How much time do you spend each week practicing trading-specific skills, obtaining feedback about your performance, and consciously working on improving your performance?

Do your trading results reveal a positively sloped learning curve? What specific skills have you learned–and do you employ–over the past year that have made you a better trader?

Archives of “Learning” tag

rss7 -Market Wisdom

- First Things First

You sure you really want to trade ? It is common for people who think they want to trade to discover that they really don’t. - Examine Your Motives

Why do you really want to trade ? Did you say excitement ? Then don’t waste your money in market, you might be better off riding a roller coaster or taking up hand gliding.

The market is a stern master. You need to do almost everything right to win. If parts of you are pulling in opposite directions, the game is lost before you start. - Match The Trading Method To Your Personality

It is critical to choose a method that is consistent with your your own personality and conflict level. - It Is Absolutely Necessary To Have An Edge

You cant win without an edge, even with the world’s greatest discipline and money management skills. If you don’t have an edge, all that money management and discipline will do for you is to guarantee that you will gradually bleed to death. Incidentally, if you don’t know what your edge is, you don’t have one. - Derive A Method

To have an edge, you must have a method. The type of method is not important, but having one is critical-and, of course, the method must have an edge. - Developing A Method Is Hard Work

Shortcuts rarely lead to trading success. Developing your own approach requires research, observation, and thought. Expect the process to take lots of time and hard work. Expect many dead ends and multiple failures before you find a successful trading approach that is right for you. Remember that you are playing against tens of thousands of professionals. Why should you be any better ? If it were that easy, there would be a lot more millionaire traders. - Skill Versus Hard Work

The general rule is that exceptional performance requires both natural talent and hard work to realize its potential. If the innate skill is lacking, hard work may provide proficiency, but not excellence.

Virtually anyone can become a net profitable trader, but only a few have the inborn talent to become supertraders ! For this reason, it may be possible to teach trading success, but only upto a point. Be realistic in your goals.

The Power of Habit-Book Review

A new year is right around the corner, and with it will come the usual host of resolutions—sadly, rarely kept. To be more precise, more than 40% of Americans make New Year’s resolutions and just 8% achieve their goals. Sometimes the goals they set are too daunting, sometimes too vague. And, perhaps the biggest problem with the whole resolution business is that people focus on goals rather than processes.

A new year is right around the corner, and with it will come the usual host of resolutions—sadly, rarely kept. To be more precise, more than 40% of Americans make New Year’s resolutions and just 8% achieve their goals. Sometimes the goals they set are too daunting, sometimes too vague. And, perhaps the biggest problem with the whole resolution business is that people focus on goals rather than processes.

In 2012 Charles Duhigg, a Pulitzer Prize-winning journalist for The New York Times, wrote The Power of Habit, which spent 62 weeks on the paper’s best seller lists and was named one of the best books of the year by The Wall Street Journal and theFinancial Times. It is now being reissued with an afterword by the author.

I reviewed the book when it first came out and thought I would write a new post now that I have the reissued edition. But then I reread my original piece and decided that I probably couldn’t improve on it. So instead I’ll republish it here.

* * *

“All our life, so far as it has definite form, is but a mass of habits,” William James wrote in 1892. Well, that might be a bit of an overstatement: a researcher in 2006 knocked that “mass” down to “over 40 percent.” Whatever the percentage, we are creatures of habit. In The Power of Habit: Why We Do What We Do and How to Change It (Random House, 2012) Charles Duhigg explores the work that neurologists, psychologists, sociologists, and marketers have done over the past two decades to figure out how habits work and how they change. It’s a fascinating tale. (more…)

Commitment

Becoming a successful investor/trader requires hard work. You must get to know yourself intimately because you are the source of your trading performance. You must develop a business plan to guide your trading. You must develop and test three or four strategies that fit within the big picture (as you see it) and then become part of your business plan. You must do your homework every evening. You must follow certain disciplines during the day that we call the ten tasks of trading. And all of this requires a lot of time and energy. And in my experience, it is only the people who are really committed who will put in the work necessary to become successful.

Ten traits of successful people

- Positive thinking. They think of success, not failure, regardless of how difficult the situation.

- Makes conscious decisions regarding what they’re after, and draw out specific plans to reach their goals.

- Action-oriented.

- Never stop learning.

- Being persistent and hard working.

- Analyze details and seek out all the facts.

- Focused, doesn’t let other people or things distract them from their goals. Learns to save money.

- Being innovative.

- Communicate with others effectively

- Integrity.

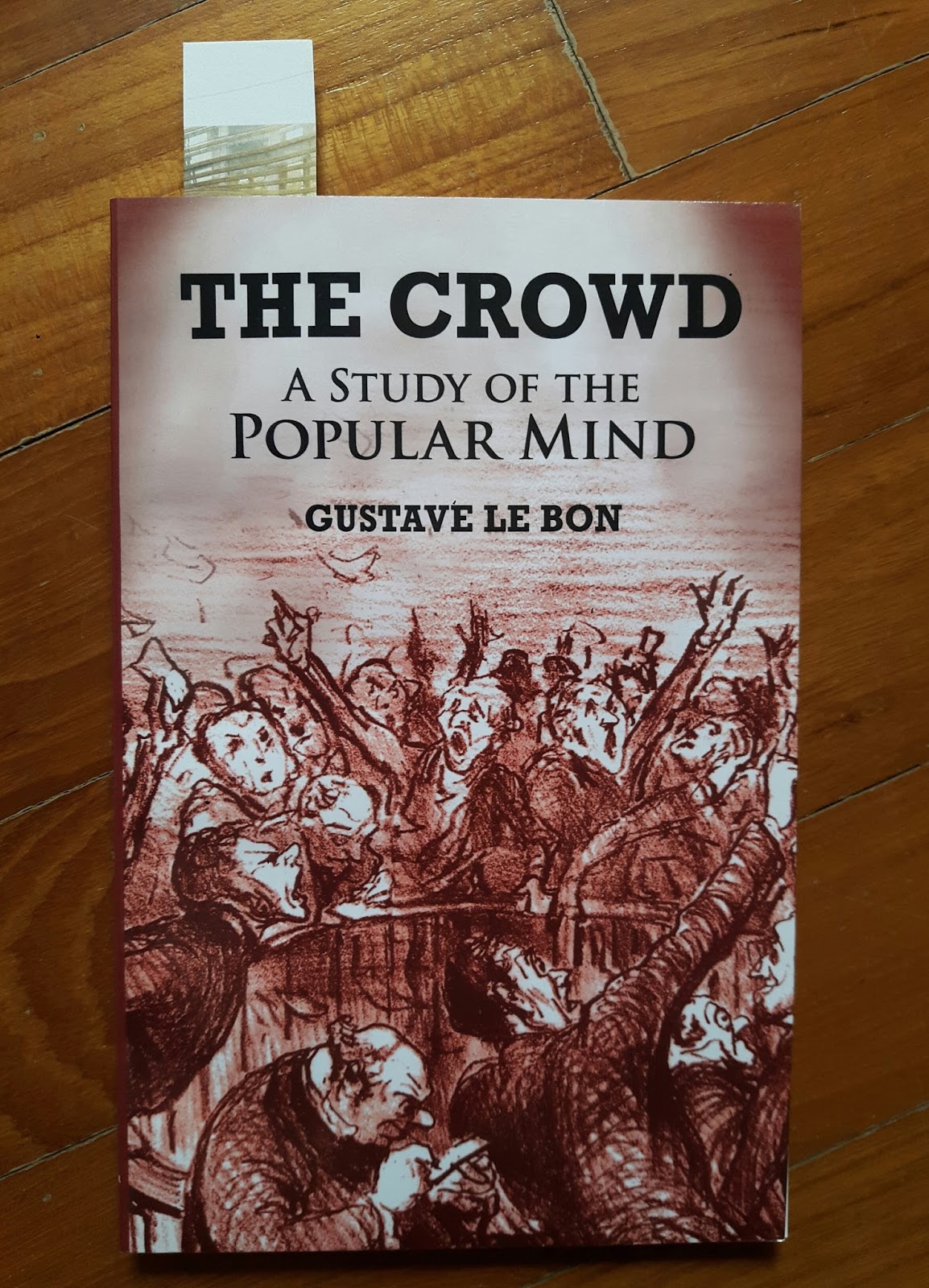

The Crowd: A Study of the Popular Mind -5 Lessons from Gustave Le Bon’s

Lesson #1: Crowds Make the Impossible Possible

The improbable does not exist for a crowd, and it is necessary to bear this circumstance well in mind to understand the facility with which are created and propagated the most improbable legends and stories.

Crowds, being incapable both of reflection and of reasoning, are devoid of the notion of improbability; and it is to be noted that in a general way it is the most improbable things that are the most striking.

Crowds being only capable of thinking in images are only to be impressed by images. It is only images that terrify or attract them and become motives of action.

Clarification: If crowds are incapable of distinguishing between the improbable and the probable, and the images it associates with the improbable invoke action, then odd things are designed to happen.

Lesson #2: Crowds Create Bulldozer-Like Momentum

…the individual forming part of a crowd acquires, solely from numerical considerations, a sentiment of invincible power which allows him to yield to instincts which, had he been alone, he would perforce have kept under restraint.

A crowd …is not prepared to admit that anything can come between its desire and the realisation of its desire.

The Trader’s Journey

- A grand call to adventure. Who would not want to make a pile of money working from the comfort of your own computer screen?

- Finding a mentor. Good mentors matter! Few of us who have succeeded would have done so without some help.

- Crossing over into an “unreal” world. Markets are crazy. When we look deeply into markets, maybe we become a little crazy ourselves, and we certainly become disconnected from ordinary reality.

- Facing dire challenges. The emotional highs and lows of trading can be extreme. Is there a trader alive who hasn’t been awake at 4am wondering if they can ever do this, why they ever tried in the first place, how they could be so stupid to make the same mistakes over and over, and what they were going to do tomorrow? (This is probably not the time to mention that we only write stories about the heroes that complete the journey! A lot of dragons feasted very well, for a very long time.)

- Failure somehow, perhaps almost miraculously, is transformed to success.

- We figure out how to incorporate our trading activities into the everyday world, and discover that things probably weren’t quite as exotic or difficult as we had thought.

See? Trading is not truly about learning patterns. It is not about learning some math. It is not about skill development, and it is not even about risk management. All of these things are important, but the real work of trading is work on ourselves.

Discipline Is Number One

Creating a system and sticking with it is one of the hardest lessons. The struggle is shared across the trading world. An excerpt from “The Little Book of Trading”:

If you learn anything from this book, let it be the simple lesson: Stick with it. There will always be distractions: Breaking news banners, surprises, and unpredictable chaotic events are everywhere, but you can’t let yourself be fazed. Here is one big secret: Top traders don’t pay attention to that stuff. They have found, through hard work, diligent study, and perhaps a little luck— that their ability to stick with a trading plan is far more important than knowing or worrying about what their neighbor is doing.

Risk intelligence – How to live with uncertainty -One of Best Book on Behavioural finance.

Risk Intelligence is a special kind of intelligence for dealing with risk and uncertainty. It doesn’t correlate with IQ, and most psychologists failed to spot it because it is found in such a disparate, rag-tag group of people – American weather-forecasters, professional gamblers, and hedge-fund managers, for example.

Dylan Evans PhD, and former senior lecturer in Behavioural Science in the School of Medicine at University of Cork, has written about his work in researching risk intelligence in ‘Risk Intelligence – How to Live with Uncertainty‘. Evans asserts that people in positions which require high risk intelligence – doctors, financial regulators and bankers, for instance – seem unable to navigate what Evans calls the “darkened room”, the domain of doubt and uncertainty.

Risk Intelligence is a traveller’s guide to the twilight zone of probabilities and speculation. Evans shows us how risk intelligence is vital to making good decisions, from dealing with climate change to combating terrorism. He argues that we can all learn a lot from expert gamblers, not just about money, but about how to make decisions in all aspects of our lives.

I read it once, and re-read it a second time. It is in my opinion, the best, yet least known book, on behavioural finance.

Benedict Carey,, How We Learn-Book REVIEW

Benedict Carey, a science reporter for The New York Times, has written a fast-paced, well-structured book that should have broad appeal. How We Learn: The Surprising Truth About When, Where, and Why It Happens (Random House, forthcoming September 9) not only summarizes a wide range of research findings that challenge traditional views but offers useful tips for both teachers and students.

For instance, most people do better if they break out of routines—if, for example, they vary their study or practice locations. Distributed study time is more effective than concentrated study time. Mixing multiple skills in a practice session sharpens our grasp of all of them. Forgetting is critical to learning. And sleep—well, we all know the value of sleep to learning and creating.

Of particularly interest to traders may be the chapter entitled “Learning Without Thinking: Harnessing Perceptual Discrimination.”