Archives of “January 4, 2019” day

rss8 MISTAKES GREAT TRADERS NEVER MAKE

- Try to close a position but accidentally DOUBLE it instead.

- Put a swing trade on and realize AFTER the close that earnings are coming soon. Like the next morning. Before the market opens.

- Buy the CALLS in a stock that is breaking out at what they think is a bargain price, only to find out later that they actually bought the PUTS.

- Constantly drive by their ex girlfriend’s house to see if she is dating that idiot biker guy with the tats who will never love her the way they would….

- Knock off early for the day to go rollerblading, sure that they put a hard stop in on their position before they left (but didn’t).

- Continuously hit the “submit” button on their trading platform when their order “hangs up” only to find out that they bought their position eight times.

- Listen to the whole “Best of WHAM” album online, unaware that Spotify is auto-posting that info to their Facebook timeline.

- Think they have a “one cancels other” limit and stop in place and take a long lunch after their position hits it’s profit target. Then come back later in the day only to learn that price reversed, hit their stop (making them net short), and then rallied.

Motivation For You

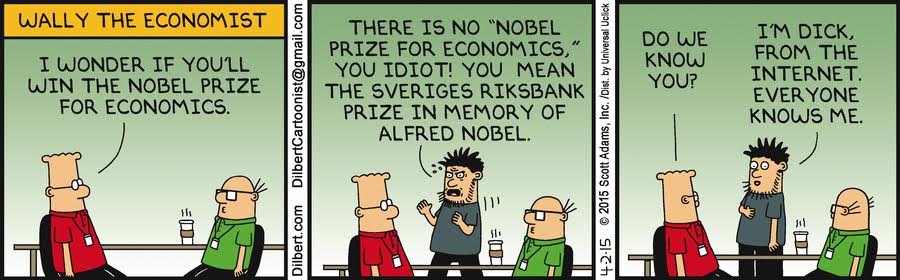

Nobel Prize for Economics

6 Mistakes done by Traders

1. Failure to have a trading plan in place before a trade is executed. A trader with no specific plan of action in place upon entry into a futures trade does not know, among other things, when or where he or she will exit the trade, or about how much money may be made or lost. Traders with no pre-determined trading plan are flying by the seat of their pants, and that’s usually a recipe for a “crash and burn.”

1. Failure to have a trading plan in place before a trade is executed. A trader with no specific plan of action in place upon entry into a futures trade does not know, among other things, when or where he or she will exit the trade, or about how much money may be made or lost. Traders with no pre-determined trading plan are flying by the seat of their pants, and that’s usually a recipe for a “crash and burn.”

2.Expectations that are too high, too soon. Beginning futures traders that expect to quit their “day job” and make a good living trading futures in their first few years of trading are usually disappointed. You don’t become a successful doctor or lawyer or business owner in the first couple years of the practice. It takes hard work and perseverance to achieve success in any field of endeavor–and trading futures is no different. Futures trading is not the easy, “get-rich-quick” scheme that a few unsavory characters make it out to be.

3.Failure to use protective stops. Using protective buy stops or sell stops upon entering a trade provide a trader with a good idea of about how much money he or she is risking on that particular trade, should it turn out to be a loser. Protective stops are a good money-management tool, but are not perfect. There are no perfect money-management tools in futures trading.

4.Lack of “patience” and “discipline.” While these two virtues are over-worked and very often mentioned when determining what unsuccessful traders lack, not many will argue with their merits. Indeed. Don’t trade just for the sake of trading or just because you haven’t traded for a while. Let those very good trading “set-ups” come to you, and then act upon them in a prudent way. The market will do what the market wants to do–and nobody can force the market’s hand.

5.Trading against the trend–or trying to pick tops and bottoms in markets. It’s human nature to want to buy low and sell high (or sell high and buy low for short-side traders). Unfortunately, that’s not at all a proven means of making profits in futures trading. Top pickers and bottom-pickers usually are trading against the trend, which is a major mistake.

6.Letting losing positions ride too long. Most successful traders will not sit on a losing position very long at all. They’ll set a tight protective stop, and if it s***they’ll take their losses (usually minimal) and then move on to the next potential trading set up. Traders who sit on a losing trade, “hoping” that the market will soon turn around in their favor, are usually doomed.

If you want new ideas, read old books.

Banker got caught looking at nude women on national tv

The announcement that the Reserve Bank had put interest rate rises on hold attracted even more attention during a live Seven News broadcast yesterday when a Macquarie Bank staffer was seen viewing pictures of nude women on his computer.

While broker Martin Lakos was updating Seven newsreader Chris Bath on the rates news, a colleague in the background was seen opening three pictures on his screen.

The bank released a statement last night, saying: “Macquarie has strict policies in place surrounding the use of technology and the issue arising from today’s live cross on Seven News is being dealt with internally.”

Great cartoon that hits home for people selling into the panic…at some point the pain will subside & we'll rally

What It Means To Live A Rich life