Intro

- Reaching the level of success they desire as traders will require them to make at least some, if not many, changes in the way they perceive market action.

- The markets have absolutely no power or control over you, no expectation of your behavior, and no regard for your welfare.

- There are only a few traders who have come to the realization that they alone are completely responsible for the outcome of their actions. Even fewer are those who have accept the psychological implications of that realization and know what to do about it.

- The nature of the markets made it easy no to have to confront anything that otherwise might be perceived as a problem because the next trade always had the possibility of making everything else in one’s life seem irrelevant.

- I CREATED MY LOSSES INSTEAD OF AVOIDING THEM SIMPLY BECAUSE I WAS TRYING TO AVOID THEM.

- Unsuccessful Trading Behaviors

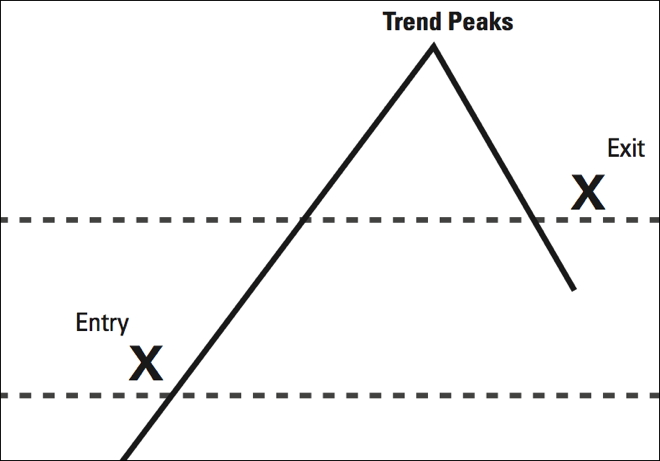

- Refusing to define a loss.

- Not liquidating a losing trade, even after you have acknowledged the trade’s potential is greatly diminished.

- Getting locked into a specific opinion or belief about market direction. I.E. “I’m right, the market is wrong.”

- Focusing on price and the money

- Revenge-trading to get back at the market from what it took from you.

- Not reversing your position even when you clearly sense a change in market direction

- Not following the rules of the trading system.

- Planning for a move or feeling one building, then not trading it.

- Not acting on your instincts or intuition

- Establishing a consistent patter of trading success over a period of time, and then giving your winning back to the market in one or two trades.

No trader can or should play the market all the time. There will be many times when you should be out of the market, sitting in cash waiting patiently for the perfect trade…. ” – Jesse Livermore

No trader can or should play the market all the time. There will be many times when you should be out of the market, sitting in cash waiting patiently for the perfect trade…. ” – Jesse Livermore