Market Rewards The Rich …..??

A Trading Plan only has value if it is utilized as intended. It does you no good to have one if you do not stick to it. We all know this, yet traders find reasons to deviate from their Plan, almost always with negative consequences. Why? There are several reasons.

A Trading Plan only has value if it is utilized as intended. It does you no good to have one if you do not stick to it. We all know this, yet traders find reasons to deviate from their Plan, almost always with negative consequences. Why? There are several reasons.

These are not the only reasons traders fail to stick to Trading Plans, but they do represent a large portion of the explanations for it happening. The point is that a Trading Plan is little more than a document if not put in to practice.

I hope this sequence has been helpful to you. Definitely feel free to drop me a question or leave a comment with your thought, experience, or ideas on the subject.

Imagine the elation of having four aces in a game of poker. Your hand is essentially unbeatable. The only way to lose is if someone has a royal flush. And what are the odds of that, right?

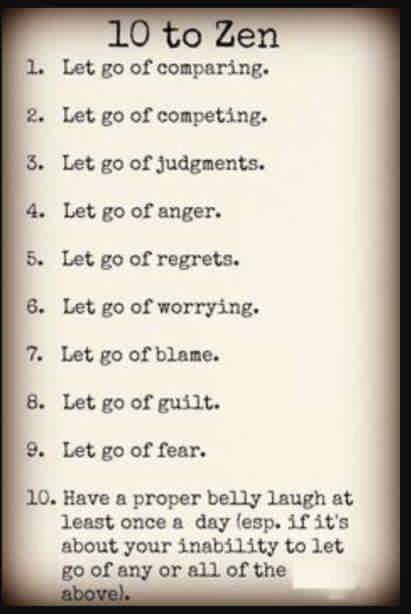

Human emotion is both the source of opportunity in trading and the greatest challenge. Trade with an edge, manage risk, be consistent, and keep it simple. Good trading is not about being right, it’s about trading right. Trading with an edge is what separates the professionals from amateurs. Edges are found in the places between the battleground between buyers and sellers. Mature understanding of and respect of risk is the hallmark of the best traders. Ruin is the risk you should be concerned with the most. Don’t spent all your time admiring the fancy tools in the magazine. Keep it simple. Simple time-tested methods that are well executed will beat fancy complicated method every time. Trading with poor methods is like learning to juggle while standing in a rowboat during the storm. Sure, it can be done, but it is much easier to juggle when one is standing on a solid ground. Trading is not a sprint; it is boxing. The market will beat you up, screw with your head, and do anything it can to defeat you. But when the bell sounds at the end of the twelfth round, you must be standing in the ring in order to win. The market does not care how you feel. It will not prop up your ego or console you when you are down. I always say that you could publish my trading rules in the newspaper and no one will follow them. |