Ignoring the downside of a trade. Most traders, when entering a trade, look only at the money they think they will make by taking the trade. They rarely consider that the trade may go against them and that they could lose. The reality is that whenever someone buys a futures contract, someone else is selling that same futures contract. The buyer is convinced that the market will go up. The seller is convinced that the market has finished going up. If you look at your trades that way, you will become a more conservative and realistic trader.

Ignoring the downside of a trade. Most traders, when entering a trade, look only at the money they think they will make by taking the trade. They rarely consider that the trade may go against them and that they could lose. The reality is that whenever someone buys a futures contract, someone else is selling that same futures contract. The buyer is convinced that the market will go up. The seller is convinced that the market has finished going up. If you look at your trades that way, you will become a more conservative and realistic trader.

Taking too much risk. With all the warnings about risk contained in the forms with which you open your account, and with all the required warnings in books, magazines, and many other forms of literature you receive as a trader, why is it so hard to believe that trading carries with it a tremendous amount of risk? It’s as though you know on an intellectual basis that trading futures is risky, but you don’t really take it to heart and live it until you find yourself caught up in the sheer terror of a major losing trade. Greed drives traders to accept too much risk. They get into too many trades. They put their stop too far away. They trade with too little capital. We’re not advising you to avoid trading futures. What we’re saying is that you should embark on a sound, disciplined trading plan based on knowledge of the futures markets in which you trade, coupled with good common sense.

