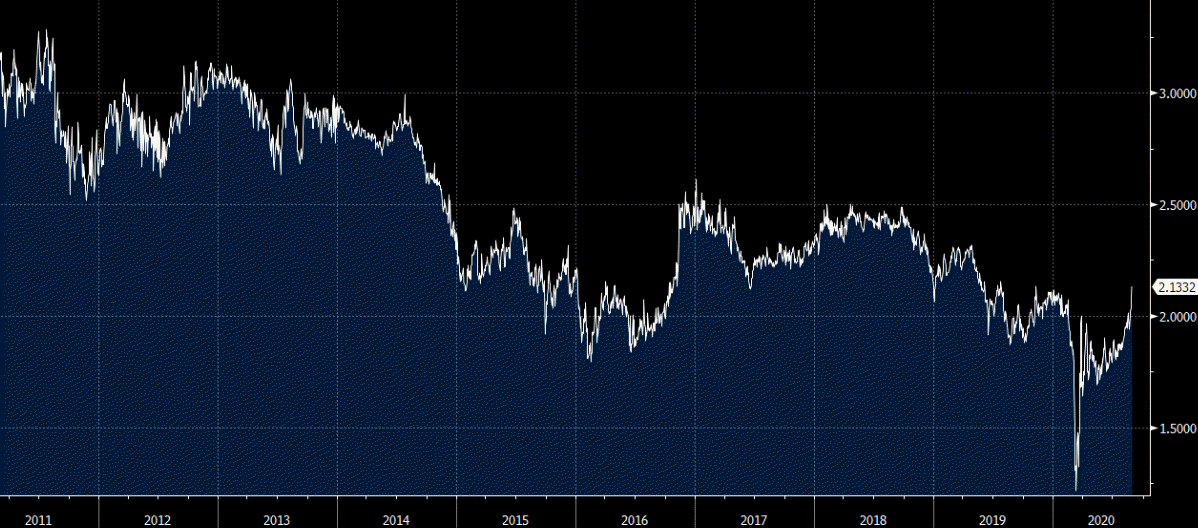

Price cracks above the recent ceiling near 1.385%

The 10 yield yield has moved to the highest level since July 14 and in the process has moved above recent ceiling near 1.385%. The price is also above the 38.2% retracement of the move down from the March 30 high at 1.375% and finally in the 100 day moving average 1.405%. The current yield is trading at 1.415%.

The next target will be at the 50% midpoint of the move down from the March 30 high at 1.452% get above that and there is more room to roam with 1.53% as another target area.

Despite higher inflation, and expectations of taper, the 10 year yield is still well below the high for the year at 1.774%. Overseas demand has been very strong especially in the longer end as concerns about Covid and higher rates in the US have investors parking funds in the liquid US debt instruments. With the Fed now targeting inflation over 2% in 2022 and 2023, the real return at 1.415% is negative. Nevertheless, it beats parking funds in France at near 0.07%.

Banco Central do Brasil hikes its benchmark interest rate to 6.25% from 5.25%.

Banco Central do Brasil hikes its benchmark interest rate to 6.25% from 5.25%.