Forbes on 2016 hedge fund performance

The average hedge fund returned 5.6% last year compared to 12% for the S&P 500 but that doesn’t mean the managers of the SPY ETF earned the most.

Forbes put together a list of the hedge fund managers who earned the most in 2016 and the results probably won’t surprise you. The familiar names are there and the paychecks are out-of-sight.

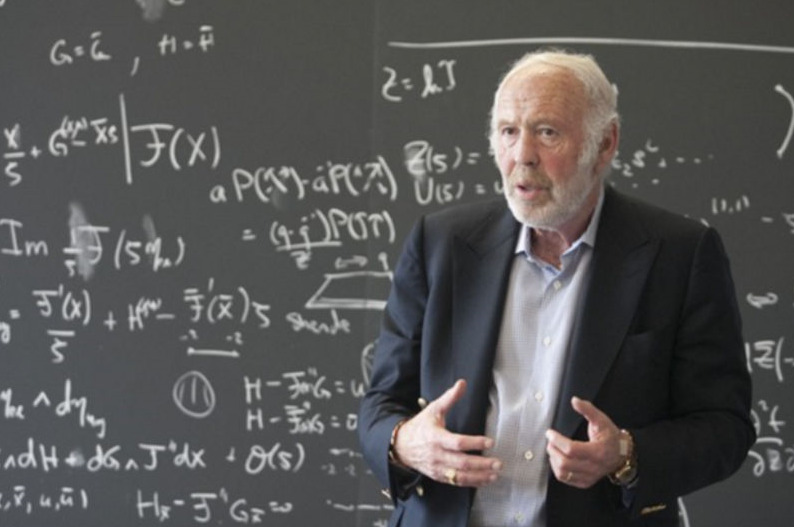

- James Simons – Renaissance Technologies $1.5 billion

- Michael Platt – BlueCrest $1.5 billion

- Ray Dalio – Bridgewater $1.4 billion

- David Tepper – Appaloosa $750 million

- Ken Griffith – Citadel $500 million

- Dan Loeb – Third Point $400 million

- Paul Singer – Elliott $400 million

- David Shaw – DE Shaw $400 million

- John Overdeck – Two Sigman $375 million

- David Sieger – Two Sigman $375 million

- Michael Hintze CQS $325 million

- San Druckenmillier – Duquesne $300 million

- Brett Ichan – Ichan Capital $280 million

Platt has a series of poor years then turned BlueCrest into a family office and earned 50% last year.

The irritating ones are Tepper, Griffith and Loeb, who all underperformed the S&P 500. Tepper returned 20% of AUM to clients at the end of the year and he’s returned $2B to clients for 6 straight years.

Bloomberg also pegs Ray Dalio’s wealth at $14.1B but that strikes me as low. He’s made a lot of money for a lot of years. That’s gotta compound.

The final big story is quants, who are slowly taking over, led by guys like Simons (shown above) and David Shaw.