Good old days…

Knowledge is the key to winning and gain in the Stock, Commodity and Futures, and Forex markets.

Trading on trust is a fools game.

Do not attempt to place a trade. If the market triggers the exit signal you had predefined, without emotion follow it immediately. Many traders enter the market with more ‘hope’ than understanding. You have to take complete charge of your trading. The best way to do this is to get knowledge and all of the information you can about the market you wish to trade and then form a plan.

You plan should include not only the entry parameters but also the exit parameters. The departure is the most important. Your trade should be protected. Failure to admit that you’re wrong when the trade is moving south is one of the reasons.

Learn to trade on knowledge. There isn’t any need for fear and hope that get in your way. When you’re able to trade on knowledge, you’ll have the ability to react to trading opportunities when it’s time to do 31 and to exit out.

Your best friend needs to be the Stop Loss order. (more…)

We are not this bad, but probably worse

Richard Donchian is known as the father of trend following. His original trend following ideas form the basis for all trend following success that has followed. Below in an excerpt from an article written in 1995 about his 5 and 20 day moving average system:

Title: Donchian’s five- and 20-day moving averages.

Author: Richard Donchian

Publication: Futures (Cedar Falls, Iowa) (Magazine/Journal)

Date: November 15, 1995

Publisher: Oster Communications, Inc.

Volume: v24 Issue: n13 Page: p32: ISSN: 0746-2468

………………………………………………………………………………….

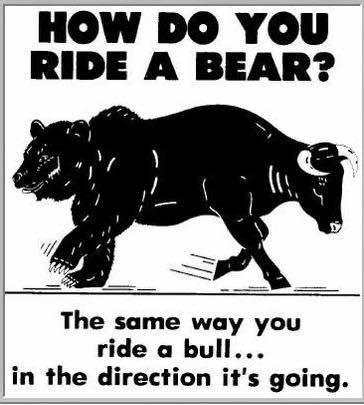

On Wall Street there are two conflicting adages:

1. “You’ll never go broke taking a profit.”

2. “Cut your losses short and let your profits ride.”

Experience has shown that in commodities trading, the first of these “old saws” is dangerous and misleading, while the second may well be regarded as the one lesson the inexperienced commodity trader should learn if he wishes to have a better-than-even chance to come out ahead.

Every well-designed, trend-following, loss-limiting method for trading in futures (or stocks) rests on the basic principle that a trend in either direction, once established, has a strong tendency to persist, at least for a time. Among the many trend-following approaches now in use are the Dow Theory, point-and-figure chart techniques, swing methods (other than the Dow Theory), trendline methods, weekly-rule methods and moving average methods. We’ll focus on moving average methods and, in particular, the comparatively simple five- and 20-day moving average method.

The Method (more…)