Archives of “March 2021” month

rssWHO says benefits of AstraZeneca vaccine outweigh the risks

WHO on AstraZeneca vaccine

- WHO carefully assessing latest available safety data

- Recommends vaccinations with AZ shot continue

This is no surprise. European officials are likely to say the same thing tomorrow. At the same time, ‘benefits outweigh the risks’ isn’t exactly ‘this vaccine is 100% safe’. Given the choice, no one would take this ahead of the alternatives, particularly given its poorer efficacy, particularly versus the South African variant.

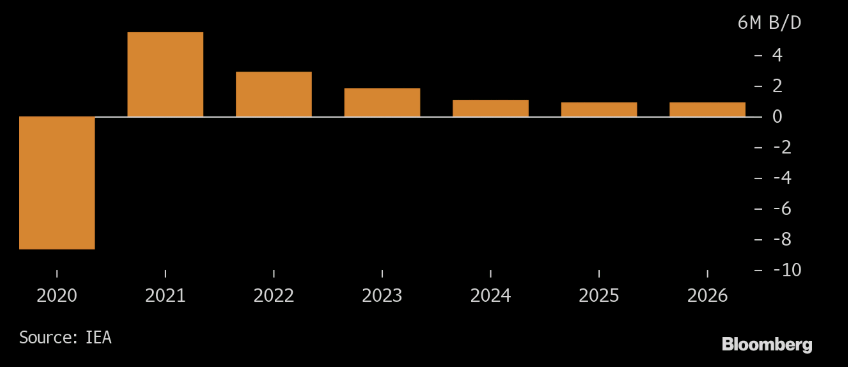

IEA says that a new oil ‘supercycle’ seems unlikely

IEA comments in its latest report on the oil market

- There is more than enough oil to keep the market adequately supplied

- Oil inventories still look ample compared with historical levels

- A hefty amount of spare production capacity has built up due to OPEC+ curbs

- Global oil demand won’t hit pre-virus levels until 2023

That is a bit of a wet blanket on the whole bullish rhetoric on oil that the market has built up in recent weeks. I’d keep this in view but the market will decide what it wants to as it sticks to the whole reflation narrative, so there’s that to consider as well.

IEA forecasts show global oil demand to slow after a burst this year

IEA forecasts show global oil demand to slow after a burst this yearEconomic data coming up in the European session

Eurozone final inflation figures for February on the agenda today

The market is keeping a more tepid mood and I would things to continue that way until we get to hear from the Fed later on in the day. There really isn’t much else to talk about in the meantime as everything else takes a backseat in trading today.

The euro may still find itself in a bit of a pickle in light of vaccine disruptions and fears surrounding a third wave in some countries, but the focus for today is the dollar.

Dollar sentiment will largely ride on the back of Treasury yields so if the dot plots and Fed forecasts give the green light for Treasuries to sell off, expect the greenback to ride high in the aftermath and that might cause jitters in equities.

I would expect Powell to keep a more dovish stance but given how the bond market has been doing its own thing in the past month or so, I reckon investors will only want to see what it wants to see unless the Fed really pushes back firmly.

1000 GMT – Eurozone January construction output

Prior release can be found here. This is very much a lagging release as the market remains more focused on the 2H 2021 outlook at this stage.

1000 GMT – Eurozone February final CPI figures

The preliminary report can be found here. As this is the final release, it shouldn’t offer much as any uptick in inflation in 1H 2021 will continue to be brushed aside by the ECB – more so now that economic developments are looking more complicated.

1100 GMT – US MBA mortgage applications w.e. 12 March

Weekly US housing data, measures the change in number of applications for mortgages backed by the MBA during the week. Amid the sudden turn higher rates this year, recent mortgage activity has dipped with purchases falling sharply alongside refinancing activity so it’ll be one to watch out for.

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

Samsung says it may suspend its Note this year, cites chip shortage

The chip shortage has been keenly felty in the vehicle industry.

Now this from Samsung.

‘Note’ is one of its phone products (I checked with the kids).

More:

- current supply-demand imbalance of IT sector chips and related components is “very serious”

- Q2 “poses a slight problem”

Demand for treasury puts is high. People still betting on higher yields

The US is expected to sanction Russia, Iran, China for 2020 election meddling

The sanctions against Russia are expected as soon as next week says a CNN report.

As a ps. US President Biden will hold a press conference on Thursday March 25 (i.e. next week) – this may be the venue for any sanctions announcement?

The latest International Atomic Energy Agency report shows Iran edging closer to developing a nuclear weapon

Reuters with the article on the latest from the IAE, on a further breach of Tehran’s deal with major powers.

- Iran has started enriching uranium at its underground Natanz plant

- using a second type of advanced centrifuge, the IR-4

“On 15 March 2021, the Agency verified that Iran began feeding the cascade of 174 IR-4 centrifuges already installed at FEP with natural UF6,”

The International Atomic Energy Agency in the United Nations nuclear ‘watchdog’. More here at Reuters report.

S&P affirms the US sovereign rating at AA+, says the outlook remains stable

Standard and Poors rating agency confirms Australia is higher rated than the US 😉

- US ‘AA+/A-1+’ sovereign ratings affirmed; outlook remains stable

- S&P says sovereign rating on the US is based on its strong institutions, diversified and resilient economy, extensive monetary policy flexibility

- says sovereign rating on US is also based on unique status as the issuer of the world’s leading reserve currency

- says stable outlook on US indicates view that negative and positive rating factors for the US will be balanced over the next three years

- S&P also expect US’s institutional checks, balances, strong rule of law, free flow of information to contribute to stability in economic policies

More (these headline summary points are via Reuters)

- outlook for US remains stable, reflecting expectation of rapid economic growth this year and next as the pandemic recedes

- says ratings for US are constrained by high general government debt and fiscal deficits, both of which worsened in 2020

- expect gradual withdrawal of unprecedented US fiscal stimulus to stabilize net general govt debt burden around 110% of GDP in next couple of years

- says US dollar’s status as world’s premier reserve currency, and size and depth of the US financial market, should sustain policy flexibility

- says expect US govt will enact countervailing measures to begin addressing longer-term fiscal challenges

- ratings for US are constrained by fiscal weaknesses and high net general government debt, which is expected to reach 107% of GDP in 2021

- says rapid economic policy response to pandemic illustrates the ability of u.s. governing institutions to undertake timely measures during crisis