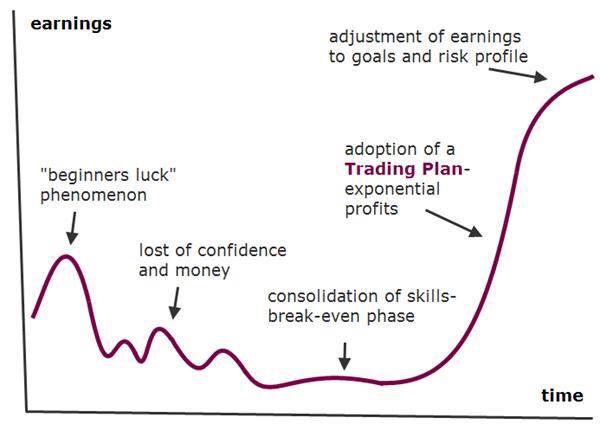

Learning to trade is a process

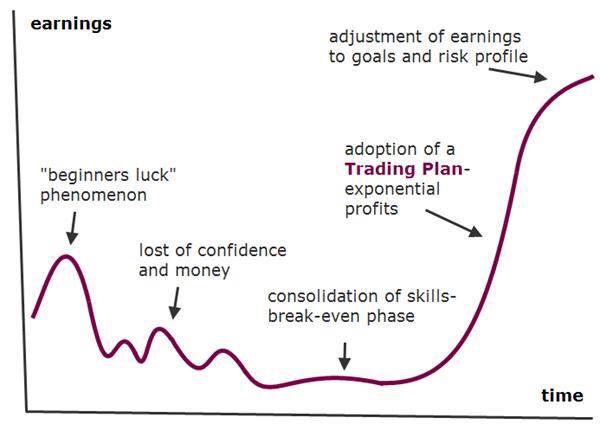

I’m sure most of you have heard this before. This one sounds easy too, until you start losing money. Then fear creeps in and you begin altering your plan, assuming you had one in the first place. All of a sudden, you begin to alter your stop loss lower in order to allow your position to “recover”. It usually results in good money wasting away in a weakening stock. This is a serious trading crime as you violate the theory of keeping losses to a minimum. But that’s not the only emotional disorder we suffer. Greed can be even more powerful and disastrous. Greed results in many problems, but there are two problems that immediately come to mind – position sizing and failing to execute and take profits when your original plan works perfectly. Incorrect position sizing can occur for a number of reasons. One is trying to “catch up” after a loss. You figure if you play twice as many shares as appropriate, then you can recover prior losses quicker. This type of thinking may work on occasion, but many of us have felt the despair as losses only deepen. Another example of incorrect position sizing occurs after a trader has correctly called several trades in a row. Overconfidence breeds greed. It’s not easy, but we must remain grounded. Those who can develop and execute a plan with little interference from fear and greed will produce better results over the long-term.

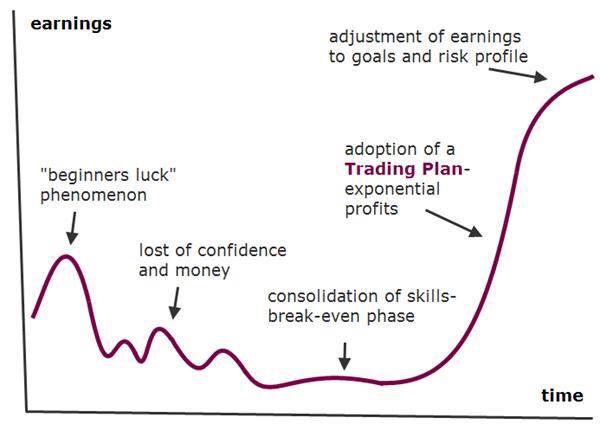

I’m sure most of you have heard this before. This one sounds easy too, until you start losing money. Then fear creeps in and you begin altering your plan, assuming you had one in the first place. All of a sudden, you begin to alter your stop loss lower in order to allow your position to “recover”. It usually results in good money wasting away in a weakening stock. This is a serious trading crime as you violate the theory of keeping losses to a minimum. But that’s not the only emotional disorder we suffer. Greed can be even more powerful and disastrous. Greed results in many problems, but there are two problems that immediately come to mind – position sizing and failing to execute and take profits when your original plan works perfectly. Incorrect position sizing can occur for a number of reasons. One is trying to “catch up” after a loss. You figure if you play twice as many shares as appropriate, then you can recover prior losses quicker. This type of thinking may work on occasion, but many of us have felt the despair as losses only deepen. Another example of incorrect position sizing occurs after a trader has correctly called several trades in a row. Overconfidence breeds greed. It’s not easy, but we must remain grounded. Those who can develop and execute a plan with little interference from fear and greed will produce better results over the long-term.