Archives of “June 17, 2021” day

rssThe rationality of the market.

US Indices close lower on FOMC decision but off the lows

Fed ups inflation expectations and said thinking about thinking about tapering

The US stocks are closing lower on FOMC decision, but well off the lows. The Fed up there expectations for inflation in 2021, but still see inflation rates moving back toward just over 2% in 2022. The US 10 yield is up about eight basis points to 1.579%. That is still off the high yield for the year 1.774%.

- Dow posts a three-day losing streak

- S&P NASDAQ low close lower for the second straight day

- Dow S&P have worst day in a four weeks

The final numbers are showing:

- S&P index is down -22.85 points or -0.54% at 4223.74. The low reached for 4202.45, down -1.05%

- NASDAQ index closed down -33.18 points or -0.24% at 14039.68. The low reached 13903.73, down -1.33%

- Dow fell -265.66 points or -0.77% at 34033.67. The low reached 33917.11, down 111% at the lows.

- Russell 2000 fell -5.38 points or -0.23% at 2314.69. The low price reached 2296.21.

Brazil’s central bank hikes rates by 75bp, indicates it may do so again next meeting

Banco Central do Brasil hikes its benchmark interest rate to 4.25%, as polls expected.

Headlines via Reuters:

- sees continued normalization of policy at next meeting

- sees another policy adjustment of the same magnitude at the next meeting

- deteriorating inflation expectations may require a more forceful reduction of monetary stimulus

- base-case scenario is for normalisation of policy towards neutral rate

- a rate hike at next meeting depends on the evolution of economic activity, the balance of risks, inflation expectations

- future monetary policy steps may be adjusted to ensure compliance with inflation goals

- accompanying current inflation shocks and their potential secondary effects

- adjustment towards neutral rate necessary to “mitigate the dissemination of the temporary shocks to inflation”

- decision was unanimous

- persistence of inflationary pressure more intense than expected

- outlook for electricity rates keeping inflation under pressure in the short run

Thought For A Day

Powell Q&A: It’s clear we’re on a path to a very strong labor market

Comments to reporters

- If we look 1-2 years out, we’ll be looking at “a very, very strong employment market”

- There are very large amounts of job openings and lots of people looking for work and the process of filling those vacancies is slower than anticipated. “It may just take longer”

- Notes that vaccinations should diminish the reluctance of people to return to work along with restart of daycare

- Unemployment insurance for around 15m people will end by the September

- I would expect that we would see strong job creation building up over the summer

- We have to be humble about our ability to understand the data

- Inflation has come in above expectations in the coming months but prices driving that are items that are directly affected by the reopening

- You can see this meeting as the ‘talking about talking about’ meeting

- We did not have a discussion of whether liftoff is appropriate in any particular year

This is the end of the ‘outcome-based Fed’. Powell is making all kinds projections about the coming months with an unusual amount of confidence that goes against what he’s been saying for months.

It’s almost like they saw something in the numbers and projections that spooked them. All that talk about letting inflation run hot and waiting to see numbers to ensure a ‘broad and inclusive’ recovery is dead.

The FOMCs central tendencies and dot plot for the June 2021 meeting

une 2021 FOMC meeting

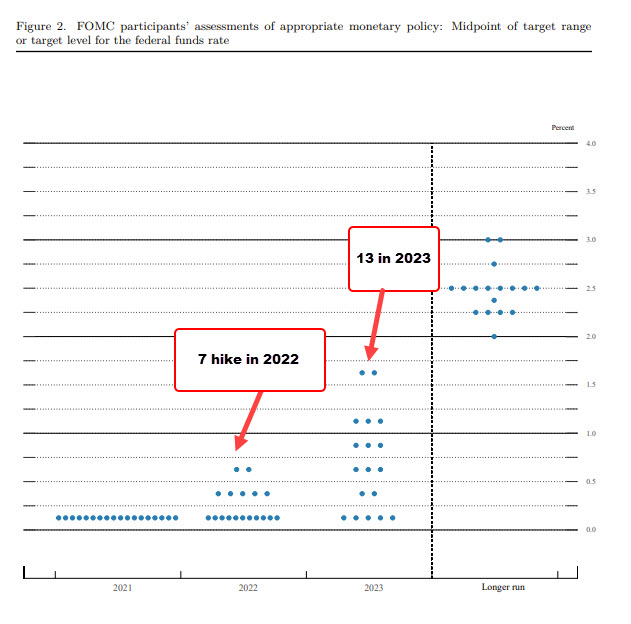

Dot Plot:

The dot plot for the June FOMC meeting shows:

- 7 fed officials see hikes in 2022

- 13 fed official see hikes in 2023.

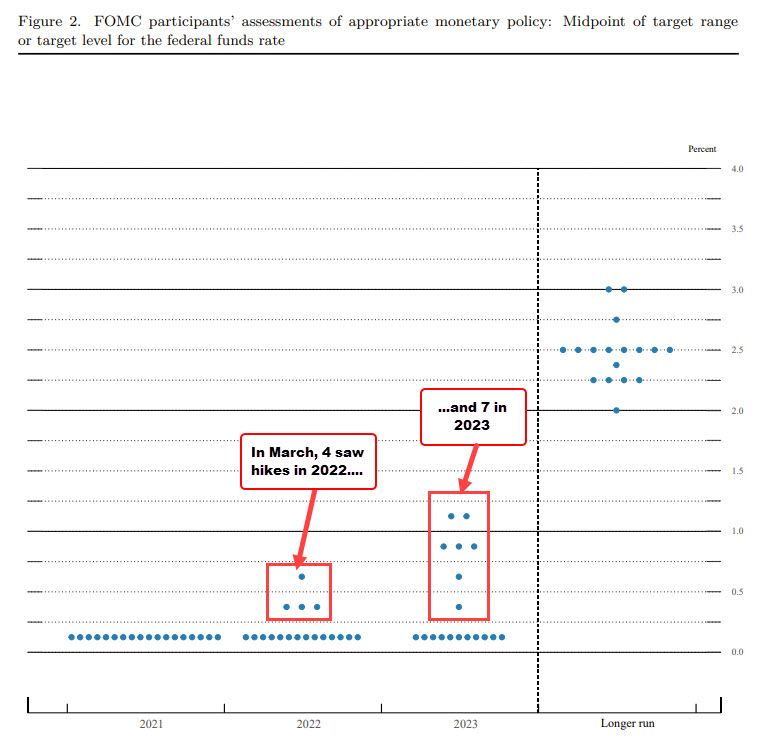

Below is the dot plot from the March meeting. At the time, 4 Fed officials expecting hikes in 2022 and 7 Fed officials in 2023.

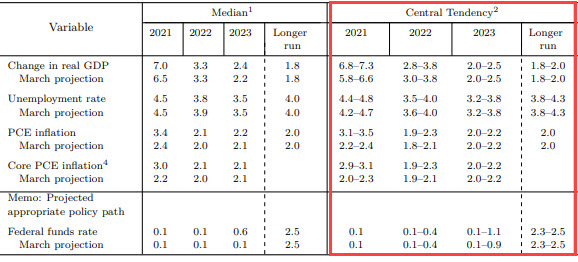

Central Tendencies June 2021:

Central Tendencies June 2021:

Central Tendencies for 2021:

- GDP 6.8% to 7.3% vs.5.8% to 6.6% in March. GDP HIGHER

- Unemployment 4.4% to 4.8% vs 4.2% to 4.7% in March. Unemployment rate marginally higher.

- PCE 3.1% to 3.5% vs 2.2% to 2.4% in March. Inflation much higher.

- Core PCE 2.9% vs 3.1% vs 2.0% to 2.3% in March. Core inflation much higher.

Central Tendencies for 2022:

- GDP 2.8% to 3.8% to 3.0% to 3.8% in March. Growth near unchanged.

- Unemployment 3.5% to4.0% vs 3.6% to 4.0% in March. Employment near unchanged

- PCE 1.9% to 2.3% vs 1.8% to 2.1% in March. Inflation marginally higher.

- Core PCE 1.9% to 2.3% vs. 1.9% to 2.1% in March. Core unchanged.

Highlights:

- More Fed officials say higher rates in 2022 (from 4 to 7)

- GDP much higher in 2021

- Headline inflation and core inflation also much higher in 2021

- 2022 central tendencies are near unchanged from March estimates

The full FOMC statement for June 2021 meeting

For release at 2:00 p.m. EDT

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

Progress on vaccinations has reduced the spread of COVID-19 in the United States. Amid this progress and strong policy support, indicators of economic activity and employment have strengthened. The sectors most adversely affected by the pandemic remain weak but have shown improvement. Inflation has risen, largely reflecting transitory factors. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy will depend significantly on the course of the virus. Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time. In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals. These asset purchases help foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Charles L. Evans; Randal K. Quarles; and Christopher J. Waller.