Yes ,Worth Watching….!!

Yes ,Worth Watching….!!

| Fear – Fear causes the day trader to hesitate and freeze when positions should be entered and exited. Fear can also cause day traders to take losses, Doubt – Doubt causes great opportunity to be missed and causes a mind to be scattered and without firm direction. Greed – Greed will cause day traders to hold onto positions too long often causing profit to turn into loss. Hope – Hope will cloud the eyes of probability. Hope is not for day traders. |

Faith is the other side of doubt @SJosephBurns @markminervini @Covel pic.twitter.com/xeh7MJCNX2

— Anirudh Sethi (@anirudhsethi71) January 31, 2016

Here is a checklist that might be useful for self-evaluation:

1) Have you experienced one or more recent large losses in markets that shook you emotionally?

2) Have you experienced a recent painful loss in your personal life that has left you feeling more vulnerable in your finances and/or your personal sense of security?

3) Have you experienced a recent threat to personal safety that shook you emotionally, such as a violent attack or a serious accident?

4) Do you find yourself emotionally “overreacting” to what should be normal trading stresses and losses? Are you experiencing significant anxiety, frustration, anger, or depressed feelings when trades don’t work out?

5) Do you find yourself “overreacting” in your trading behaviors during what should be times of normal stress? Are you freezing up and not acting on your ideas or impulsively lurching into trades after losing periods in markets?

6) Do you look back on your trading and feel confusion, shame, or puzzlement over actions that you took that run completely contrary to your plans for the day?

7) Have you tried to reduce your emotional and/or behavioral reactivity to markets, only to see the same destructive patterns return during times of stress? (more…)

Really We are Progressing………………………Very Fast !

-All traders have their own opinions.

-Yes, but traders who invent their own facts go broke

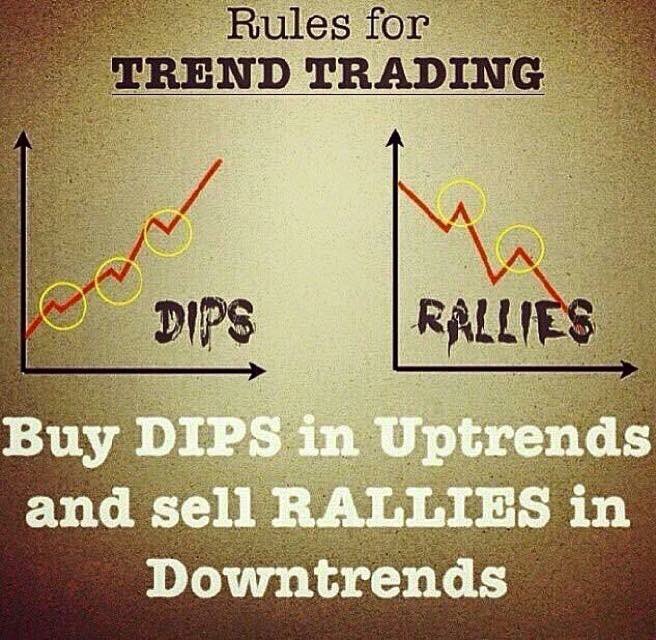

Never add too a losing trade. In adding to a losing trade you are already wrong but now become more wrong with a bigger trading size. Adding to losers makes you a counter trend trader that usually ends badly.

Your risk management rules will ultimately determine the success of your technical trading system.