German DAX, -3.1%. France’s CAC down -3.8%

The good news for the European stock markets is that they are close for the day. Each of the major indices had sharp declines. Sometimes closing feels good. The provisional closes are showing:

- German DAX, -3.1%

- France’s CAC, -3.2%

- UK’s FTSE 100, -3.5%

- Spain’s Ibex, -3.8%

- Italy’s FTSE MIB, -2.6%

To give an idea of the year to date performance of the major indices :

- Germany, -6.65%

- France, -7.6%

- UK FTSE 100, -9.7%

- Spain’s Ibex, -5.6%

- Italy’s FTSE MIB, -2.8%

Comparing to the US market year-to-date:

- Dow industrial average, -7.6%

- S&P index, -5.63%

- NASDAQ index -2.42%

In Asia the year-to-date’s are showing:

- Japan’s Nikkei, -7.22%

- Hong Kong’s Hang Seng index, -5.01%

- Australia S&P/ASX 200 -0.39%

- China’s Shanghai index -1.93%

In other markets as London/European traders look to exit:

- gold is trading up $12.80 or 0.78% at $1653.72

- WTI crude oil futures are trading down $-2.08 or -4.25% of $46.66

In the US stock market the snapshot of the major indices currently shows:

- S&P index -69.3 points or -2.22% of 3047.44

- NASDAQ index -221.2 points or -2.46% at 8759.96

- Dow -578 points or at -2.17% at 26371

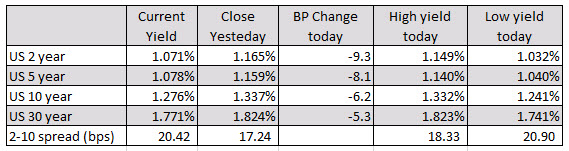

In the US debt market yields are sharply lower with the 2 year down -8.9 basis points. The 10 year is down -5.8 basis points.. The 2 – 10 yield spread has widened to 20.42 basis points from 17.24 basis points yesterday on increasing expectations that the FOMC will be forced to lower rates

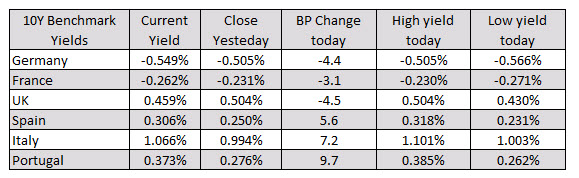

In the European debt market, yields are mixed with German, France, and UK yields lower while Spain, Italy, Portugal yields are higher (flight to safety and out of the riskier countries):

In the forex market, the EUR is the strongest (and got stronger in the session). Germany did say earlier today that they would contemplate more fiscal stimulus and technicals improved. The EURUSD did run into resistance against the 1.100 level however.

The weakest currency is the CAD as oil continues to get hammered. The GBP and USD are also weaker on the day: