1/ The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professional.

2/ In this business a man has to think of both theory and practice. A speculator must not be merely a student, he must be both a student and a speculator.

3/ When you know what not to do in order not to lose money, you begin to learn what to do in order to win.

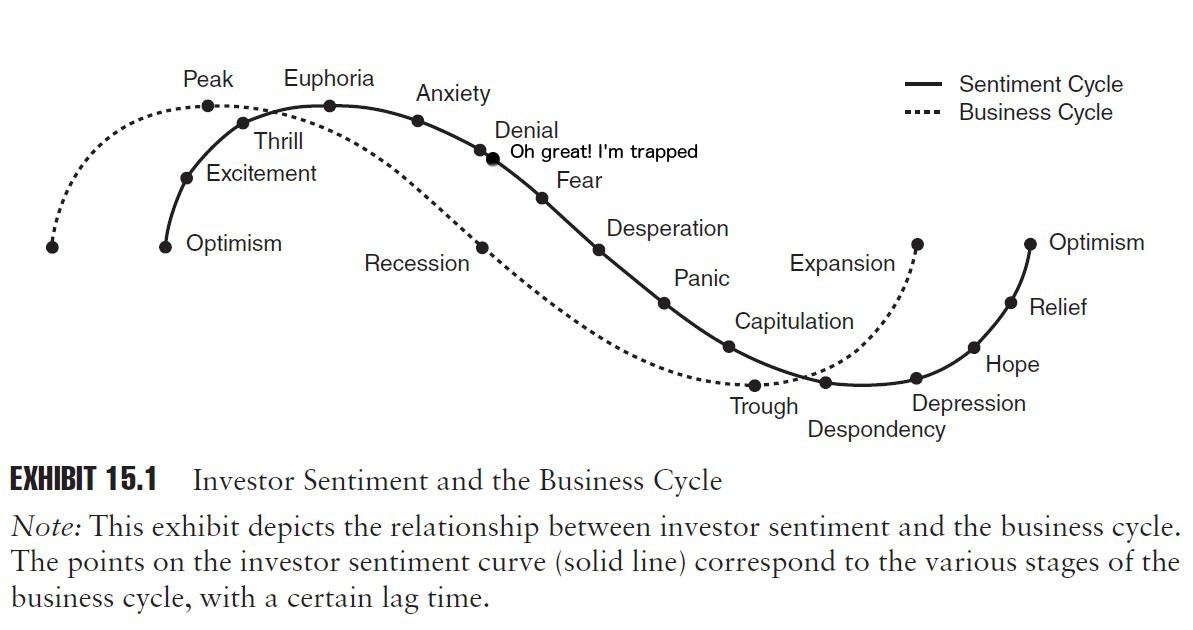

4/ Not even a world war can keep the stock market from being a bull market when conditions are bullish, or a bear market when conditions are bearish. And all a man needs to know to make money is to appraise conditions.

5/ They say you never grow poor taking profits. No, you don’t. But neither do you grow rich taking a four-point profit in a bull market.

6/ When you are as old as I am and you’ve been through as many booms and panics as I have, you’ll know that to lose your position is something nobody can afford.

7/ The big money was not in the individual fluctuations but in the main movements— that is, not in reading the tape but in sizing up the entire market and its trend. It never was my thinking that made the big money for me. It always was my sitting.

8/ One of the most helpful things that anybody can learn is to give up trying to catch the last eighth—or the first. These two are the most expensive eighths in the world.

9/ The average man doesn’t wish to be told that it is a bull or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn’t even wish to have to think.

10/ I don’t buy long stock on a scale down, I buy on a scale-up. Remember that stocks are never too high for you to begin buying or too low to begin selling.

11/ When I am long of stocks it is because my reading of conditions has made me bullish. But you find many people, reputed to be intelligent, who are bullish because they have stocks. I do not allow my possessions—or my prepossessions either—to do any thinking for me

12/ The trend has been established before the news is published, and in bull markets bear items are ignored and bull news exaggerated, and vice versa.

13/ A speculator must concern himself with making money out of the market and not with insisting that the tape must agree with him.

14/ A man can excuse his mistakes only by capitalizing them to his subsequent profit.

15/ Of all speculative blunders, there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit.

1. Follow the Rule of Three. The rule of three simply states that a trade will not be made unless you can carefully articulate three reasons for doing so. This eliminates trading from an indicator alone.

1. Follow the Rule of Three. The rule of three simply states that a trade will not be made unless you can carefully articulate three reasons for doing so. This eliminates trading from an indicator alone.