Archives of “June 18, 2021” day

rssEuropean indices end the week on a sour note

Big fall today and down for the week

The major European indices are ending the week on a sour note with big declines on the day. For the week the indices are also lower.

Looking at the provisional closes:

- German DAX -1.9%

- France’s CAC -1.5%

- UK’s FTSE 100 -2.0%

- Spain’s Ibex -1.9%

- Italy’s FTSE MIB -1.8%

For the week, the indices are all in the red:

- German DAX, -1.65%

- France’s CAC -0.5%

- UK’s FTSE 100 -1.75%

- Spain’s Ibex -2.05%

- Italy’s FTSE MIB -2.0%

A look around the markets as London/European traders look to exit shows:

- Spot gold up to dollars and $0.50 or +0.13% at $1775.62.

- Spot silver is up $0.10 or 0.4% $26 even

- WTI crude oil futures are rebounding and currently up around $0.96 or 1.35% at $72 even. The high price reached $72.17. The low extended to $70.16

- Bitcoin is down $-1300 or -3.45% at $36,437. The low price reached $36,366. The hi was up at $38,240

in the US stock market, the major indices are down sharply with the Dow industrial average leading the way.

- S&P index -48 points or -1.4% at 4173.63

- NASDAQ index -136 points or -0.96% at 14025.65

- Dow is down -472 points or -1.4% at 33352.

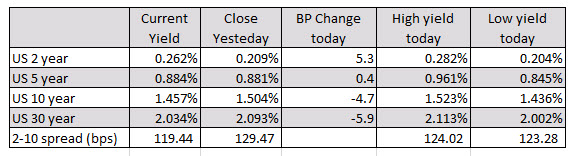

In the US debt market, the yields are mixed with a flatter yield curve as traders exit the shorter end (pushing up yields on Fed hikes sooner than expected). The longer and is down as the market prepares for the economy slowing because of the Fed hikes.

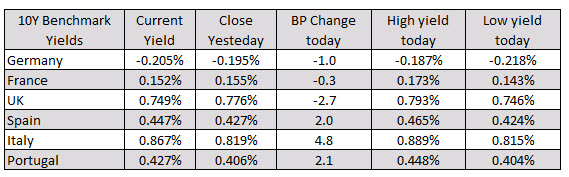

In the European equity market, the benchmark 10 year yields are mixed with flight to safety flows into the German, France, UK debt (yields lower), and flights out of risk in the Spain, Italy, and Portugal notes (yields higher):

The USD remains the strongest of the major currencies (and moving higher) followed closely by the JPY. Fed’s Bullard’s comments have been the big catalyst for a higher dollar (more hawkish in his interview on CNBC). The NZD is the weakest followed by the other commodity currencies including CAD and AUD.

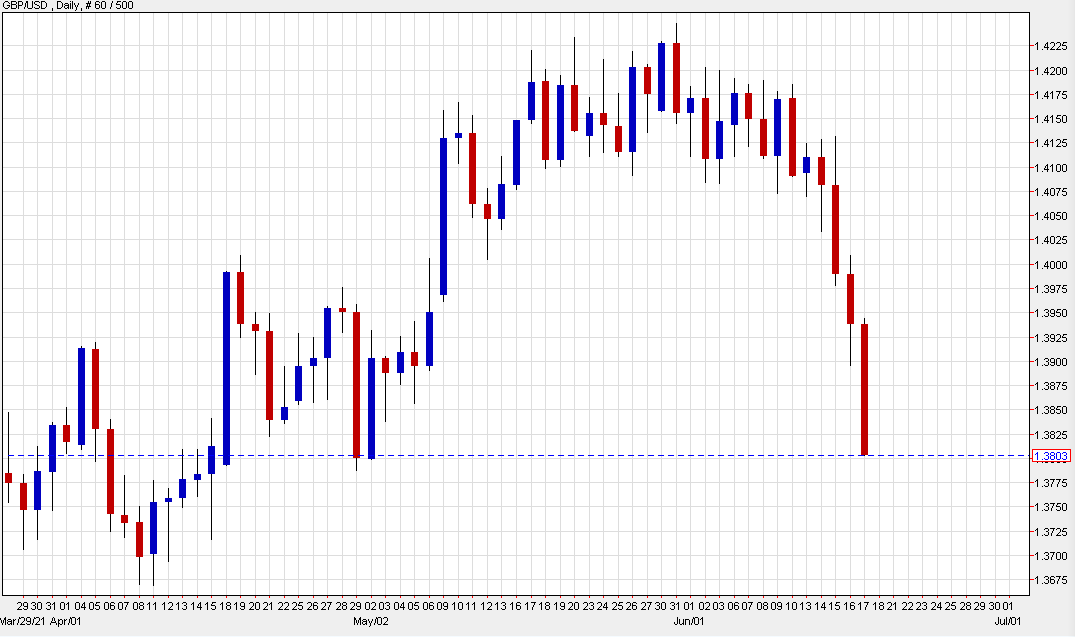

UK covid cases stay high. Cable nears 1.38

UK continues to report high cases

UK covid cases reported today are 10,476, which is just below yesterday’s four-month high of 11,007.

