- Actual winning/losing of a trade is unimportant.

- Each well executed trade, win or lose, is a victory.

- Each poorly executed trade is a defeat (even if you make money).

- Each move or action lacking discipline can eventually cost much more money than the original trade in the form of monetary/emotional loss.

Archives of “February 2019” month

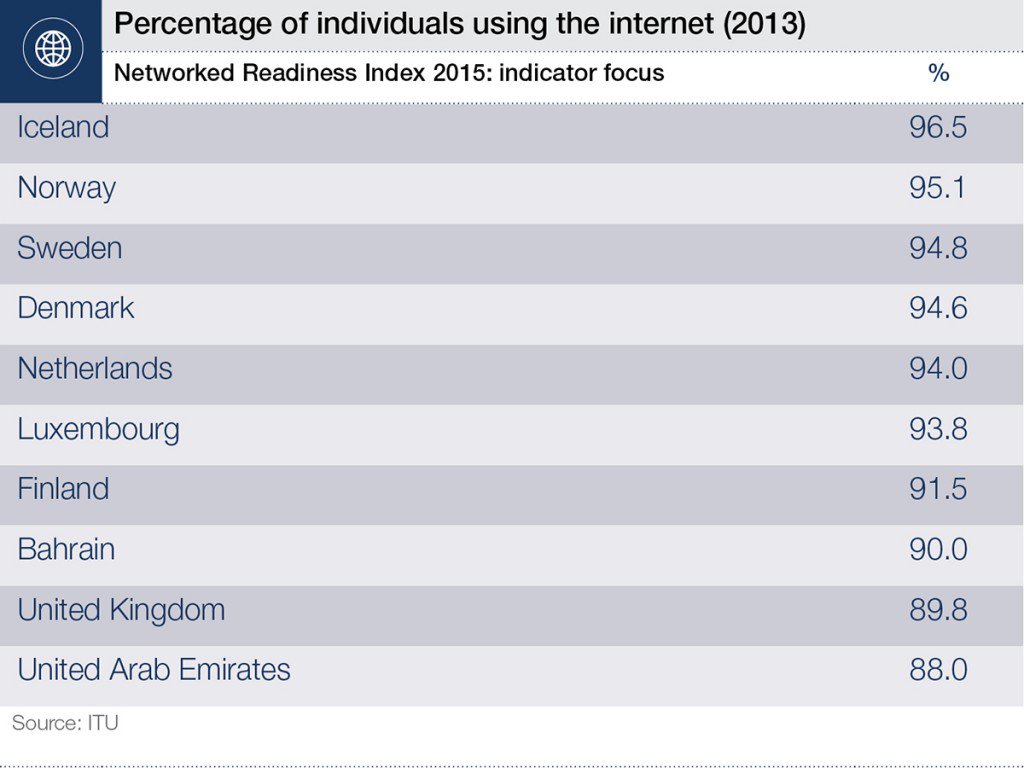

rssWhich countries have the highest proportion of Internet users?-Are U Able to see India's Name ?

Thirty Trading Rules for Traders

1. Buying a weak stock is like betting on a slow horse. It is retarded.

2. Stocks are only cheap if they are going higher after you buy them.

3. Never trust a person more than the market. People lie, the market does not.

4. Controlling losers is a must; let your winners run out of control.

5. Simplicity in trading demonstrates wisdom. Complexity is the sign of inexperience.

6. Have loyalty to your family, your dog, your team. Have no loyalty to your stocks.

7. Emotional traders want to give the disciplined their money.

8. Trends have counter trends to shake the weak hands out of the market.

9. The market is usually efficient and can not be beat. Exploit inefficiencies.

10. To beat the market, you must have an edge.

11. Being wrong is a necessary part of trading profitably. Admit when you are wrong.

12. If you do what everyone is doing you will be average, so goes the definition.

13. Information is only valuable if no one knows about it.

14. Lower your risk till you sleep like a baby.

15. There is always a reason why stocks go up or down, we usually only learn the reason when it is too late.

16. Trades that make a lot of intellectual sense are likely to be losers.

17. You do not have to be right more than you are wrong to make money in the market.

18. Don’t worry about the trades that you miss, there will always be another.

19. Fear is more powerful than greed and so down trends are sharper than up trends.

20. Analyze the people, not the stock.

21. Trading is a dictators game; you can not trade by committee.

22. The best traders are the ones who do not care about the money.

23. Do not think you are smarter than the market, you are not.

24. For most traders, profits are short term loans from the market.

25. The stock market can not be predicted, we can only play the probabilities.

26. The farther price is from a linear trend, the more likely it is to correct.

27. Learn from your losses, you paid for them.

28. The market is cruel, it gives the test first and the lesson afterward.

29. Trading is simple but it is not easy.

30. The easiest time to make money is when there is a trend.

Two Types of Traders

In general, I find there are two kinds of traders. The first kind trades visually, from patterns that are evident on visual inspection. Those include chart patterns, oscillator patterns, Elliott waves, and the like. Their trading decisions are discretionary, in that they elect to buy, hold, and sell based upon their perception of patterns and their judgment as to their meaning.

In general, I find there are two kinds of traders. The first kind trades visually, from patterns that are evident on visual inspection. Those include chart patterns, oscillator patterns, Elliott waves, and the like. Their trading decisions are discretionary, in that they elect to buy, hold, and sell based upon their perception of patterns and their judgment as to their meaning.

The second kind of trader distrusts visual inspection. Such traders are more likely to buy into the behavioral finance notion that unaided human perception and judgment are subject to a variety of biases. Accordingly, these traders use some form of historical/statistical analysis and/or system development to test ideas and trade only those that test out in a promising way.

Now here’s the interesting part: The first group of traders almost universally asks me to help them tame their emotions. They have problems with impulsive trading, failing to honor risk limits, failing to take valid signals due to anxiety, etc. The second group of traders, having researched successful strategies, almost universally asks me to help them take maximum advantage of their edge. They want help taking *more* risk and trading larger positions. (more…)

Do U Remember This or Not ?

Just be you…

Morgan Housel’s 9 Financial Rules

| 1. Nine out of 10 people in finance don’t have your best interest at heart. 2. Don’t try to predict the future. 3. Saving can be more important than investing. 4. Tune out the majority of news. 5. Emotional intelligence is more important than classroom intelligence. 6. Talk about your money. 7. Most financial problems are caused by debt. 8. Forget about past performance. 9. The perfect investment doesn’t exist. |

Thought For A Day

Trading with the Tao

“The Tao” means different things to different people. It’s generally thought to have been introduced to the world sometime around 500 B.C. in China. Since then, millions of interpretations have been contemplated. In modern times, everyone from the Dali Lama to Willie Nelson has offered their take on it.

“The Tao” means different things to different people. It’s generally thought to have been introduced to the world sometime around 500 B.C. in China. Since then, millions of interpretations have been contemplated. In modern times, everyone from the Dali Lama to Willie Nelson has offered their take on it.

What exactly is “The Tao?”

It’s usually translated directly as “the way” or “the path.” But most who have studied it agree that it also refers to “the Source” behind everything. The unseen force in the universe that essentially makes things happen.

A Christian theologian would probably see similarities between the Tao and the “Holy Spirit.” Physicists likely see it represented as “energy.” Self-help gurus often compare the Tao to “consciousness.” Luke Skywalker called it “the Force.” Had Michael Jordan delved into the world of metaphysics, he probably would have referred to the Tao as “the zone.”

The overriding message of the Tao is that you’re either flowing with it or against it. You’re either in the zone or out of the zone, using the Force or blocking the Force. However you want to describe it, the point is that you feel good and peaceful when you’re flowing with the Tao and you feel bad and fearful when you’re trying to fight against it. (more…)

Niederhoffer on making errors

As a squash player, I was gifted. I had all the right things going for me. I practiced. I was very good with the racket, and I had tremendous anticipation. But I tended to play an errorless game by hitting a slice on my backhand, which took a lot of power off the ball. That wasn’t a disaster, but it was definitely a weakness in my game. My opponents always used to say that on a good day they could beat me, because they could hit more spectacular shots than me. But they never did. I went for about 10 years without losing a game, except to [the great Pakistani squash player] Sharif Kahn. He made about six, seven errors a game—but he also made eight or nine winners. I would make about zero errors per game but only one or two winners. He had the edge on me about 10-4, and I regret that I was never willing to accept the risky shots and confrontations, never willing to play a more error-full game.

As a squash player, I was gifted. I had all the right things going for me. I practiced. I was very good with the racket, and I had tremendous anticipation. But I tended to play an errorless game by hitting a slice on my backhand, which took a lot of power off the ball. That wasn’t a disaster, but it was definitely a weakness in my game. My opponents always used to say that on a good day they could beat me, because they could hit more spectacular shots than me. But they never did. I went for about 10 years without losing a game, except to [the great Pakistani squash player] Sharif Kahn. He made about six, seven errors a game—but he also made eight or nine winners. I would make about zero errors per game but only one or two winners. He had the edge on me about 10-4, and I regret that I was never willing to accept the risky shots and confrontations, never willing to play a more error-full game.

In my market career, I took too many risks. In my squash career, I didn’t take enough.

I wish I had applied my squash methods to my speculating. I’d be a very wealthy man if I had.