Thought For A Day

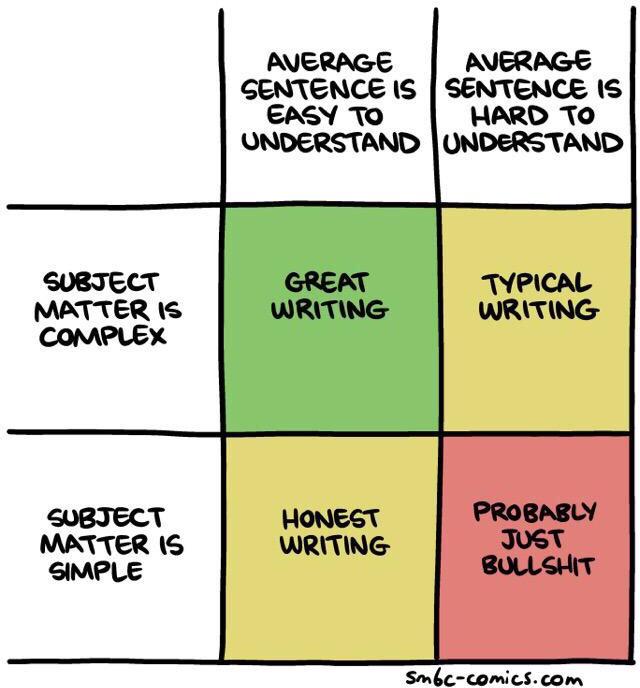

Less is more, simple is good.

That’s been one of my mantras—focus and simplicity. Simple can be harder than complex; you have to work hard to get your thinking clean to make it simple.

Your first loss is your best loss

Sometimes when you innovate, you make mistakes. It is best to admit them quickly, and get on with improving your other innovations.

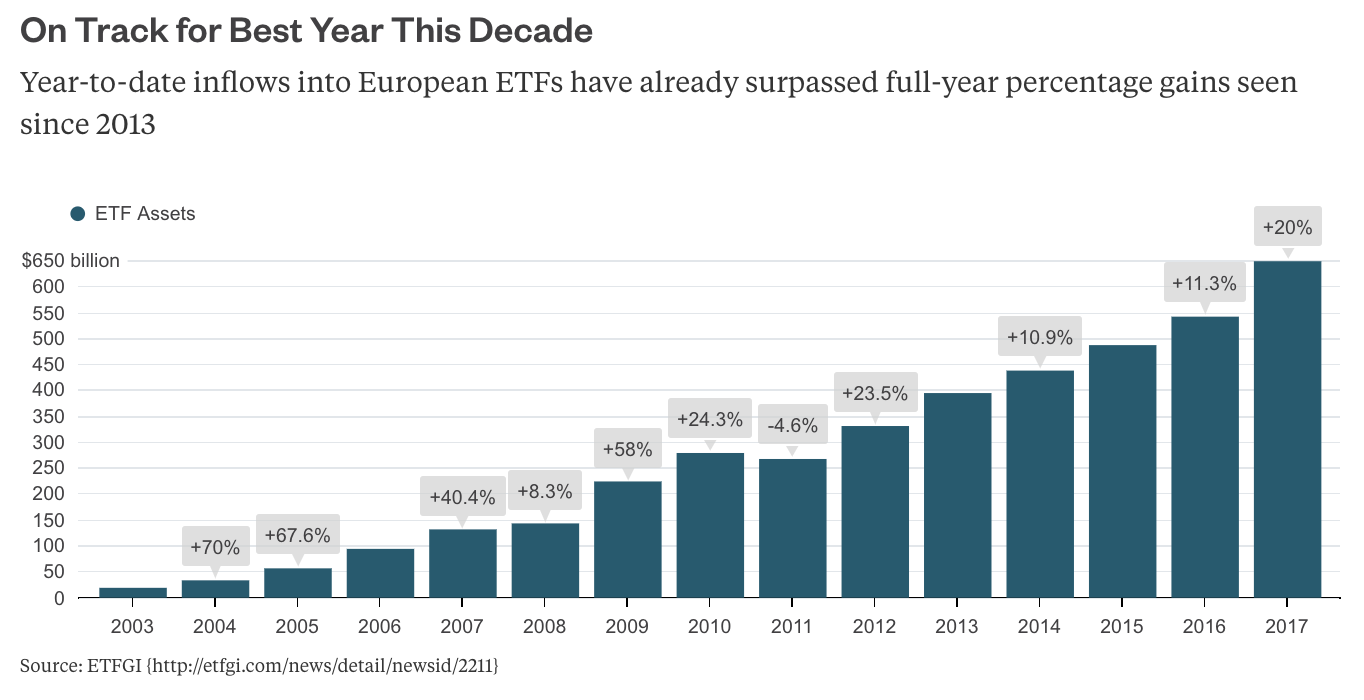

When studying the market and speculating about the future, the past is all we have.

You can’t connect the dots looking forward; you can only connect them looking backward. So you have to trust that the dots will somehow connect in your future. You have to trust in something — your gut, destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life.

No one gets paid for originality – you get paid for making money. You should be happy to take other people’s good ideas and run with them, as long as you understand exactly why you are in the trade and take full responsibility of the results. If you don’t know why you are in a trade, you won’t know when to exit. (more…)

1. Decide that you want to trade for the long haul. i.e decide that you want to trade 20 years from now.

2. Learn as much as you can. Read, and listen to the experts, but keep a healthy disbelief about everything.

3. Do not be greedy and rush to trade – take your time to learn. The market will be there with many good opportunities in the months and years ahead.

4. Develop a method for analyzing the market, that is, if A happens, B is likely to happen. Markets have many dimensions – use several analytics methods to confirm trades.

5. Develop a money management plan. Your first goal should be of long term survival, second goal, a steady growth of capital and third goal, making high profits.

6. Be aware the trader is the weakest link in the system. Learn how to avoid losses and develop your method of cutting out impulsive trades.

7. Winners think, feel and act differently than loosers. You must look within yourself and strip away the illusions and change your old way of thinking, acting and being. Change is hard, but if you want to be a successful trader, you have to work on changing your personality.

You know, once you’re down 25-30 percent, you’re in that emotional ‘web’. That you think, “Man, it’s gotta come back”, and you know, “if it just comes back a little bit, I’ll sell”, and then it doesn’t and then you’re down 40 percent. And then it comes back to only down 30 percent, and you’re saying “ok, I’m going to sell it when it comes back to down only 20 percent”, and then it goes right back down.

And then once you’re past 50 and 60 percent, you know what you say to yourself — you know the words, you’ve had it happen to you before, right? “Aaah, screw it, I don’t care if goes to zero!” Right? Isn’t that what you say once you get into ‘the web’?

So don’t let that happen to you. There’s a simple word to protect yourself from big losses in the market. Easy word — “Sell.” “Sell.”