Hospitalizations have risen 43% in the past week and the delta variant is dominant. We’re still a long ways from the 60,000 cases per day in January but with pubs packed for Euro 2020, I don’t see how this gets better any time soon.

The drop in cable is mostly a result US dollar strength following the Fed move but if the UK can’t get control of covid, it will widen rate differentials and the expected path of tightening.

Technically though, there’s good support at 1.3800 and just below with the April 29 low at 1.3787.

Bond yields touch 2.0%

The pressure on the long end continues

I tend to think this is more of a squeeze that will run into sellers at 2%.

The takeaway from Bullard today was hawkish but I’m not sure that’s right. He said he wants to hike in late 2022 if inflation runs at 2.5-3.0% next year. That’s a high bar considering that some base effects next year will unwind. For instance, used car prices should be lower a year from now than today.

In any case, do you really want to lose money (in real terms) in bonds for the next 18 months just for the chance of disinflation later?

10-year Treasury yields retreat further to pre-FOMC lows

The bond market is one to watch as yields struggle to keep higher post-FOMC

10-year Treasury yields are down by nearly 3 bps now to 1.475% with the low today touching 1.467% as yields retrace further after the surge higher on Wednesday.

The push lower completely negates the jump post-FOMC as yields now slump back to levels seen going into the Fed meeting earlier in the week.

It is either inflation bets are dying off and we are seeing some position squaring in the meantime or that the market simply isn’t so committed to the Fed’s hawkish tilt.

I’d argue it is the former but the latter will likely see yields pick back up once the flush is completed. Either way, as soon as tapering signals start to become more evident, it is hard to challenge the narrative that the only direction for yields is up.

For now though, lower yields could temper with the dollar’s momentum despite the greenback threatening key technical breaks against major currencies.

BOJ’s Kuroda: Fed could begin tapering given solid economic recovery, rising inflation

Kuroda stepping on the Fed’s toes here

I’m not too sure Powell would like that but Kuroda is trying to spur some weakness in the yen here, adding that the fact that the BOJ is still continuing with bold monetary easing means that “the dollar with strengthen”.

In any case, he is just speaking what the market is saying and after the Fed caved this week, they don’t have much credibility to defend themselves either to be fair.

European equities more sluggish to kick start the day

epid tones after the mixed session yesterday

- Eurostoxx -0.1%

- Germany DAX flat

- France CAC 40 -0.1%

- UK FTSE -0.2%

- Spain IBEX -0.5%

Even though the dollar may be keeping in good stead, the bond market and equities aren’t quite sharing a similarly outsized reaction to the Fed.

US stocks were under pressure early on yesterday but recovered towards the end with the Nasdaq near record highs after a close of 0.9% higher. US futures are keeping steadier with S&P 500 futures up 0.1%, Nasdaq futures up 0.3%, and Dow futures flat.

Just be mindful though that it is also quadruple witching day today.

Friday 18 June 2021 is ‘quadruple witching’ day

Witching hour is the final hour of trading on the 3rd Friday of each month as options and futures on stocks and stock indexes expire.

More specifically, expiry of:

- stock index futures,

- stock index options,

- stock options

- and single stock futures

Market folklore says the final hour of (US cash market) trading today, 3- 4 pm ET, will be more volatile than usual due to QWH!

Ummm, maybe, maybe not. So far its an excuse for the complete absence of FX volatility in Asia today … Then again the timezone here doesn’t often need much of an excuse. 🙁

US / Iran talks to revive 2015 Iran nuclear deal – Iran says still work to be done

Reuters with an update on talks, will be of interest to the oil traders.

- essential issues remain to be negotiated, the top Iranian negotiator said on Thursday

- “We achieved good, tangible progress on the different issues …. we are closer than ever to an agreement but there are still essential issues under negotiations,” Iranian Deputy Foreign Minister Abbas Araqchi was quoted as telling Al Jazeera television.

Once the agreement is renegotiated Iranian oil should return to markets within months. Still a ways off though.

—

Background to this is

- The US withdrew from the agreement in 2018

- Iran and six world powers have now been negotiating in Vienna since April

North Korea is preparing for both dialogue and confrontation with the US

North Korean dictator Kim Jong Un hedging his bets!

- says NK is prepared for both dialogue and confrontation with the US

Info from South Korean media, Yonhap, citing North Korea state media KCNA