Pizza Fork -Great Idea

Warren Buffett released his annual letter (PDF file, Adobe Acrobat required) to Berkshire Hathaway (NYSE: BRK-B ) on Saturday. If you have the time, it’s worth reading the whole thing. If not, here are 25 important quotes.

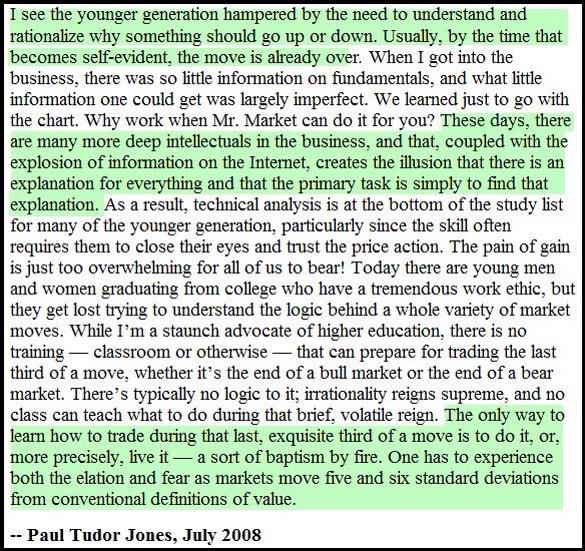

On value: “The logic is simple: If you are going to be a netbuyer of stocks in the future, either directly with your own money or indirectly (through your ownership of a company that is repurchasing shares), you are hurt when stocks rise. You benefit when stocks swoon. Emotions, however, too often complicate the matter: Most people, including those who will be net buyers in the future, take comfort in seeing stock prices advance. These shareholders resemble a commuter who rejoices after the price of gas increases, simply because his tank contains a day’s supply.”

On market moves: “Here a confession is in order: In my early days I, too, rejoiced when the market rose. Then I read Chapter Eight of Ben Graham’s The Intelligent Investor, the chapter dealing with how investors should view fluctuations in stock prices. Immediately the scales fell from my eyes, and low prices became my friend. Picking up that book was one of the luckiest moments in my life.”

On foreclosures: “A largely unnoted fact: Large numbers of people who have ‘lost’ their house through foreclosure have actually realized a profit because they carried out refinancings earlier that gave them cash in excess of their cost. In these cases, the evicted homeowner was the winner, and the victim was the lender.”

On share buybacks: “The first law of capital allocation — whether the money is slated for acquisitions or share repurchases — is that what is smart at one price is dumb at another.”

On predicting turnarounds: “Last year, I told you that ‘a housing recovery will probably begin within a year or so.’ I was dead wrong.” (more…)

Here are 10 prerequisites that I believe are important: