- Blaming outside forces for poor trading results is an incredibly destructive behavior. High frequency traders, market makers, and irrational markets, give an undisciplined trader license to make reckless trades. The less responsibility taken for results, the more destructive they can be with an account.

- Trading with no plan and making decisions based on feelings, is a really bad idea. Letting opinions and predictions be a guide to entries, and emotions be a guide to exits, guarantees maximum destruction of trading capital.

- Trade first and learn how to trade later. Traders who don’t spend time educating themselves before trading will learn the hard way, and give their trading capital to other traders as tuition.

- Focusing on ego and the desire to be right, instead of profitability and big losses, will quickly destroy a trader’s account.

- Traders that fight the trend and disagree with the actual price action will give their trading capital to those that follow the trend.

- Trade without discipline and risk management and a trader will be destroyed regardless of their trading system or method.

- If a trader doesn’t diversify their life with strong relationships, fun, peace, and health, their trading results become too entangled with their self worth. This can lead to mental and emotional ruin.

Archives of “February 11, 2019” day

rssValid For Life & Trading Too

Thought For A Day

Deal. But not yet a Done Deal.

Don’t Trust, Just Verify

These European schools produce the highest-paid finance grads

How close are you to perfect?

Becoming the perfect trader is no easy task, and I daresay that nobody has been able to achieve this great feat. The perfect trader buys at the absolute low of the day and sells at the absolute high. And depending on whether the high happens first or the low happens first determines if he is long or short for the day. It’s really easy to calculate this metric. It is simply the absolute value of the daily range or the high minus the low.

Becoming the perfect trader is no easy task, and I daresay that nobody has been able to achieve this great feat. The perfect trader buys at the absolute low of the day and sells at the absolute high. And depending on whether the high happens first or the low happens first determines if he is long or short for the day. It’s really easy to calculate this metric. It is simply the absolute value of the daily range or the high minus the low.

To get an accurate handle on the concept, we first ask what time frame we will be using. For end-of-day traders or swing traders, the daily bar is your competition. If you day-trade off the five-minute bar, well then use the five-minute bar to gauge your performance.

This concept is used in system trading and because vast amounts of data are typically used, we system traders need to resort to our super-duper calculators, also referred to as our programming language. This is an example of what code looks like for our daily perfect trader. The language is TradersStudio’s version of Visual Basic, but you can get the idea and use it with any program you wish. It’s the basic loop function.

For i = FirstBar to LastBar step 1

Next

PerfectProfit = PerfectProfit + Range [i]

You’ll need to dimension your PerfectProfit variable as an array if you want it to tally up daily ranges. (more…)

6 Trading Rules for Traders

- Devise a trading plan and follow it. I believe the best trading strategy is the one you’ve been able to review, back test and fits your trading style and risk tolerance. It is important that you know all vitals of the trade (the entries, possible exit targets, and where your stops may be prior to placing your trade orders.) By having a concrete plan, you assist in removing the emotion out of the equation.

- Stick with the trend!There’s a reason why the cliché “The trend is your friend” exists. It’s because it’s true! Successful traders will always tend to follow the trend when trading. Remember, if you trade with the trend, you have the majority of the market on your side.

- Control your emotions.This by far is the hardest thing for any trader to do. After all, it has been said that emotional control is 90‐95% of trading and the rest is your strategy. Therefore, I can’t say it enough times… Figure out a way to trade without emotions. To help with this matter, I believe it’s vital that you trade only with capital you can afford to lose. If you are using money that you need to pay your bills, you will almost certainly get emotional about every trade you make. In addition, I found that the more confident you are about your trading strategy, the better the chances are that you can trade with little emotional stress.

- Record your trades in a trade journal.When I first started trading, I was a bit lax about this concept. But once I started doing recording my actions, I found that I was able to identify my strengths and weaknesses. I take about 30‐45 minutes each day after I’m finished trading for the day to review my trades and to analyze any disconnect from my original plan. This helps me strengthen my conviction of my plan.

