US dollar hits fresh highs

“The eurozone’s vast service sector sprang back into life in May, commencing a solid recovery that looks likely to be sustained throughout the summer.

“Businesses reported the strongest surge in demand since the start of 2018 as covid restrictions were eased and vaccine progress boosted confidence.

“After covid fighting measures were tightened to the harshest for a year in April, restrictions eased considerably in May on average. These measures are on course to moderate further at least until the autumn, assuming further significant covid waves are avoided. This should facilitate the further return to more normal business conditions as the summer proceeds. Business optimism for the year ahead has consequently hit the highest for over 17 years.

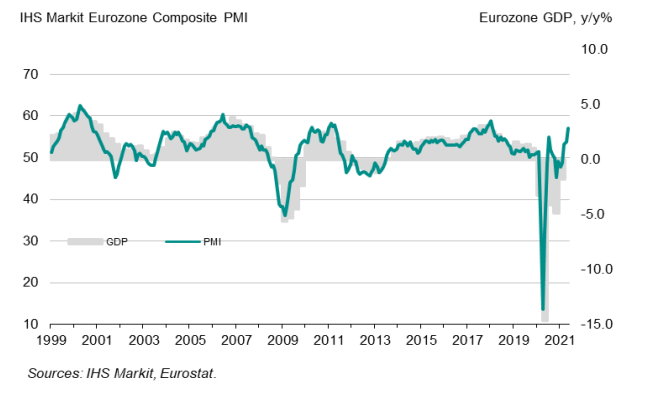

“The service sector revival accompanies a booming manufacturing sector, meaning GDP should rise strongly in the second quarter. With a survey record build-up of work-in-hand to be followed by the further loosening of covid restrictions in the coming months, growth is likely to be even more impressive in the third quarter.

“A growing area of concern is capacity constraints, both in terms of supplier shortages and difficulties taking on new staff to meet the recent surge in demand. This is leading to a spike in price pressures, which should ease as supply conditions improve, but may remain an area of concern for so

The Meme frenzy continued today with: