Nasdaq 1.9% from the all time high

The major indices are all closing higher and near highs for the day/week. The S&P and Dow industrial average both closed at record highs. The NASDAQ index is just under 2% away from the all time high.

The major indices also closed higher for the week with the NASDAQ index leading the charge at up 3.12%.

The final numbers are showing:

- S&P index +31.58 points or 0.77% at 4128.75. The high reached 4129.48 which is the all time high for the pair.

- Nasdaq +70.878 points or 0.51% at 13900.18. The all-time high price is at 14175.12. The index is 275 points from the all time high putting the index about 1.9% from the all time high

- Dow rose 298.68 points or 0.89% at 33801.25. That was just off the high for the week at 33810.87 (which is also the all time high).

For the week, the Nasdaq led. The Dow lagged but was still higher. The Russell 2000 index of small cap stocks fell -0.56%. The Nasdaq was up 3.12%.

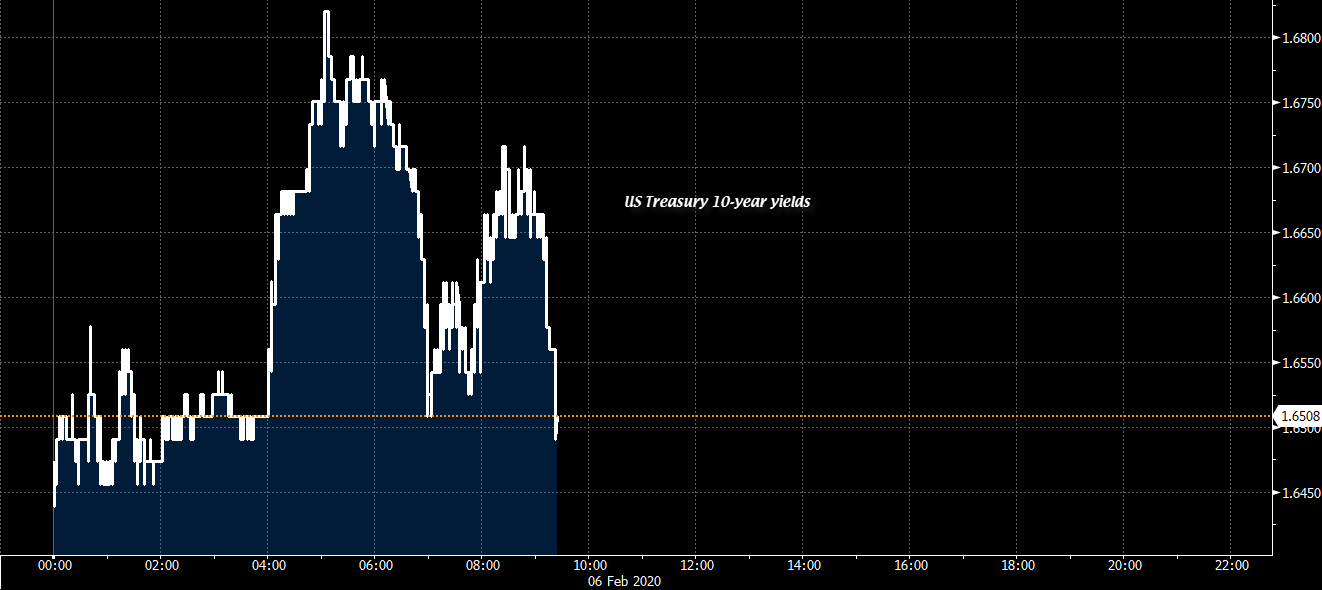

Helping in the US was lower /steady rates despite the rise in rates today. Below are the changes for the week. The largest decline was in the 5 year sector with a decline of 11.59 basis points. The 10 year is down -6.49 basis points (rates are up about 4 bps today). Next week the US treasury will be auctioning of reopened 3, 10 and 30 year issues.