Imagine for a minute your relationship with markets. How would you characterize that relationship? Is it an adversarial relationship? A hot-and-cold, confusing relationship? A fulfilling relationship?

Many traders talk about markets as if they are battlegrounds and they prepare for combat each day. Other traders, frustrated, talk about markets been manipulated.

How we related to markets very much impacts our trading experience. If we think of the market as casino, we will frame one kind of experience. If we treat markets as battlegrounds, our experience will be quite different.

Now imagine what it would be like to be in loved with markets: to find in them something unique, special and valued. A person who is in love with markets will be market focused even outside normal trading hours.

They are not simply preparing for day’s trading; they are passionately interested in deepening their market experience, learning everything they can about markets.

Archives of “January 2019” month

rssAmazing: The difference a good photographer can make like A Great Technical Analyst (Everything in Eyes )

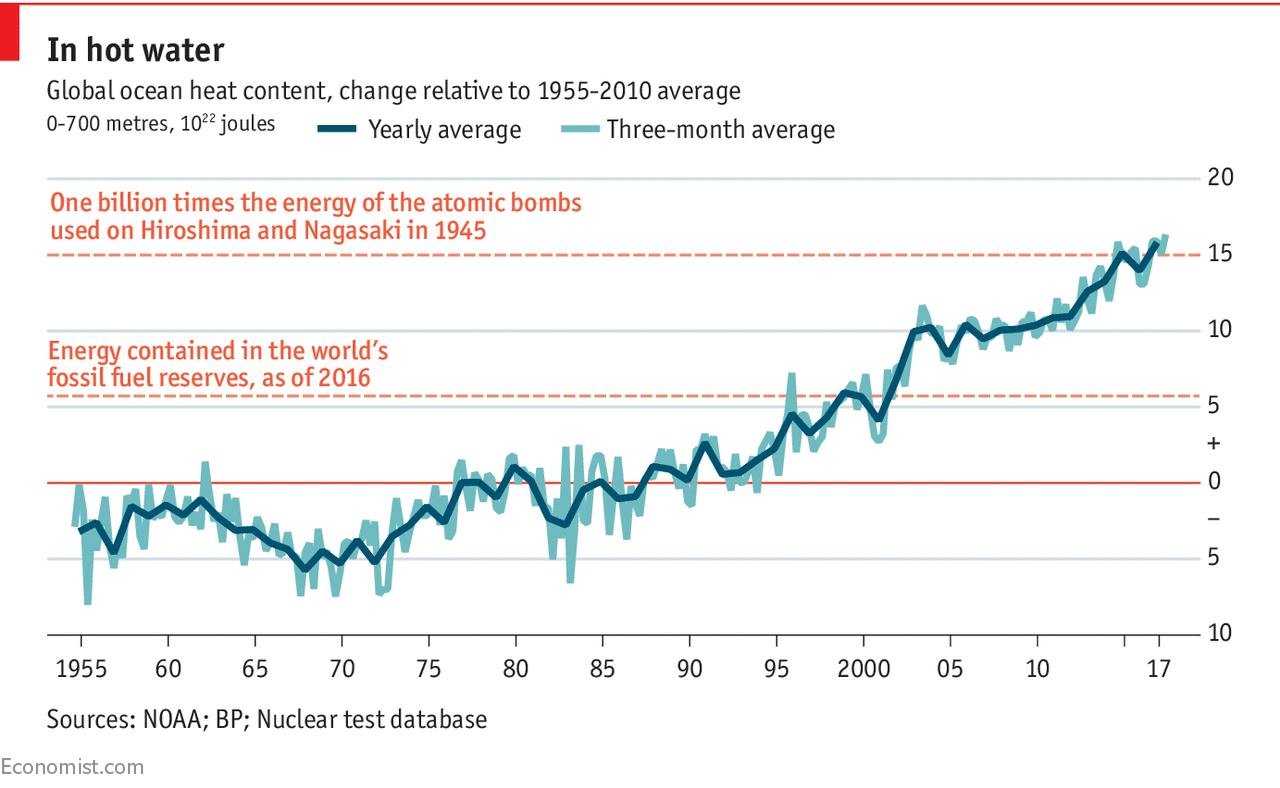

The temperature of the ocean is rising

Confidence

Many times, you won’t feel quite right about a buy or sell decision. If this feeling persists after you have done all your research and you have followed the rules to this point, don’t take the trade. Too many times, individuals try to rationalize a decision. Don’t try to find a good reason for making a bad decision. Your decision must be made with confidence.

Many times, you won’t feel quite right about a buy or sell decision. If this feeling persists after you have done all your research and you have followed the rules to this point, don’t take the trade. Too many times, individuals try to rationalize a decision. Don’t try to find a good reason for making a bad decision. Your decision must be made with confidence.

Good Trades- 10 Points

1.Good trades are generally winners from the very start.

2. Good trades do not take a lot of thinking about; they are triggered through robust entry signals.

3. Good trades aren’t really stressful. With the right position sizing and entry level it should not

cause high stress but instead confidence in your decision.

4. Good trades don’t have to be baby sat and watched for every tick. Good trades can be left alone to work.

5. Good trades are not hard to hold because they are in the direction of the trend for your time frame and get little heat put on them.

6. Good trades hit your price target or trailing stop before your stop loss.

7. Time is on the side of a good trade; the longer you can stay with it the more money you make.

