That’s not as good as it sounds

Fox Business reports that China’s commerce ministry told the US it’s prepared to do a deal on the parts of negotiations both sides agree upon. The ministry told Fox they’re prepared to set out a timetable for the harder issues to be worked out next year.

This report has boosted risk trades but it’s not all it seems. US officials — including Trump — have said many times that they want a big deal or no deal.

He said it on TV about 30 minutes ago but it’s moving the market now as it does the rounds. A reader who caught the clip on TV also tells us it wasn’t as positive as the spin that’s coming out.

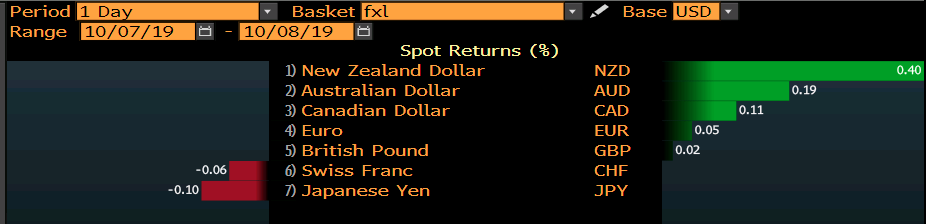

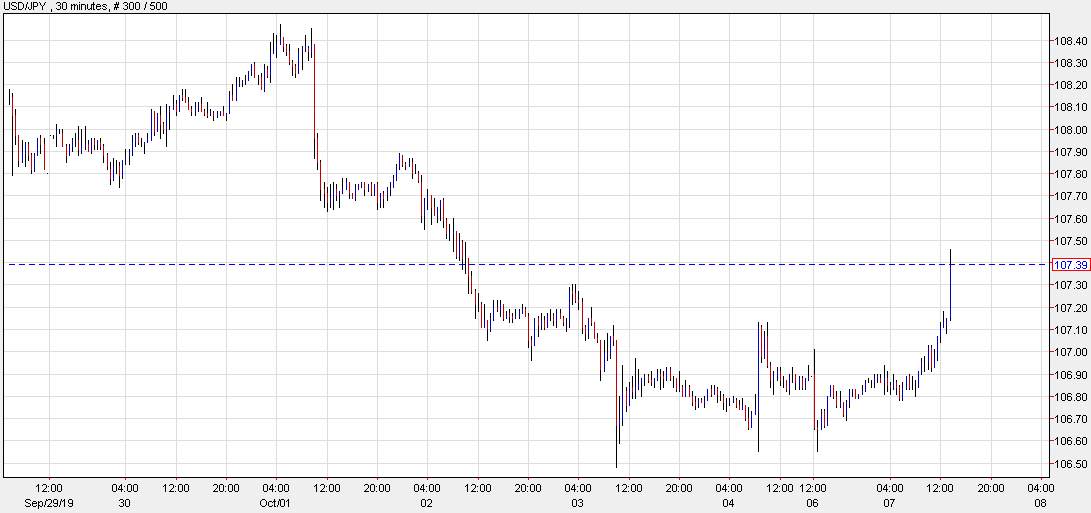

Of course that can change and the US might be bluffing but I don’t see this being received as unambiguously good news. If anything, the initial market reaction might have it wrong as USD/JPY rises and gold falls.

USD/JPY:

Isn’t this just another way of saying ‘If you like what we’re offering, take it; as for the parts you don’t like, we can talk about those some other time, because we’re not going to discuss those now.’.