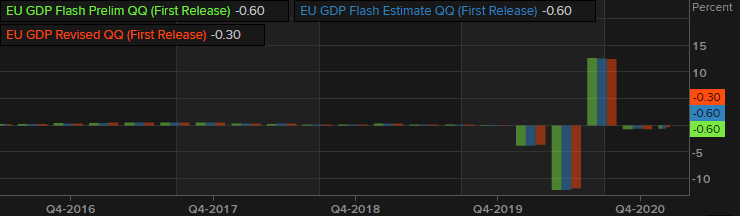

The low for the day reached $31000 so far today

The IRS Chief Rettig is saying:

- Congress should provide clear authority requiring large crypto currency transfers to be reported to the IRS.

A problem with the ransomeware problems of late is that tracking bitcoin was thought to be impossible to do and that it promoted bad actors. Yesterday, the US government said that they got back most of the ransom paid by Continental Pipeline. That has led to some uneasiness in the crypto currency world where players assumed their accounts were sacred only to them.

This declaration from Rettig is a step in the regulation direction for crypto.

The price is currently down $-2240 or -6.49% at $32,267. The low price reached $31,004.