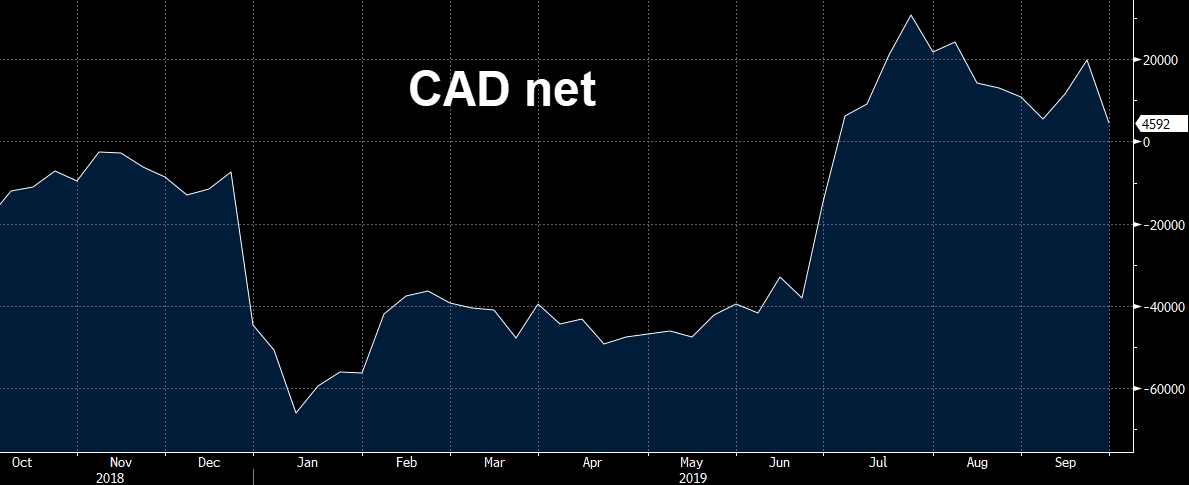

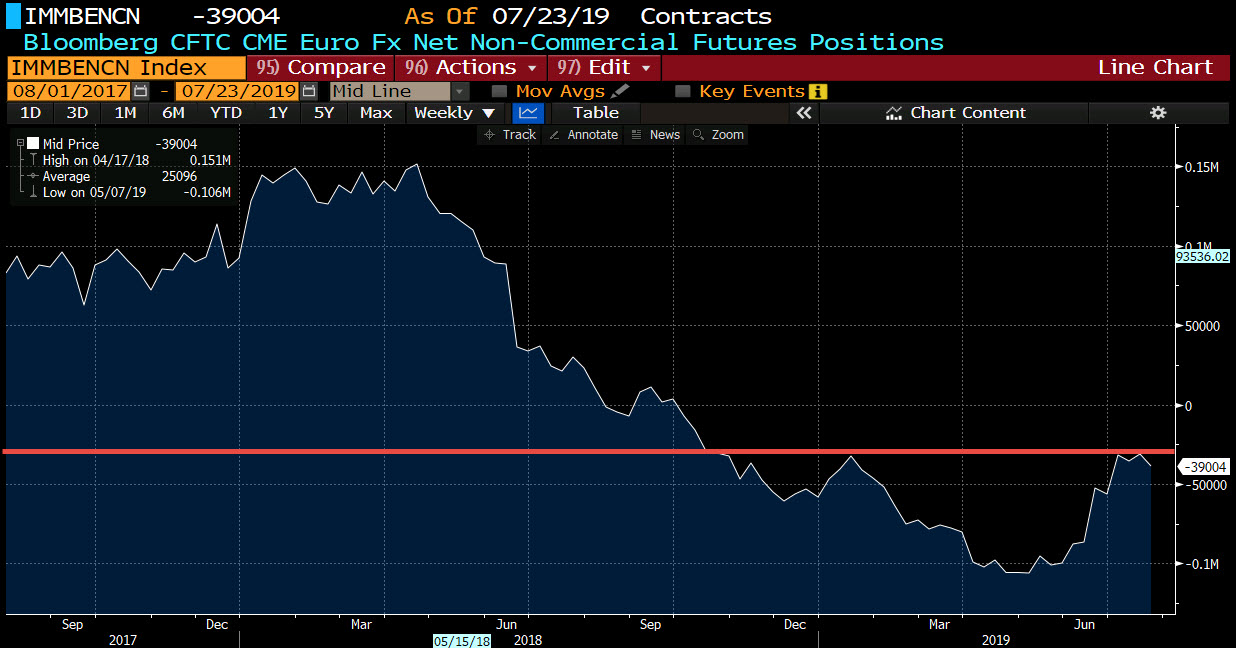

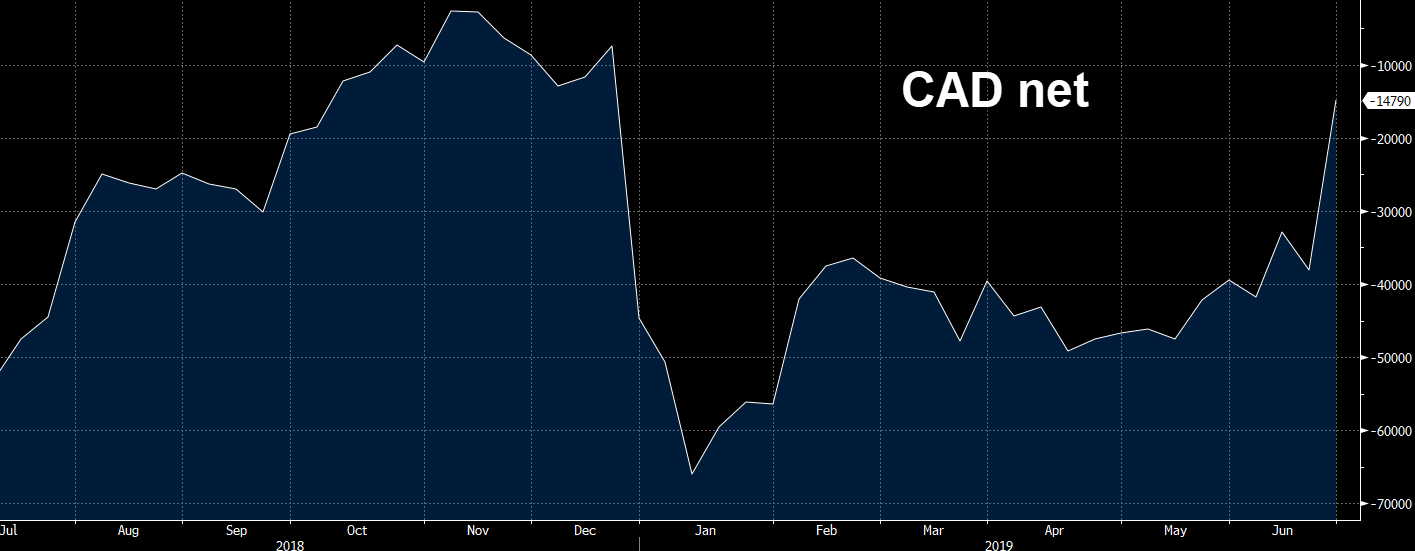

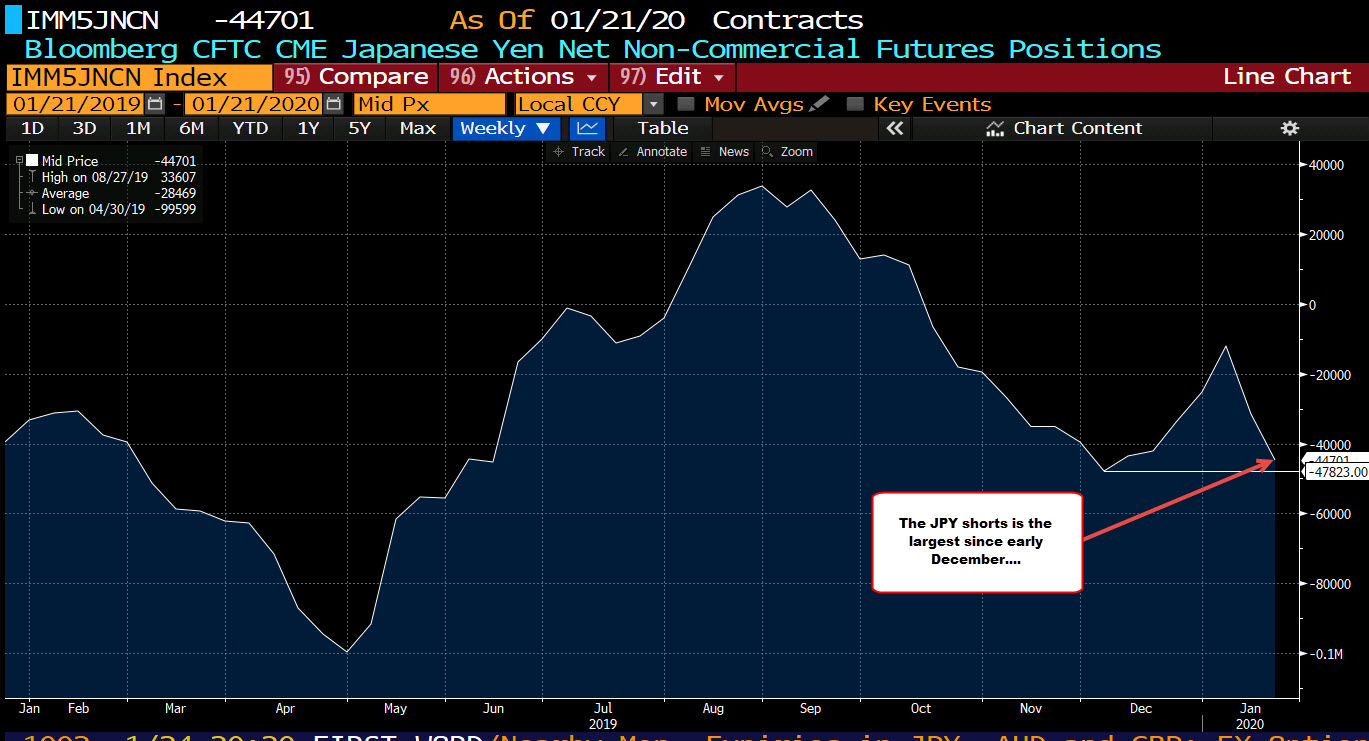

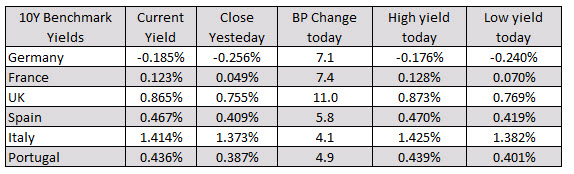

In other markets as European traders exit:

In other markets as European traders exit: