Alexa traffic for http://Damai.cn , China’s largest entertainment ticket platform

Big losers on the day include:

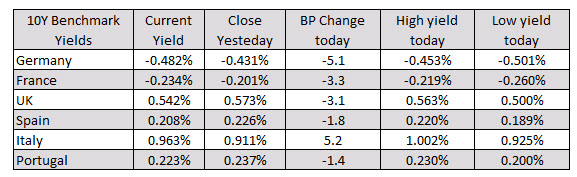

The European markets are now closed and it was an ugly one today. The major indices all fell sharply as global fear about the spread of the coronavirus takes solid hold on growth prospects. If anything, the uncertainty about the spread is worrying investors.