Bloomberg reports, citing people familiar with the matter

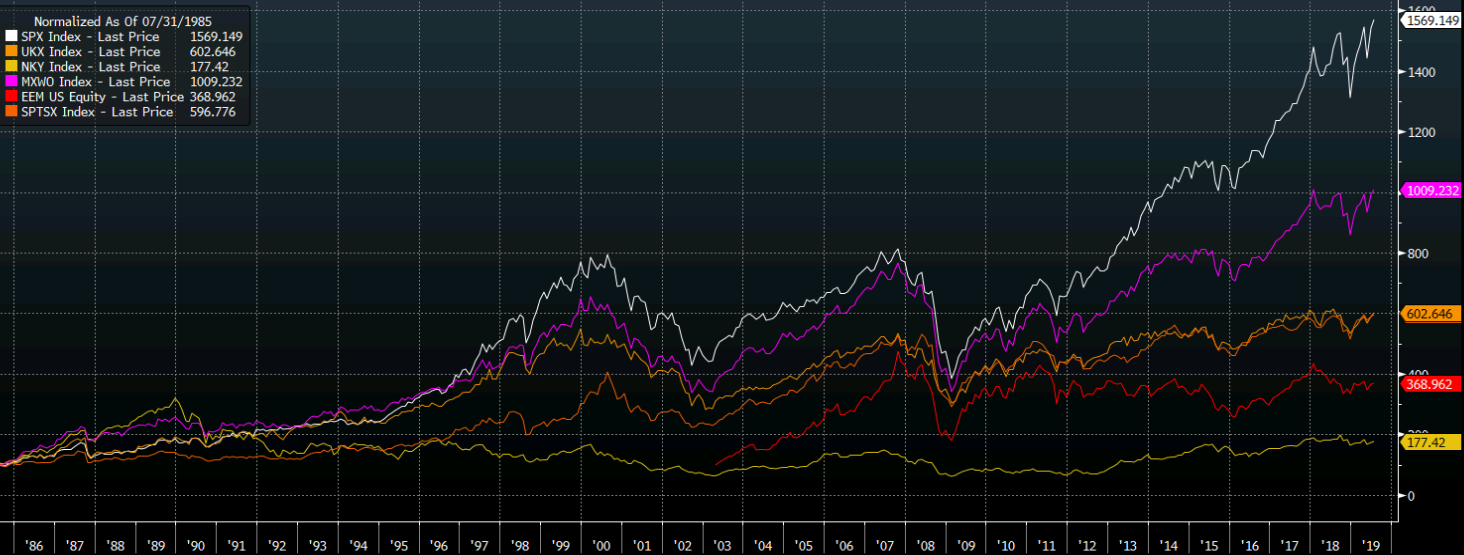

Market reaction:

trade balance adjusted Y -34.7bn

exports -9.2% y/y – worse than expected and the biggest y/y fall in 3 years.

imports -14.8% y/y – not as bad as expected but not good, ditto on the biggest y/y fall in 3 years.

The U.S. slapped fresh tariffs on Chinese goods on Sunday to bring the average to more than 20%, comparable with levels seen during the protectionist era preceding World War II.

At 12:01 a.m. EDT, the U.S. imposed additional tariffs of 15% on about $110 billion in imports from China, covering 3,243 items. Consumer goods account for about half — far more than the 20%-plus of the previous round last September, which included such products as furniture. China’s corresponding tariffs against U.S. products took effect at the same time.

U.S. President Donald Trump postponed tariffs on 555 items on the original list — including smartphones — until Dec. 15 to soften the impact on the year-end shopping season. More than 80% of American imports of these goods come from China, and finding alternative sources is difficult. Higher tariffs are likely to lead to price increases, which risk weighing on consumer spending and thus the broader economy.

Digital consumer devices such as smartwatches are among the largest import categories by value affected by Sunday’s tariffs. More than half of all apparel is taxed as well.

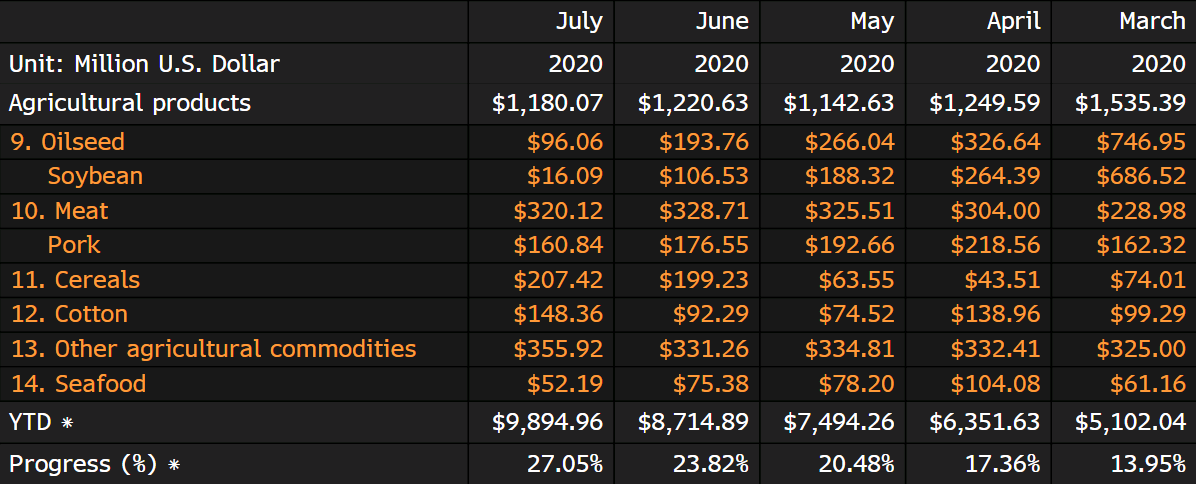

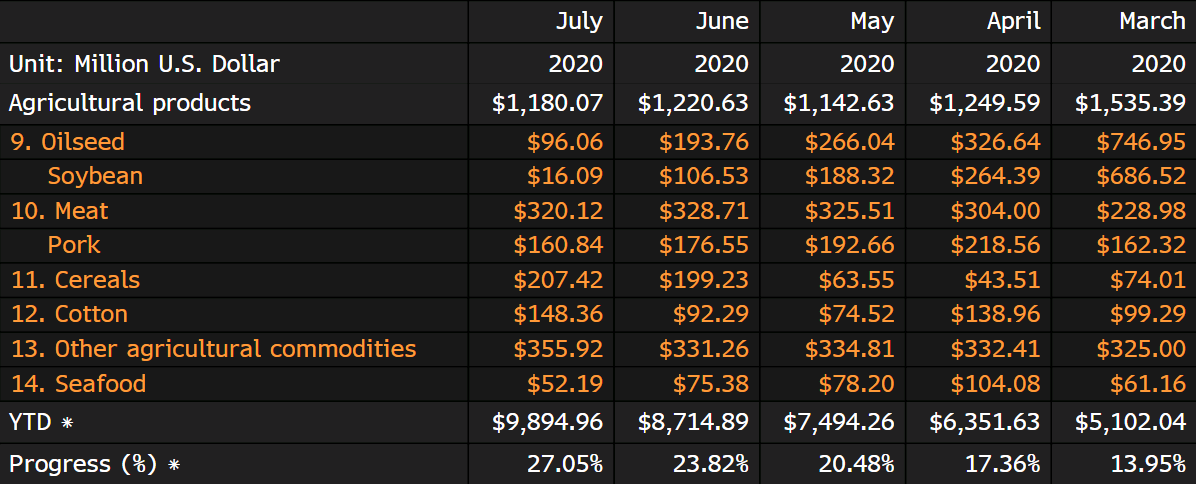

China is retaliating with additional duties of 5% to 10% on $75 billion in imports from the U.S. The first tranche covers 1,717 goods including soybeans and crude oil, while the second set being implemented Dec. 15 will cover 3,361 items including autos.

But all told, fewer than 1,800 of these items — only about 35%, including crude oil — are new additions. Most have already been hit by previous rounds of tit-for-tat tariffs.

Beijing has already imposed tariffs on about 70% of its imports from the U.S. by value, and after these rounds, the only items left untouched will be those that it would be disadvantageous to domestic industry to tax, such as large aircraft. Previous tariff rounds have already led to sharp declines in imports of affected goods, and further hikes are unlikely to have much of an effect.

With the September duties, the average American tariff on Chinese goods rises to slightly above 21%, up from about 3% before the trade war, according to Chad Bown of the Peterson Institute for International Economics. China’s average tariff on imports from the U.S. climbs to nearly 22%. (more…)

Each seminar and book will disclose to you that controlling your feelings and have taught in your trading are fundamental to your prosperity. In any case, nobody reveals to you how to accomplish passionate control and individual teachers while trading the market. Each trader sees the market distinctively in light of the fact that our past, our present lives, and our discernments are special. Understanding those things about yourself and tackling their impact on your trading will enable you to continue trading substances free of enthusiastic flotsam and jetsam. Here are a few stages that will have any kind of effect. You should adopt a specialized strategy to your feelings and teach preparing similarly as you adopt a specialized strategy to dissecting a stock outline. However, before we get into the coordination of how to control feelings, you should see a few rudiments of why some market members have strong control of their feelings while others don’t. Experience considerable difficulties recently? Is it true that you are getting a handle on worried about it? Assuming this is the case, you may find that a lot of the proposals you ordinarily get to enable you to the center are not doing a mess of good. You have been adhering to your trading technique as well as can be expected and endeavoring to trade with train, yet things still are not working out. You continue losing trades in any case, and you have a feeling that your entire basic leadership handle is a wreck.

Each seminar and book will disclose to you that controlling your feelings and have taught in your trading are fundamental to your prosperity. In any case, nobody reveals to you how to accomplish passionate control and individual teachers while trading the market. Each trader sees the market distinctively in light of the fact that our past, our present lives, and our discernments are special. Understanding those things about yourself and tackling their impact on your trading will enable you to continue trading substances free of enthusiastic flotsam and jetsam. Here are a few stages that will have any kind of effect. You should adopt a specialized strategy to your feelings and teach preparing similarly as you adopt a specialized strategy to dissecting a stock outline. However, before we get into the coordination of how to control feelings, you should see a few rudiments of why some market members have strong control of their feelings while others don’t. Experience considerable difficulties recently? Is it true that you are getting a handle on worried about it? Assuming this is the case, you may find that a lot of the proposals you ordinarily get to enable you to the center are not doing a mess of good. You have been adhering to your trading technique as well as can be expected and endeavoring to trade with train, yet things still are not working out. You continue losing trades in any case, and you have a feeling that your entire basic leadership handle is a wreck.

Trading Emotion is Required to Understand Market Vibrations

All value activity in stocks is fundamentally reliant on enthusiastic responses from differing market members. Without feelings, cost sits level. There are numerous degrees of passionate surges, influxes of happiness and covetousness, and floods of frenzy and sadness that drive costs up or down. What’s more, dependable inside those waves are the executioner tear tides that originate from the individuals who have figured out how to control feelings and wipe out the individuals who don’t have control. At last, achievement in the market is a mix of foreseeing the following move and the moves of the various market members who may enter that stock, and decide when you ought to take an interest. Shockingly, most traders trade the market not as though they were playing chess with the many-sided quality of the game of poker. However, they were in Las Vegas, betting on a roulette wheel. On occasion this way, you now and then need to handle the intense subject matters which are throwing you off track before you begin managing specialized parts of the circumstance. Possibly you are making blunders with your trading framework and how you utilize your pointers, yet you might not be able to settle those mistakes in your present mental state. You just can’t see obviously when your brain is a jumble of enthusiastic debris. In the event that that is your circumstance, I prescribe that you went through an enthusiastic agenda before you proceed. You should recognize any enthusiastic injuries which might be meddling in your trading, and afterward, make sense of regardless of whether those injuries are no less than one reason for your present issues. In the realm of stock trading, there are Master Traders who have control over their feelings and after that, there are the Gambler traders who purchase and offer construct absolutely with respect to feeling whether they understand it or not. A Master Trader joins the expertise of a chess player who envisions a rival’s moves and plans his own particular well ahead of time and furthermore utilizes the poker player’s reign in never uncovering his hand he uncovers it. A card shark is basically responding to his feelings without rationale or thinking ahead in what he does. Market members who trade the market with the ability of a Master Chess Player–anticipating value activity days, weeks, and months ahead of time; fusing the ‘never uncover your hand’ part of poker–have the extraordinary favorable position over speculator traders. They have control over their feelings and thus control over how they trade. The card shark trader is simply tossing money at the market and trusting something will go their direction. (more…)

“I learned that an opinion isn’t worth that much. It is more important to listen to the market.”

“Most traders who fail have large egos and can’t admit that they are wrong. Even those who are willing to admit that they are wrong early in their career can’t admit it later on! Also, some traders fail because they are too worried about losing. I’m not afraid to lose. When you start being afraid to lose, you’re finished.”

Brian Gelber

“I don’t lose much on trades, because I wait for the exact right moment.”

Mark Weinstein

“Many people actually want to lose on a subconscious level.”

“The realization that you are responsible for your results is the key to successful investing. Winners know they are responsible for their results; losers think they are not.”

Dr. Van K. Tharp (more…)