Archives of “June 1, 2021” day

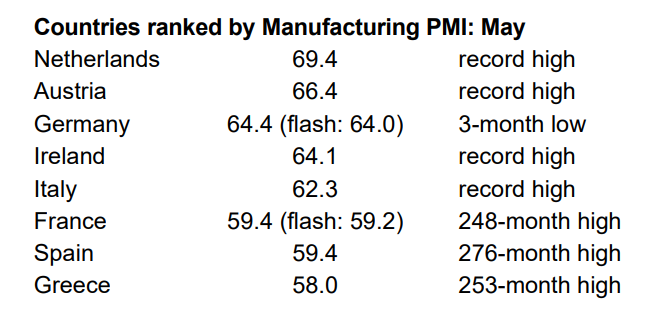

rssEuropean shares in the day higher. German Dax closes at record high

France’s CAC closes at the highest level since 2000.

The German DAX is closing up about 1% and in doing so is closing at a new all-time high. The France’s CAC is also closing higher and at the highest level since August 2000. Below is a look at the daily chart of the German Dax.

- German DAX, +1.0%

- France’s CAC, +0.7%

- UK’s FTSE 100, +0.9%

- Spain’s Ibex, +0.6%

- Italy’s FTSE MIB, +0.7%

- Spot gold is trading down seven dollars or -0.37% at $1899.70.

- Spot silver is trading unchanged at $28.03

- WTI crude oil futures are up $1.49 or 2.23% at $67.81. The high price extended to $68.87. That was the highest level since October 2018.

- S&P index up 5.24 points or 0.12% at 4209.30

- NASDAQ index -15.67 points or -0.11% at 13732.20

- Dow up 137 points or 0.4% at 34666.90

$AMC had giant options volumes this week, only second to $SPY. at one point it was up 180% on the week!

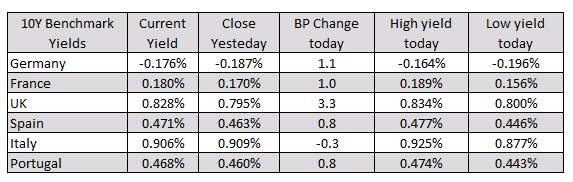

Eurozone April unemployment rate 8.0% vs 8.1% expected

Latest data released by Eurostat – 1 June 2021

- Prior 8.1%

A slight tick lower in the jobless rate but considering the furlough programs in the region, it is tough to draw much conclusions from the reading above.

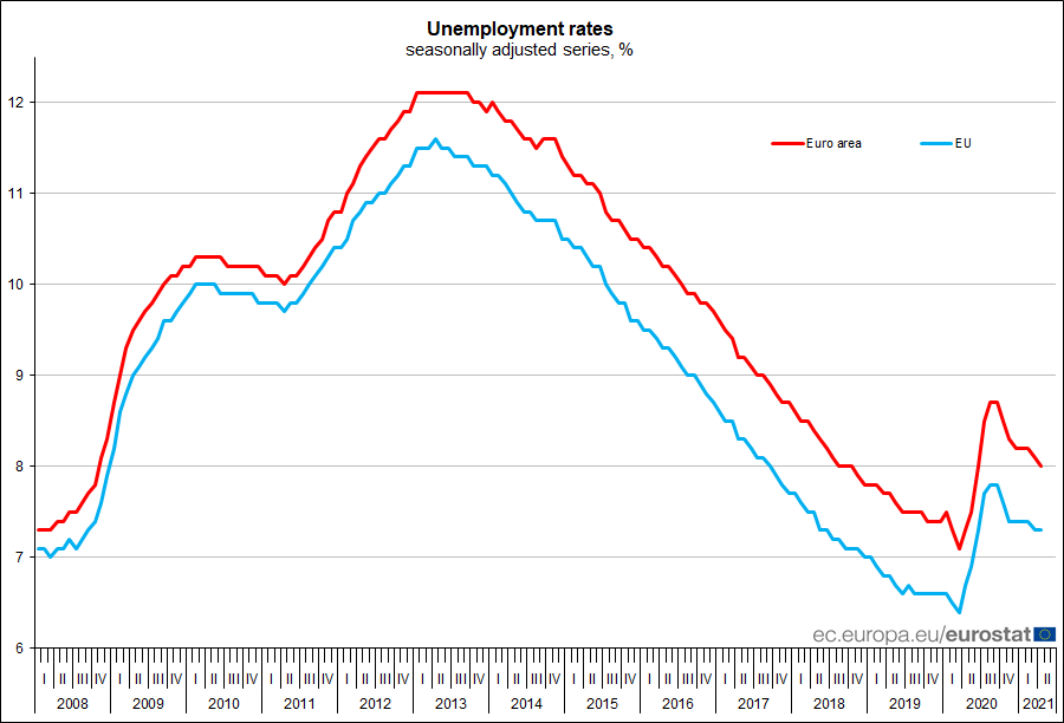

Eurozone May preliminary CPI +2.0% vs +1.9% y/y expected

Latest data released by Eurostat – 1 June 2021

- Prior +1.6%

- Core CPI +0.9% vs +0.9% y/y expected

- Prior +0.7%

The headline reading is the highest since November 2018 as it reaffirms stronger inflation pressures, which could owe to some part in base effects and also higher input cost inflation across the region/globe.

Oil climbs to highest level since October 2018 ahead of OPEC+ meeting

WTI up by 2.8% to $68.20 currently

Oil is searching for a break to the topside as price now extends to its highest since October 2018 with buyers pushing price action above $68 at the moment.

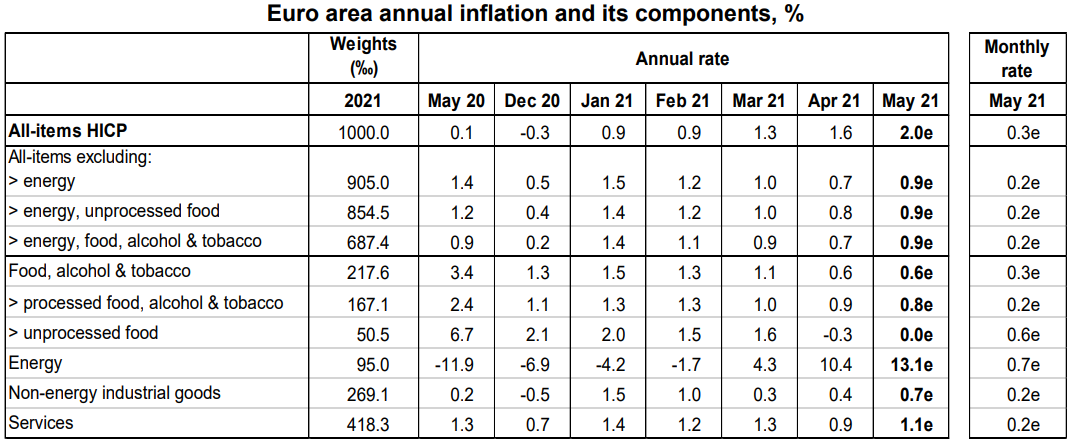

Eurozone May final manufacturing PMI 63.1 vs 62.8 prelim

Latest data released by Markit – 1 June 2021

“Eurozone manufacturing continues to grow at a rate unprecedented in almost 24 years of survey history, the PMI breaking new records for a third month in a row. Surging output growth adds to signs that the economy is rebounding strongly in the second quarter.

“However, May also saw record supply delays, which are constraining output growth and leaving firms unable to meet demand to a degree not previously witnessed by the survey.

“High sales volumes are consequently depleting warehouse stocks and backlogs of uncompleted work have soared at a record pace. While these forward-looking indicators bode well for production and employment gains to persist into coming months as firms seek to catch up with demand, the flip-side is higher prices. The combination of strong demand and deteriorating supply is pushing up prices to a degree unparalleled over the past 24 years.

“The survey data therefore indicate that the economy looks set for strong growth over the summer but will likely also see a sharp rise in inflation. However, we expect price pressures to moderate as the disruptive effects of the pandemic ease further in coming months and global supply chains improve. We should also see demand shift from goods to services as economies continue to reopen, taking some pressure off prices but helping to sustain a solid pace of economic recovery.”

Dollar a touch on the softer side for now

Dollar keeps mildly lower across the board to start the session

RBA leaves cash rate unchanged at 0.10% in June monetary policy decision

Latest monetary policy decision by the RBA – 1 June 2021

- Prior 0.10%

- 3-year bond yields target 0.10%

- 3-year government bond yields is consistent with RBA target

- Australian recovery is stronger than earlier expected and is forecast to continue

- Central scenario is for GDP to grow by 4.75% over this year and 3.50% over 2022

- An important ongoing source of uncertainty is the possibility of significant outbreaks of the virus, although this should diminish as more of the population is vaccinated

- While a pick-up in inflation and wages growth is expected, it is likely to be only gradual and modest

- RBA will consider in July whether to retain the April 2024 bond as the target bond for the 3-year yield target or to shift to the next maturity, the November 2024 bond

- RBA is not considering a change to the target of 10 basis points

- AUD remains in the upper end of the range of recent years

- RBA will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range

- This is unlikely to be until 2024 at the earliest

- Full statement

Forecasts for Chinese yuan raised for Q2, Q3 2021

HSBC cite the currency strengthening more than expected recently, forecasts:

- Q2 6.25 (from prior forecast at 6.5)

- Q3 6.45 (also from 6.5)

- End 2021 fall back to 6.6 (unchanged from previous)

- “China is unlikely to deliberately strengthen the RMB so as to curb rising import costs”

- “The recent surge in commodity prices is partly supply-side driven, rather than due to China’s demand”

- “The Fed may be patient about rate hikes, but it will have to taper its asset purchases eventually”