrible traders. Average intelligence is enough. Beyond that, emotional makeup is more important.

- As I recall more than half the course revolved around developing the right attitude, guarding against debilitating emotions, how to think about risk, and how to handle success and failure.

- Teaching the turtle system itself doesn’t take very long. I was saying you need less than 12 degrees of freedom in a system; versions of the turtle system had three or four.

- We spent a lot of time talking about our theories on how to control risk; that was actually the bulk of the course. Attitude, emotional control, discipline; those things are harder to teach. All the turtles learned the system and learned the strategy; that was the easy part, but some of them brought the right attitude and right mental set to it and they prospered and became very rich. Others had a more halting career and did not succeed as well. They had the same training, but maybe they did not have the same emotional make-up.

JoshuaMomoa (Big Mike’s Trading Forum) on Simplicity

- I currently use NinjaTrader with Zen-Fire (Mirus Futures). I’m a full-time day trader. I primarily use technical analysis for my trading decision but nothing very complicated (support & resistance). I’m not a scalper and I don’t use the DOM to place my orders. I’m trying to catch as much as possible of the intraday swings. I’m not chasing a couple of ticks 50 times a day. I usually place 1 or 2 orders per instrument per day.

- I’m in the process of opening an account with Advantage Futures but I still can’t decide whether to choose CQG Integrated Client or X_Trader Pro. I’ve decided to change my broker and my trading platform because I’m now trading bigger lots (between 100 and 200 contracts per trade for ES) and I had a lot of problems with the execution of my trades with NinjaTrader and Zen-Fire recently. I want to move to something more “professional”.

Jake Bernstein on Faulty Learning from Positive Reinforcement

- The tension of riding a profit or loss may be quite intense for some investors. By liquidating too early, they are relieved of the tension, and, therefore, the mere termination of this situation will have the same result as a positive experience. They will be more likely to behave the same way in future trades.

- Those who ride losses to unacceptably large amounts also tend to experience the positive effects of relief. Again the relief can serve to reward an otherwise inappropriate act. It’s like the man who, when asked why he kept banging his head against the wall, replied, “because it feels so good when I stop.”

Paul Graham on the Shortness of Life

- If life is short, we should expect its shortness to take us by surprise. And that is just what tends to happen. You take things for granted, and then they’re gone. You think you can always write that book, or climb that mountain, or whatever, and then you realize the window has closed. The saddest windows close when other people die. Their lives are short too.

- It’s easy to let the days rush by. The “flow” that imaginative people love so much has a darker cousin that prevents you from pausing to savor life amid the daily slurry of errands and alarms.

- Cultivate a habit of impatience about the things you most want to do. Don’t wait before climbing that mountain or writing that book or visiting your mother. You don’t need to be constantly reminding yourself why you shouldn’t wait. Just don’t wait.

Seneca on Time

- It is not that we have a short time to live, but that we waste a lot of it. Life is long enough, and a sufficiently generous amount has been given to us for the highest achievements if it were all well invested. But when it is wasted in heedless luxury and spent on no good activity, we are forced at last by death’s final constraint to realize that it has passed away before we knew it was passing.

- So it is: we are not given a short life but we make it short, and we are not ill-supplied but wasteful of it… Life is long if you know how to use it.

- Putting things off is the biggest waste of life: it snatches away each day as it comes, and denies us the present by promising the future.