Archives of “June 10, 2021” day

rssEuropean equity close: Mixed bag, small moves

Closing changes for the main bourses:

- UK FTSE 100 +0.1%

- German DAX flat

- French CAC -0.3%

- Spain IBEX -0.2%

- Italy MIB -0.3%

There’s been a bit of a loss of momentum this week. Some might argue that’s an ominous sign but it could be healthy consolidation.

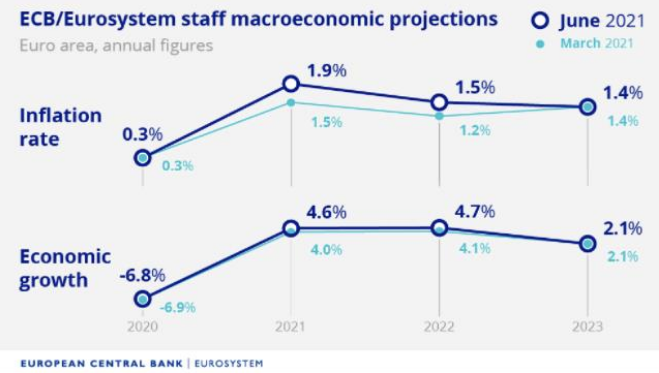

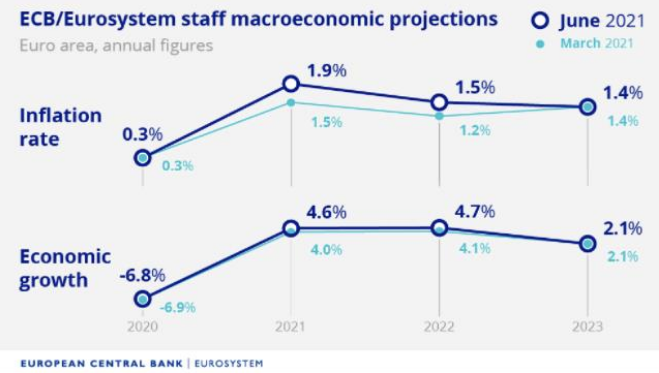

ECB boosts 2021 and 2022 inflation forecasts

The latest HICP forecasts

- 2021 inflation to 1.9% from 1.5%

- 2022 to 1.5% from 1.2%

- 2023 inflation remains at 1.4%

US CPI was at 5.0% y/y today. Are the base effects that much less in Europe? We’ll have to wait and see.

Core inflation:

- 2021 at 1.1% vs 1.0% prior

- 2022 1.3% vs 1.1% prior

- 2023 1.4% vs 1.3% prior

ECB raises 2021 and 2022 GDP forecasts

The latest GDP forecasts

- 2021 GDP +4.6% vs +4.0% prior

- 2022 GDP +4.7% vs +4.1% prior

- 2023 GDP +2.1% vs +2.1% prior

The consensus estimates are

- 2021 +4.2%

- 2022 +4.1%

- 2023 +2.0%

These are some rosy numbers and that’s good for the euro — at least in as much as you can trust a central bank forecast. Notably, they aren’t forecasting any rate hikes and still see CPI below target through the horizon.

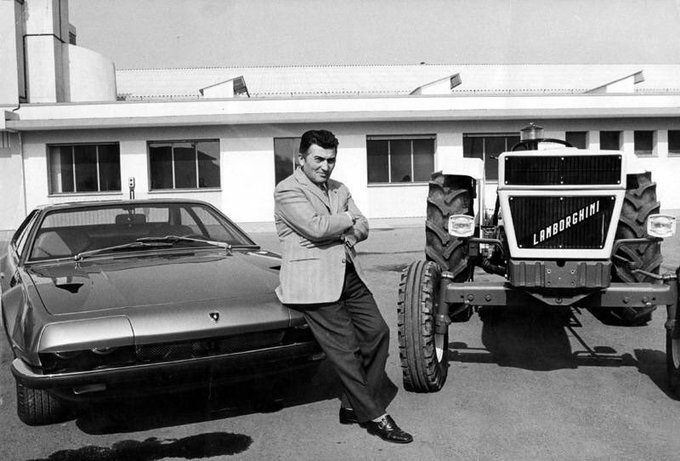

Ferruccio Lamborghini founded a successful tractor company.

He owned a Ferrari, but complained about it to founder Enzo Ferrari. Enzo told him “you may be able to drive a tractor, but you will never be able to handle a Ferrari properly.” So Ferruccio founded Lamborghini.

Iran / US talks to revive the 2015 nuclear accord will resume this weekend

Confirmation the talks would recommence came from US Deputy Secretary of State Wendy Sherman on Wednesday.

Sherman says the US administration is aiming to reach an agreement with Iran ahead of the June 18 Iranian presidential election, which could complicate the talks. Says:

- I think there’s been a lot of progress made

- but out of my own experience until the last detail is nailed down, and I mean nailed down, we will not know if we have an agreement

For more background on the talks and the Joint Comprehensive Plan of Action (JCPOA) Al Jazeera have a good piece here.

Oil traders will be watching for signs that an agreement could increase oil supply from Iran in the coming months. This has been spoken about at great length in past weeks and months.

US monetary base is going vertical again.

JBS paid an $11 million ransom in bitcoin re cyber attack

Wall Street Journal carry the news that meat supplier JBS paid a cyber ransom.

- ransom payment in bitcoin,

- made to stop further disruption at JBS meat plants

Andre Nogueira, chief executive of Brazilian meat company JBS SA’s U.S. division comment:

- “It was very painful to pay the criminals, but we did the right thing for our customers”

Link (may be gated)

Meanwhile BTC making a new high on the session:

PBOC sets USD/ CNY reference rate for today at 6.3972 (vs. yesterday at 6.3956)

The People’s Bank of China set the onshore yuan (CNY) reference rate for the trading session ahead.

- USD/CNY is permitted to trade plus or minus 2% from this daily reference rate.

- CNH is the offshore yuan. USD/CNH has no restrictions on its trading range.

- The previous close was 6.3865

- Reuters estimate from their survey was 6.3971, Bloomberg 6.3967 …. (A rate that’s significantly stronger or weaker than expected is typically considered a signal from the PBOC).

Major indices close lower on the day. Dow post three days losing streak

Dow the worst performer

The major indices lost steam and moved lower in the last hour of trading.

- NASDAQ composite index closes lower for the first time four days

- NASDAQ 100 close higher for the fourth straight day

- Dow has its worst performance in three weeks

- Dow posts a three-day losing streak

- S&P closes lower for the second time in three days. Fails to stay above the all-time high closing level

A look at the major indices shows:

- S&P index fell -7.64 points or -0.18% at 4219.82

- NASDAQ index fell -13.16 points or -0.09% at 13911.75

- Dow felt -153.01 points or -0.44% at 34446.81.

The small-cap Russell 2000 index closed down -16.62 points or -0.71% at 2327.14.