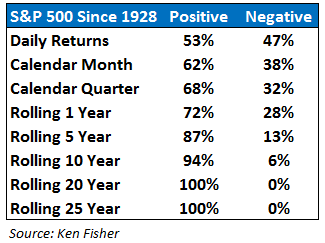

You can see that daily returns in the market are more or less a fifty-fifty proposition. Since loss aversion means that losses make us feel worse than gains make us feel better by a factor of 2:1, this means that if you check the value of your stock portfolio on a daily basis, you will feel terrible every single day.

Every good feeling you get from gains will get completely wiped out by the terrible feelings from the down days. But lengthen your time horizon and the effects of loss aversion slowly start to fade.

In More than You Know, Michael Mauboussin discusses the phenomenon of loss aversion with respect to investment decisions and time horizons:

(1) Loss Aversion – We regret losses two to two and a half times more than similar-sized gains. Since the stock price is generally the frame of reference, the probability of loss or gain is important. Naturally, the longer the holding period in a financial market the higher the probability of a positive return. (Financial markets must have a positive expected return to lure capital, since investors must forgo current consumption.)

(2) Myopia – The more frequently we evaluate our portfolios, the more likely we are to see losses and hence suffer from loss aversion. Inversely, the less frequently investors evaluate their portfolio the more likely they are to see gains.

This is what Richard Thaler has termed myopic loss aversion. It’s a combination of loss aversion with our tendency to look at the outcomes of events far too frequently.

The prescription for this bias is to either (a) follow along so closely that you become immune to the daily gyrations or (b) stop looking at your portfolio’s market value so much (quarterly probably works for most people).

Kahneman describes in his research that professional risk takers in the financial markets are more tolerant of losses than non-professionals because they become accustomed to the daily fluctuations. Yet even the pros can have a difficult time focusing on the correct time horizon with an increased focus on quarterly and annual results against benchmarks and peers in the industry. It takes takes time and experience in the markets to build up your tolerance for the correct time horizon.