Archives of “June 19, 2021” day

rssWhat’s on the US economic calendar next week: PCE data and plenty of Fedspeak

Fed speak will be one of the highlights

The Fed dominated the past week and it will likely be more of the same in the days ahead with a heavy slate of speakers scheduled to offer their thoughts on the stance of monetary policy.

The Fed dominated the past week and it will likely be more of the same in the days ahead with a heavy slate of speakers scheduled to offer their thoughts on the stance of monetary policy.Monday:

- Bullard

- Kaplan

- Williams

Tuesday:

- Mester

- Daly

- Powell testifies in Congress

Wednesday:

- Bowman

- Bostic

- Rosengren

Thursday:

- Bostic

- Harker

- Williams

- Bullard

- Kaplan

- Fed bank stress tests

Friday:

- Mester

- Rosengren

- Williams

Expect a handful of media appearances as well. If there’s a message the Federal Reserve wants to send, they will certainly have an opportunity.

The economic data calendar also has some highlights but the week will start quietly with nothing market moving scheduled for Monday. It picks up from there.

Tuesday:

- Existing home sales

- Richmond Fed

Wednesday:

- Markit manufacturing and services prelim

- New home sales

Thursday:

- Trade balance

- Durable goods orders

- Q1 GDP (third look)

- Initial jobless claims

Friday:

- PCE

- UMich sentiment

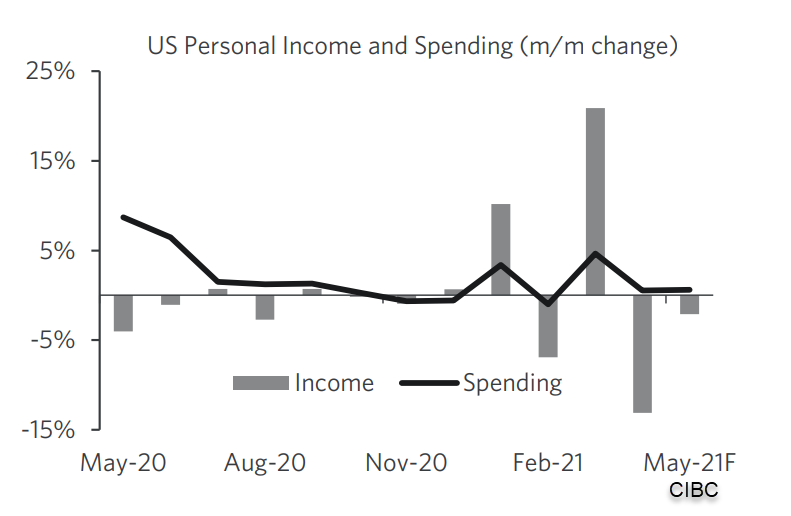

For the PCE report, CIBC forecasts an above-consensus reading of +0.6% on personal spending (+0.3% exp) and is in-line on the +3.5% y/y core inflation number.

“Although households have ample savings as a result of past fiscal stimulus to spend, labor shortages and supply chain issues are proving to be a headwind to activity, while quickly rising prices in some areas of the economy could pose a threat to future demand. The escalation in prices has been expected by the Fed and it will look through the acceleration as transitory and remain focused on the recovery in the labor market.”

S&P, Dow close near session lows. Nasdaq under pressure as well.

Dow down for the fifth consecutive day

The major US indices are selling off into the close with the S&P and Dow industrial average near the lows for the day.

- The Dow closed lower for the fifth consecutive day

- S&P closes lower for the fourth straight day

- Dow has its worst week in 2021

- Dow has its worst day in more than five weeks

- Technology index fell -0.93%

- Consumer staples are down -1.67%

A snapshot of the closes shows

- S&P index -55.45 points or -1.31% at 4166.38. The low price was at 4164.40. The hi was at 4204.78

- NASDAQ index fell -130.97 points or -0.92% at 14030.38. It’s low price reached 14009.04. The hi was at 14129.25

- Dow industrial average felt -531.92 points or -1.57% at 33291.53. It’s high price reached 33622.70. The low price extended to 33271.93

- Russell 2000 index felt -49.74 points or -2.17% at 2237.72. It’s high price reached 2284.95. The low extended to 2229.58.

For the trading week, the major indices were lower led by the Dow which felt -3.45%

- Dow industrial average -3.54%

- S&P index -1.91%

- NASDAQ index -0.28%

Stocks were pressure from the “get-go” as Fed’s Bullard gave a more hawkish assessment of the FOMC decision on Wednesday. As a result, in addition to stocks getting hit, the shorter end of the treasury curve saw yields rising. This week the five year yield rose 13.92 basis points, and the two year yield rose 10.72 basis point. Meanwhile the 30 year fell -12.19 basis points and the 10 yield was near unchanged.

Thought For A Day