- Never trade unless the signal is clear.There are times when the market can confuse you. For me, confusion is a clear cut signal to keep out of the market. I always want my trades to be high probability signals. My signal has generated a winning percentage of more than 70%. So if I’m uncertain about a signal why would I want to take it, knowing that the chance of it winning is more like a coin toss or less? To me, that is gambling… and I do not consider myself a gambler.

- Never make trades because you are bored. Sitting on the sidelines waiting for your next trade signal to line up can be very unsettling. Many traders have learned that trading out of boredom can blow out your account in a hurry. For me, trading out of boredom while failing to follow your trading signal is gambling.

Gold : Who's Got It And Who's Finding It

With the dramatic rise in gold’s popularity many still need to be educated about some of the core concepts of the gold market, such as who holds it, and who produces it. Courtesy of Money Hacker we have a useful visual representation that answers precisely these two questions. In addition, here are some of the most useful and trivial factoids about gold, that have no bearing on its price whatsoever, but serve as perfect cocktail small talk.

Click Image to ENLARGE !

Some Insights into the data on the infographic:

All Gold Ever Mined – The total amount of gold ever mined is estimated to be worth around US$5 trillion.

How Gold is Used – You might have though (like me) that most of the gold in the world stored in bank vaults and lock-boxes? Actually, 78 % of the worlds’ gold is made into jewelery. Other industries, mostly electronics, medical, and dental, require about 12%. The remaining 10% of the yearly gold supply is used in financial transactions. (more…)

New Trading Chair For Blue Channel Watchers/Analysts/Whatsapp /Twitter Traders

Technically Yours/ASR TEAM/BARODA

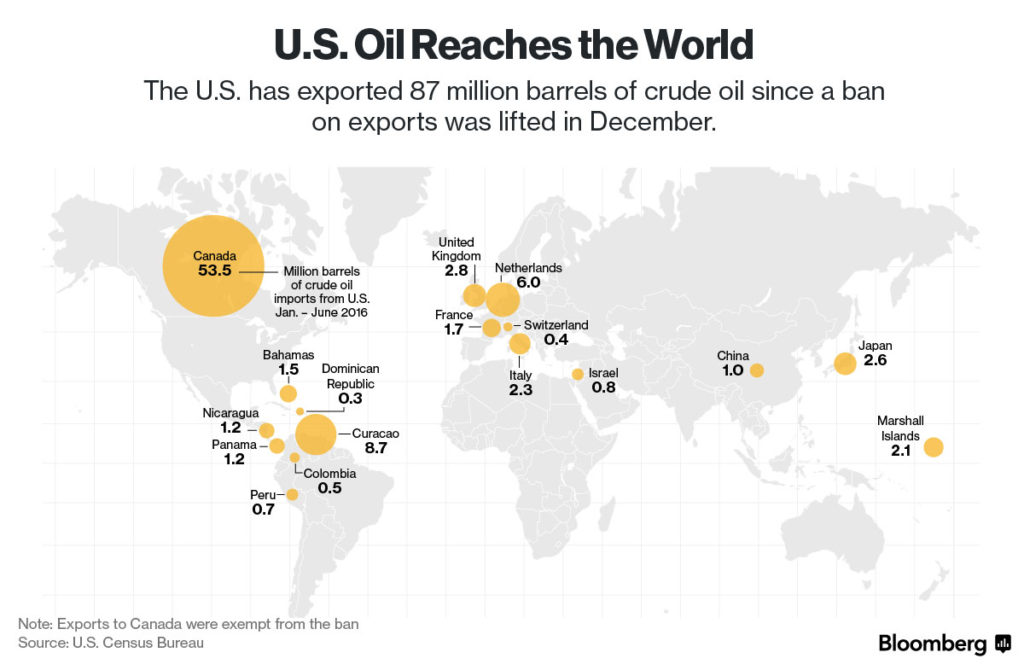

Who’s Buying Up U.S. Oil ?