Archives of “January 5, 2019” day

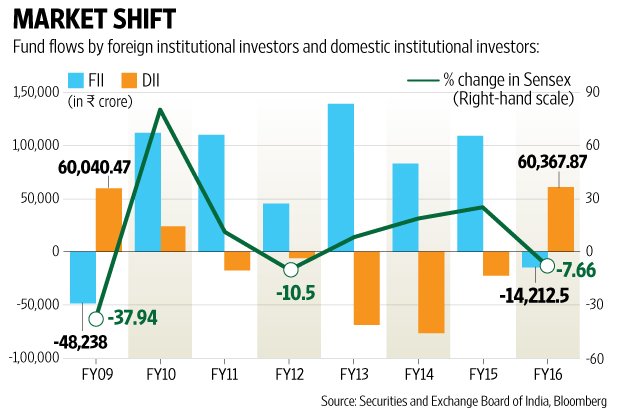

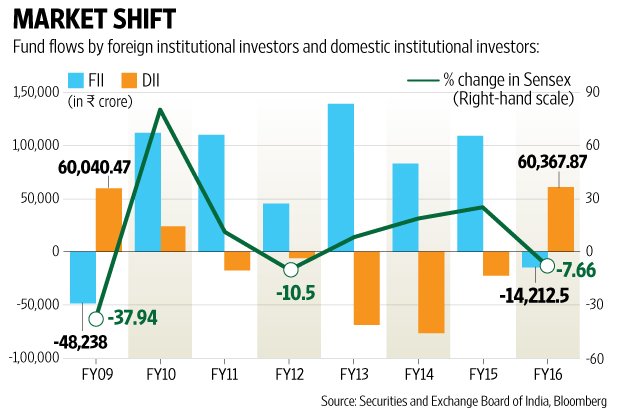

rssFII outflows at Rs14k cr so far this fiscal year, the highest in the last seven years

Buffett quote on EBITDA.-Really Great !

“We’ll (Berkshire Hathaway [BRK.A][BRK.B]) never buy a company when the managers talk about EBITDA. There are more frauds talking about EBITDA. That term has never appeared in the annual reports of companies like Walmart (WMT), General Electric (GE) or Microsoft(MSFT). The fraudsters are trying to con you or they’re trying to con themselves. Interest and taxes are real expenses. Depreciation is the worst kind of expense: You buy an asset first and then pay a deduction, and you don’t get the tax benefit until you start making money. We have found that many of the crooks look like crooks. They are usually people that tell you things that are too good to be true. They have a smell about them.”

You wanna be right? Or make money?

We all have ego. Everyone likes to be right, likes to be seen as intelligent, and likes to be a winner. We all hate to lose, and we hate to be wrong; traders, as a group, tend to be more competitive than the average person. These personality traits are part of what allows a trader to face the market every day—a person without exceptional self-confidence would not be able to operate in the market environment.

Like so many things, ego is both a strength and a weakness for traders. When it goes awry, things go badly wrong. Excessive ego can lead traders to the point where they are fighting the market, or where they hold a position at a significant loss because they are convinced the market is wrong. It is not possible to make consistent money fighting the market, so ego must be subjugated to the realities of the marketplace.

One of the big problems is that, for many traders, the need to be right is at least as strong as the drive to make money—many traders find that the pain of being wrong is greater than the pain of losing money. You often have minutes or seconds to evaluate a market and make a snap decision. You know you are making a decision without all the important information, so it would be logical if it were easy to let go of that decision once it was made. (more…)

"If you don’t have an edge and can’t articulate it, you probably aren’t going to outperform."

11 Points -Will Show U That U Are Not Trader -U Are A Gambler

1. IF you enter trades without a clear trading plan, you just might be a gambler.

2. IF you trade just to be trading, you just might be a gambler.

3. IF you’re bored and enter a trade, you just might be a gambler.

4. IF you look at potential profit before assessing potential loses, you just might be a gambler.

5. IF you have no impulse control, you just might be a gambler.

6. IF you have no methodology, you just might be a gambler.

7. IF you rely on others for your trading decisions, you just might be a gambler.

8. IF you do not take full responsibility for your trading outcomes, you just might be a gambler.

9. IF you increase your risk due to losses, you just might be a gambler.

10. IF you do not use stop losses or do not adhere to them, you just might be a gambler.

And my all time favorite

11. IF you get an adrenaline rush when your entering trades, you just might be a gambler.

95% Traders Don't Understand this….

"Economics" Explained

Trading Profits

Michael Shermer on Self-Deception

Fantastic Speech for Traders to watch especially Technical Traders. See what you want or what is real? What is real?