Thought For A Day

The successful trader that you want to become is a future projection of yourself that you have to grow into. Growth implies expansion, learning, and creating a new way of expressing yourself. This is true even if you’re already a successful trader and are reading this book to become more successful. Many of the new ways in which you will learn to express yourself will be in direct conflict with ideas and beliefs you presently hold about the nature of trading. You may or may not already be aware of some of these beliefs. In any case, what you currently hold to be true about the nature of trading will argue to keep things just the way they are, in spite of your frustrations and unsatisfying results. – Mark Douglas

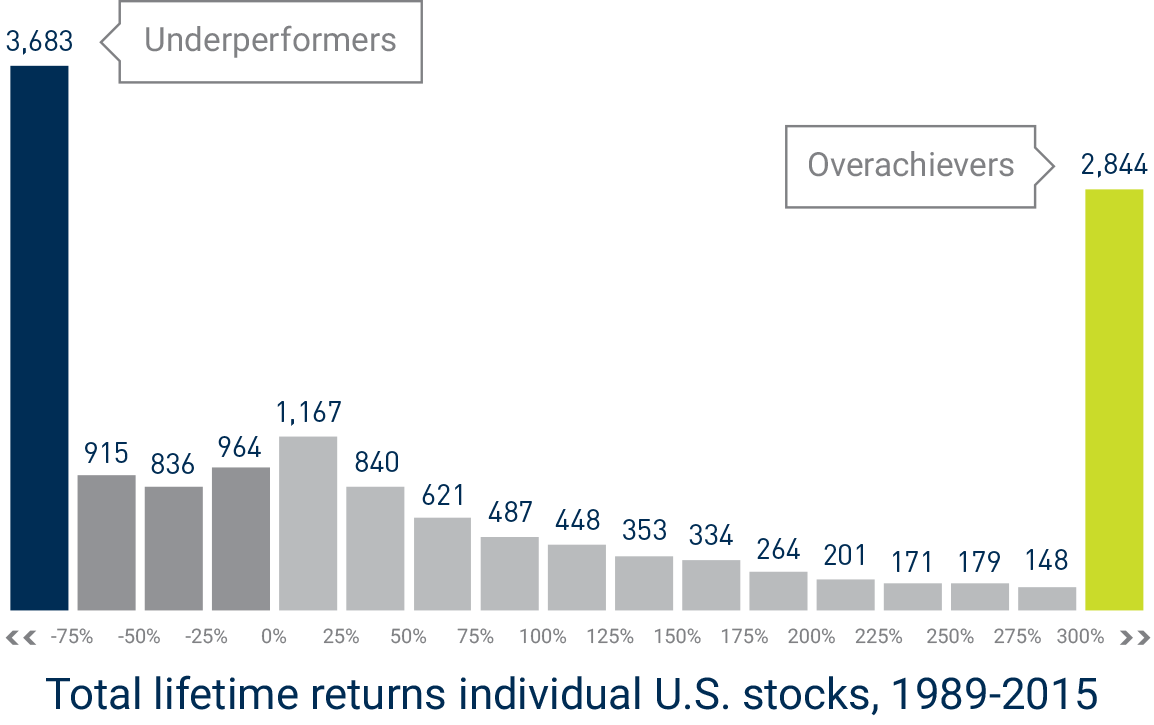

Individual US stock performance is not normally distributed.

New Traders do not understand what all the fuss is about risk management and trader psychology they do not need all that they are special.