Archives of “June 28, 2021” day

rssEuropean equity close: Spain leads the way lower

Closing changes in the main European bourses:

- UK FTSE 100 -0.9%

- German DAX -0.4%

- French CAC -1.0%

- Italy MIB -0.9%

- Spain IBEX -1.6%

That’s not a great start to the week for European equities.

Oil upside continues with OPEC+ in focus this week

Oil is holding steady, up 0.2% on the day

There hasn’t been much to really thwart the momentum in oil and I don’t see the OPEC+ decision this week being a major game changer whatsoever.

The consensus is largely that OPEC+ will step up production by 500k bpd but there is a slight chance they may go for more. That might upset oil bulls a little but it won’t deter them from the bigger picture and the continued rally in oil surely.

With the market so focused on inflation and with the ongoing view that demand conditions are likely to keep more robust going into 2H 2021 as well as 2022 as the world economy picks up, it is tough to fight the universal call that oil prices are headed upwards.

The July and October 2018 highs at around $75-76 will pose the next challenge but that may be a mere pit stop before the next leg higher in oil should this landscape maintain.

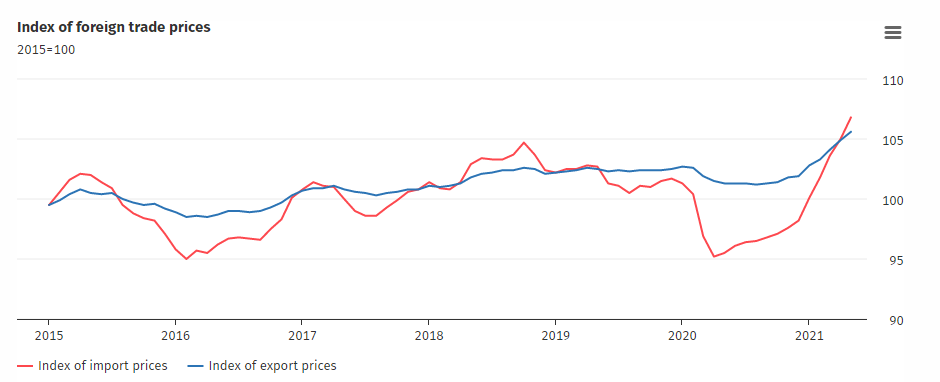

Germany May import price index +1.7% vs +1.3% m/m expected

Latest data released by Destatis – 28 June 2021

- Prior +1.4%

- Import price index +11.8% vs +11.4% y/y expected

- Prior +10.3%

Not much of a surprise as German import prices continue to tick higher on the month owing likely to the impact of supply constraints, though the annual rate is largely influenced by energy prices (crude oil prices +135% y/y).

Avoid revenge trading: Think golf, not tennis

Golf vs Tennis

Some sports punish you all the way for a bad shot. In Tennis a bad shot and you lose the point, no big deal. Lose the game, you can still win the set. However, with golf one disatrous hole and it is very hard to win the match. In golf sometimes just that one bad hole will prevent you from winning. That in itself can ruin the whole round for you.

Trading is more like golf than tennis. It is possible to undo years of hard work in your trading on just one trading day. The way it often starts is by revenge trading. A losing trade turns into rage that turns into jumping back into the market with more leverage. Before you know it you are underwater and you give up caring. At this point all control is gone and you are just clutching at straws to recover.

One of the key trading skills to learn is how to control that internal desire for revenge. Working for a firm can sometimes help here. You know you have to manage risk within the defined parameters or you get sacked! It is harder when it is just you. However, if you are a retail trader and you do manage risk then you may be showing greater control than even those who are pro’s.

So if this post is for you. Do something. Determine to manage your risk so you will never again let one day ruin your whole trading year. Then, when you get the inevitable hole in ones they really count.

Economic data coming up in the European session

A quiet one to kick start the new week

Good day, everyone. I hope your weekend went well. Things are a bit quieter as we look towards European trading with major currencies sitting more mixed and little changed for the most part at the moment.

The two key risk events this week are the OPEC+ meeting on Thursday and the US non-farm payrolls release on Friday, so there might be some waiting in the meantime.

The dollar gave back some of its post-Fed gains last week as equities rallied but the tone from Fed speakers will continue to be key in the weeks to come.

US futures are holding steadier near flat levels as we get things underway.

For today, there isn’t much in terms of releases in Europe so things are likely to keep quieter and follow a slower pace in the session ahead.

0600 GMT – Germany May import price index

Prior release can be found here. Import prices are estimated to tick higher amid supply constraints and that fits with the trend we know is still playing out globally.

0800 GMT – SNB total sight deposits w.e. 25 June

Your weekly check of the deposits kept at the SNB by Swiss banks. This data is a proxy for FX interventions.

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

Moody’s is optimistic Chinese authorities will continue to lower systemic risks in the fintech sector

From Moody’s latest piece on China shadow banking, the key highlights:

- Shadow banking assets as a share of nominal GDP fell in Q1 2021 to the lowest in eight years

- Economy-wide leverage to stabilize as authorities aim for a credit growth rate that matches nominal GDP growth

And:

- Moody’s measure of the economy-wide leverage ratio declined in the first quarter of 2021

- The ratio is set to decline and stabilize in 2021 amid the steady economic recovery and a less accommodative credit environment, as the Chinese government targets a rate of credit growth that matches nominal GDP growth.

Link here for more of the summary.

China leverage levels have been out of the headlines, property prices are reported as showing a steady if unspectacular rate of increase.

Don’t be afraid to change for the better. You have the power to live your best life and make it legendary.

BOJ June policy meeting Summary of Opinions

The Summary of Opinions at the Monetary Policy Meeting on June 17 and 18, 2021 precedes the minutes for this meeting by many weeks.

Headlines via Reuters:

- BOJ has approached time when it needs to show direction on what it can do on climate change via monetary policy

- BOJ’s response on climate change must be tied to its mandate of achieving stable economy

- BOJ must make its climate change scheme flexible one

- BOJ can avoid getting directly involved in income distribution by back-financing loans, investment banks make on climate change

- govt rep said BOJ’s plan on climate change is timely

- Japan’s inflation likely to accelerate as pent-up demand begins to appear in latter half of this year

- Japan’s prices likely to lack momentum despite support from rising commodity costs, improvement in demand

- inflationary pressure likely to remain subdued in Japan due to sticky deflationary mindset

I bolded the remarks on inflation. The BOJ pretty much always expresses a degree of optimism that inflation will rise, but for a decade or more they have missed their target by a long, long way and continue to do so.

US air strikes against Iran-backed militia in Syria and Iraq

The US has carried out airstrikes in Iraq and Syria on Iran-backed militias

- targeting operational and weapons storage facilities

- two locations (one each in Syria and Iraq)