8. Good trades inspire you to stay in them as they become more profitable while bad trades make you want out of them as they lose money.

9. Good trades are psychologically hard to get into because they are generally against the consensus. Bad trades are hard to get out of because you have to admit you are wrong.

10. Good trades make you happy; bad trades make you miserable.

Always Have Positive Approach

Perfect description of a stock market mania. From “The Money Game” (1967), Adam Smith.

Clear your mind

Someone asked a surfer what he does when a big surf comes along, and he goes underwater. The surfer said it was simple. “If I panic, I only have 3-5 seconds of air to breathe. If I stay calm, I have 45-60 seconds of air.“

Someone asked a surfer what he does when a big surf comes along, and he goes underwater. The surfer said it was simple. “If I panic, I only have 3-5 seconds of air to breathe. If I stay calm, I have 45-60 seconds of air.“

Trading Lesson: If you let your emotions get the better of you, you could lose all of your capital. However, if you take a moment and think about your trades, you can have much better results.

Where Are We Know ?After Media Attention ,4 More Stages to go

Super forecasting: the Art and Science of Prediction by Philip Tetlock -Book Review

I have found the bookSuperforecasting: the Art and Science of Prediction by Philip Tetlock to be interesting, provocative and useful. I strongly recommend it.

Philip Tetlock is on the faculty of Wharton in the Management Department, and Dan Gardner is a journalist and author.

The basic story is that Philip Tetlock and his colleagues formed the Good Judgment Project (or “GJP”), and joined a prediction competition sponsored by the Intelligence Advanced Research Project Activity, or IARPA, which is the intelligence community’s version of DARPA. GJP recruited volunteer forecasters, gave them some basic training, and put them into teams. The GJP teams were so successful that eventually the competing groups, including Michigan and MIT, were shut down or merged with Tetlock’s group. As they screened out their most successful participants, Tetlock called them “superforecasters”. (more…)

The basic story is that Philip Tetlock and his colleagues formed the Good Judgment Project (or “GJP”), and joined a prediction competition sponsored by the Intelligence Advanced Research Project Activity, or IARPA, which is the intelligence community’s version of DARPA. GJP recruited volunteer forecasters, gave them some basic training, and put them into teams. The GJP teams were so successful that eventually the competing groups, including Michigan and MIT, were shut down or merged with Tetlock’s group. As they screened out their most successful participants, Tetlock called them “superforecasters”. (more…)