Learn as much from your losers as you do from your winners.

Learn as much from your losers as you do from your winners.

Failure is important in success but do not overlook the importance of success in succeeding.

Archives of “February 2019” month

rssEmotions and Mindset

Emotional stability and discipline is the foundation upon which a trader has to build his trading methodology. Without the ability to control emotions and the impulsive trading decisions emotions cause, the best trading system and the best thought-out risk management approach are useless.

I truly feel that I could give away all my secrets and it wouldn’t make any difference. Most people can’t control their emotions or follow a system. – Linda Raschke

Markets are never wrong – opinions often are. – Jesse Livermore

I don’t get caught up in the moment. – Ray Dalio

If you argue with the market, you will lose. – Larry Hite

The psychological factor for investing has 5 areas. These include a well-rounded personal life, a positive attitude, the motivation to make money, lack of conflict [such as psychological hang ups about success], and responsibility for results. -Dr. Van K. Tharp

It is hard enough to know what the market is going to do; if you don’t know what you are going to do, the game is lost. – Alexander Elder

These quote highlight the fact that, before you get into the nitty-gritty of your trading system and try to tweak your stop loss or take profit placement, you have to work on your discipline. It is not a stop loss order that should have been placed 5 points higher or lower that makes the difference between a consistently losing and a profitable trader, but the degree to how a trader can avoid emotionally caused trading mistakes.

Best Traders

“Habits of Success”

Winning, Psychology (60%) x Effective Risk Management (30%) x Written Trading Methodology (that has an edge, 10%) = $UCCE$$

Deep….Must Read & Understand

Jim Rogers: Here's The Most Important Thing On What Investors Should Do

I would say one lesson we all need to learn is that after you’ve had a great success, you really should be very worried. Let’s say you sell and say you’ve made 10 times on your money. You should be extremely worried. You should close the curtains, not read, look at the TV, or anything because that’s when you’re full of hubris, arrogance, confidence. You think, “God, this is something easy,” and you’re desperate to jump around to something new. You should do your very best to avoid making another play until you’ve calmed down a lot. Just wait. It’s a very dangerous time for any investor.

I would say one lesson we all need to learn is that after you’ve had a great success, you really should be very worried. Let’s say you sell and say you’ve made 10 times on your money. You should be extremely worried. You should close the curtains, not read, look at the TV, or anything because that’s when you’re full of hubris, arrogance, confidence. You think, “God, this is something easy,” and you’re desperate to jump around to something new. You should do your very best to avoid making another play until you’ve calmed down a lot. Just wait. It’s a very dangerous time for any investor.Likewise, if you take a huge loss and there’s a big panic and things are dumped on your head because you’re overextended or wrong for whatever reason, calm down, don’t say, “I’m never gonna invest in stocks again or commodities or whatever.” That’s the time you really should be willing to invest again if you can gather together some capital money. The investments can be terribly emotional. You have to figure out a way to control your emotions and deal with your emotions if you’re going to survive in these markets.

My advice is that, most of the time, most investors should do nothing. They should look out the window or go to the beach. You should wait until you see money lying in the corner and all you have to do is go over and pick it up. That’s how most investors should invest. The problem is we all think we need to jump around all the time and be jumping in and out and that’s not good. (more…)

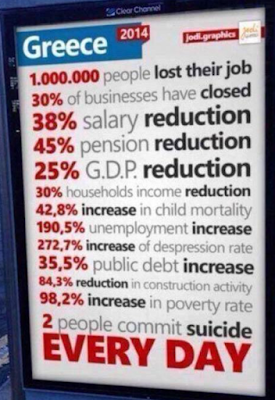

In 2014-This Happened in Greece :More than 10,000 have committed suicide. That's about 1/1000th of the population.

Doing Nothing Isn't a Financial Plan

Thought For A Day

The Media Campaign Begins: BP Is Now Too Big To Fail

As prospects before BP get darker by the day, and the likelihood of bankruptcy grows, the TBTF propaganda begins. Evidence A – Bloomberg headline: “BP Demise Would Threaten U.S. Energy Security, Industry.” Just as the failure of bankrupt banks was supposed to lead to the destruction of capitalism, so the bankruptcy of BP plc is now supposed to lead to the degeneration of US energy independence. And who in their mind would force the Chapter 11 of a systemically important company? Once again, free market capitalism is about to walk out through the back door…

As prospects before BP get darker by the day, and the likelihood of bankruptcy grows, the TBTF propaganda begins. Evidence A – Bloomberg headline: “BP Demise Would Threaten U.S. Energy Security, Industry.” Just as the failure of bankrupt banks was supposed to lead to the destruction of capitalism, so the bankruptcy of BP plc is now supposed to lead to the degeneration of US energy independence. And who in their mind would force the Chapter 11 of a systemically important company? Once again, free market capitalism is about to walk out through the back door…

From Bloomberg:

The company’s demise would be disruptive to the American oil industry, given that BP is the largest oil and gas producer in the U.S., with about 1 million barrels per day of production. Some 7,000 of BP’s 23,000 U.S. employees work in the Houston area, many in a suburban office park just off the Katy Freeway.

From there the company runs its Gulf of Mexico offshore operations with a phalanx of engineers, geologists, and computer scientists. “These are highly compensated people,” says J. Robinson West, chairman of Washington-based consultants PFC Energy. (more…)