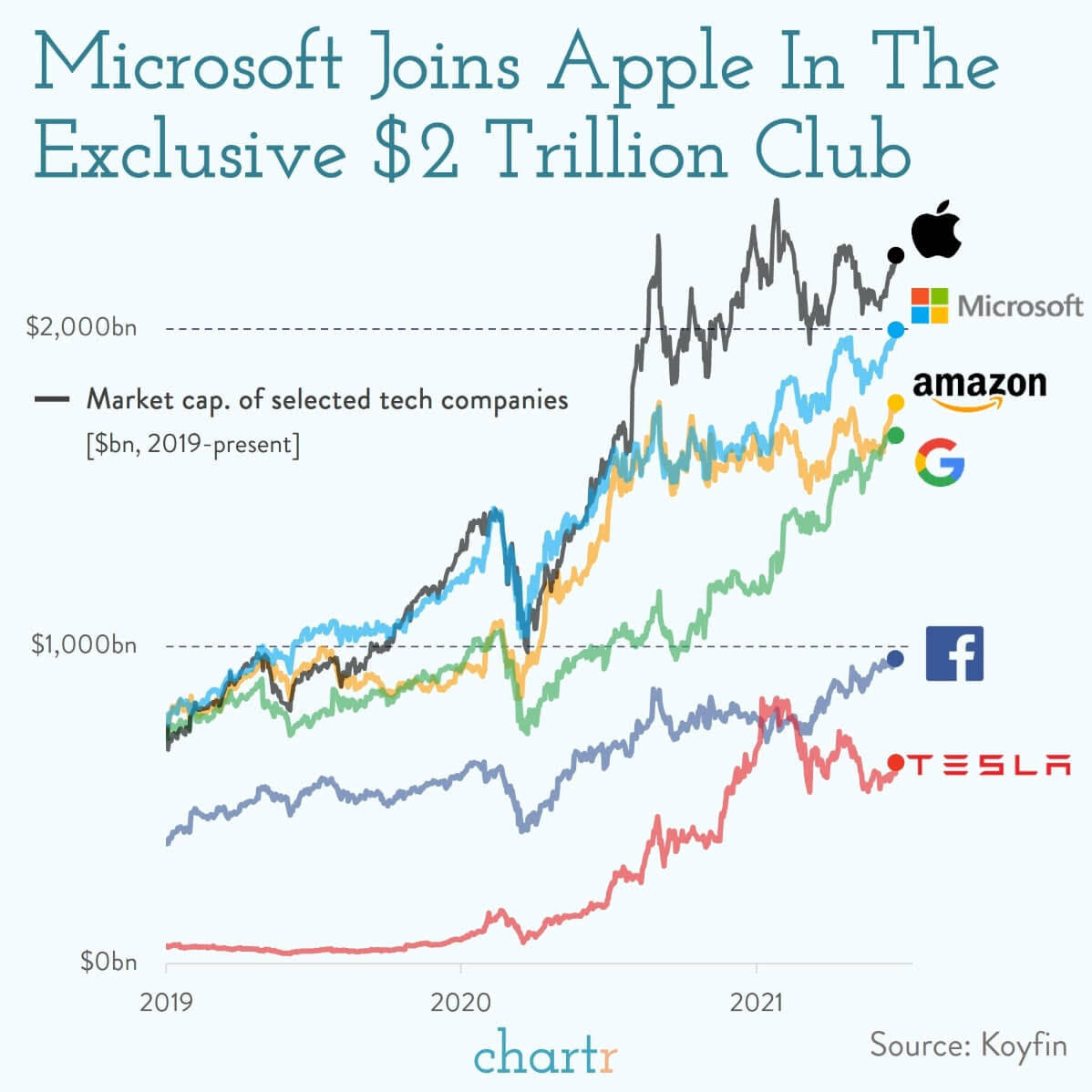

The $2 Trillion Club

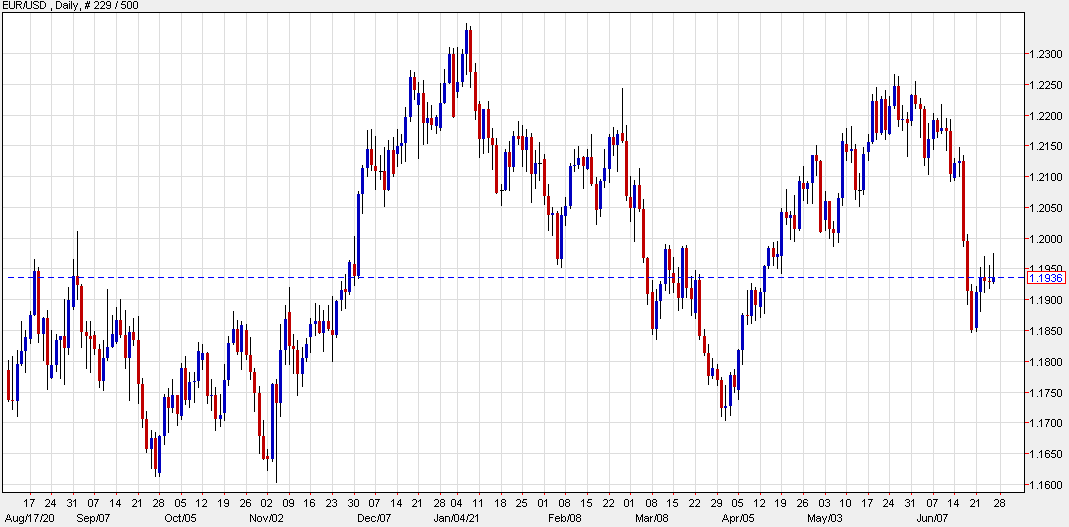

There were substantial shifts into euro and GBP longs in the lead up to the FOMC decision. That left a big chunk of the market vulnerable to the Fed surprise. Afterwards, there was a bit of rush to the exits and that likely exaggerated last week’s rally in the dollar. I’m surprised we didn’t see that in CAD as well but those proved to be stronger hands.

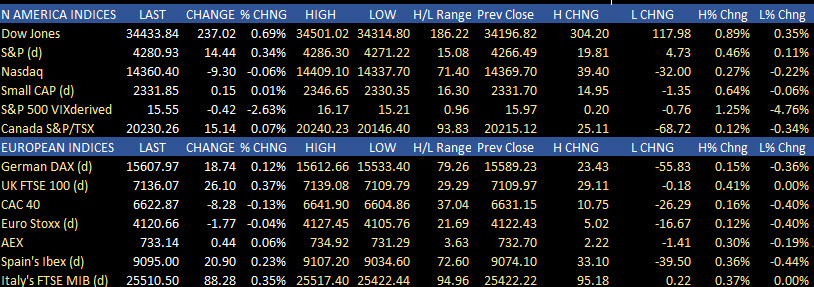

For the week, all the major indices are closing higher with the small-cap Russell 2000 and the Dow 30 leading the way: